Market Analysis

In-depth Analysis of Refrigeration Oil Market Industry Landscape

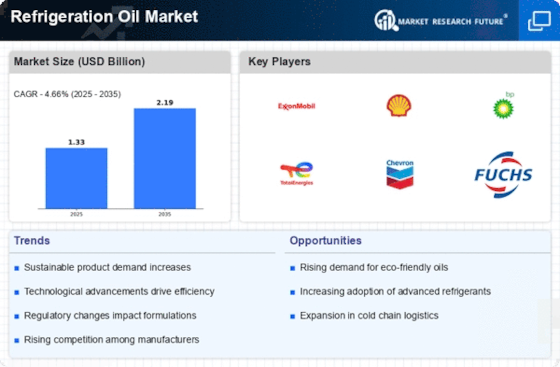

The refrigeration oil market is influenced by various market dynamics that affect its growth, demand, and pricing. One of the key factors driving this market is the increasing demand for refrigeration and air conditioning systems across various industries such as food and beverage, pharmaceuticals, and chemicals. As these industries continue to expand, the need for efficient cooling systems also rises, leading to a higher demand for refrigeration oils.

Refrigeration oil is extracted from synthetic or mineral oil. It is produced by mixing additives and oil. Refrigeration oil is majorly used for lubrication of the compressors that help in the production of cold air. The refrigeration oil helps in the reduction of friction between metal parts that diminishes the wearing out of compressors and increasing its life. The refrigeration oil has tolerance towards high temperature, which makes it the best lubricant in the metal industry.

Another factor that impacts the market dynamics of refrigeration oils is technological advancements in the field of refrigeration systems. Manufacturers are constantly innovating to develop more energy-efficient and environmentally friendly refrigeration systems. This has led to the development of new types of refrigeration oils that offer better performance and comply with regulatory standards such as the Montreal Protocol and the Kyoto Protocol. As a result, there is a growing demand for these advanced refrigeration oils in the market.

Moreover, the regulatory landscape also plays a significant role in shaping the dynamics of the refrigeration oil market. Government regulations aimed at reducing greenhouse gas emissions and phasing out ozone-depleting substances have led to the implementation of stricter environmental standards for refrigeration systems and their components, including refrigeration oils. Manufacturers are therefore required to comply with these regulations, which often involves reformulating their products to meet the required specifications. This can impact the supply chain and pricing of refrigeration oils in the market.

Additionally, the global economic conditions and geopolitical factors can influence the demand for refrigeration oils. Economic growth in emerging markets, such as China and India, has led to increased industrialization and urbanization, driving the demand for refrigeration systems and related products. On the other hand, geopolitical tensions or trade disputes can disrupt the supply chain and affect the availability of refrigeration oils in certain regions, leading to fluctuations in prices.

Furthermore, the competitive landscape within the refrigeration oil market also affects its dynamics. The market is characterized by a few major players, as well as numerous smaller manufacturers and suppliers. Competition among these players is based on factors such as product quality, pricing, distribution network, and technological capabilities. Market consolidation through mergers and acquisitions can also impact the competitive dynamics within the industry, leading to changes in market share and pricing strategies.

Leave a Comment