Market Analysis

In-depth Analysis of Rhodium Market Industry Landscape

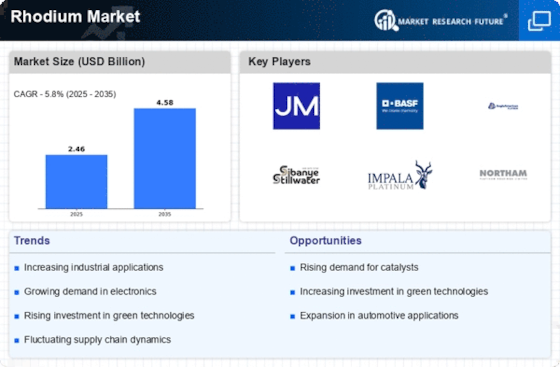

The market dynamics of the rhodium market are shaped by a combination of factors, including industrial applications, supply-demand dynamics, and economic conditions. Automotive Catalysts Demand: A significant driver of the rhodium market is its extensive use in automotive catalysts. Rhodium is a crucial component in catalytic converters, where it helps reduce harmful emissions from vehicles. As automotive emission standards become more stringent globally, the demand for rhodium in the production of catalytic converters continues to rise. Tight Supply and Growing Demand: The market dynamics of rhodium are influenced by the tight supply-demand balance. Rhodium is a rare and precious metal, and its availability is limited. Meanwhile, the demand for rhodium, particularly in the automotive industry, has been consistently growing. This supply-demand imbalance contributes to the volatility in rhodium prices. Investment and Speculation: The dynamics of the rhodium market are also influenced by investment and speculation. Investors, drawn by the metal's high value and potential for significant price fluctuations, engage in speculative activities in the rhodium market. This financial activity can amplify market volatility, impacting the overall dynamics of rhodium prices. Global Economic Conditions: The rhodium market is sensitive to global economic conditions. Economic downturns or recessions can impact automotive production and industrial activities, leading to fluctuations in rhodium demand. Conversely, periods of economic growth may boost the demand for rhodium in various industrial applications, influencing market dynamics. Jewelry and Electroplating Applications: Rhodium's use in the jewelry industry for electroplating white gold and silver contributes to market dynamics. The metal's ability to provide a lustrous and corrosion-resistant coating makes it a sought-after material in the production of high-end jewelry. Trends in the jewelry market and luxury goods industry impact the demand for rhodium. Mining Industry Challenges: The dynamics of the rhodium market are affected by challenges in the mining industry. Rhodium is often a byproduct of platinum and palladium mining. Factors such as labor strikes, geopolitical tensions in mining regions, and operational disruptions can impact the overall supply of rhodium, influencing market dynamics. Environmental Regulations: Stringent environmental regulations and emission standards worldwide contribute to the demand for rhodium in automotive catalysts. As countries continue to tighten regulations to combat air pollution, the automotive industry seeks advanced catalytic technologies that utilize rhodium, influencing the market dynamics of the metal. Emerging Technologies: The dynamics of the rhodium market are shaped by emerging technologies. Rhodium is used in various industrial processes, including fuel cell development and electronic components. Innovations in technology and the adoption of new applications that utilize rhodium can create shifts in demand and impact market dynamics. Substitution Challenges: Rhodium faces challenges from potential substitutes in certain applications. While rhodium's unique properties make it irreplaceable in some applications, efforts to find alternative materials with similar characteristics could impact its market dynamics, particularly if more cost-effective substitutes are identified. Geopolitical Factors: Geopolitical factors, including trade tensions and mining policies in major producing regions, influence the rhodium market dynamics. Changes in geopolitical landscapes can impact the supply chain, affecting the availability of rhodium and contributing to market uncertainties.

Leave a Comment