Plastic Stabilizer Size

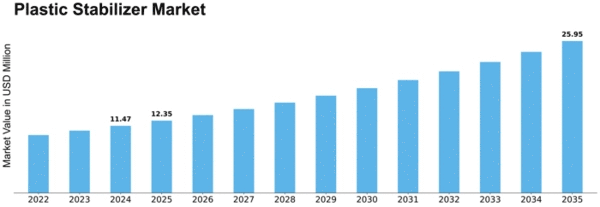

Plastic Stabilizer Market Growth Projections and Opportunities

Plastic stabilizers play a crucial role in preventing the deterioration of plastic materials when exposed to various environmental factors such as heat, cold, and light. These stabilizers are essential in maintaining the integrity and durability of plastic applications by enhancing their resistance to degradation. They are particularly significant in bolstering the antioxidant and UV absorber properties of plastics, ensuring their prolonged functionality and appearance.

The application of plastic stabilizers is widespread in the plastic processing industry, especially in the production of lightweight materials. This is instrumental in the creation of a diverse range of plastic products that are resilient to environmental conditions and capable of maintaining their structural integrity over time.

The global plastic stabilizer market is categorized based on types, materials, and end-use industries. In terms of types, heat stabilizers dominate the market share, followed closely by antioxidant and light stabilizers. These different types of stabilizers address specific challenges related to heat, oxidation, and light exposure, catering to the varied needs of the plastic industry.

When considering materials, the plastic stabilizer market is primarily led by thermoplastics, which are widely utilized in diverse applications. Thermosetting materials and elastomers also contribute to the market, offering their own unique set of properties and applications. The choice of material depends on the specific requirements of the end product and the intended use.

In the realm of end-use industries, the packaging sector emerges as the largest consumer of plastic stabilizers. This is due to the critical need for packaging materials that can withstand environmental factors and protect the contents within. Following closely are industries such as consumer goods, building and construction, automotive, electrical and electronics, and agriculture, among others. Each of these industries relies on plastic stabilizers to ensure the longevity and performance of their respective products.

The demand for plastic stabilizers is driven by the growing need for durable and resilient plastic materials across various sectors. In the packaging industry, for instance, the emphasis on preserving the quality and freshness of packaged goods necessitates the use of plastic stabilizers. Similarly, in the automotive and construction industries, where exposure to harsh environmental conditions is common, the incorporation of stabilizers becomes imperative to enhance the lifespan and reliability of plastic components.

As the global market for plastic stabilizers continues to evolve, advancements in technology and research contribute to the development of more effective and sustainable stabilizer solutions. Manufacturers are constantly innovating to meet the increasing demands of industries that rely on plastic materials for their products.

plastic stabilizers play a pivotal role in safeguarding plastic materials from degradation caused by heat, cold, and light exposure. Their widespread use in various industries, including packaging, consumer goods, construction, automotive, and more, underscores their importance in ensuring the longevity and performance of plastic applications. The market's segmentation based on types, materials, and end-use industries reflects the diverse and dynamic nature of the plastic stabilizer industry, with ongoing efforts focused on technological advancements and sustainability.

Leave a Comment