Overhead Console Size

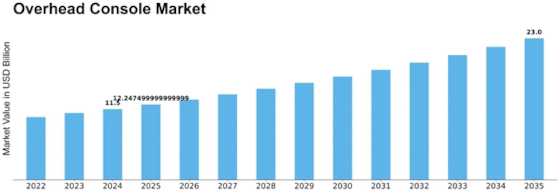

Overhead Console Market Growth Projections and Opportunities

The growth and direction of the overhead console segment's market dynamics are dynamic, as are the interchanging factors that determine it. The overhead console (OHC) market is a vital constituent of vehicle interior fittings, which is closely tied to how the general automotive sector performs. One of these important drivers in this market is the increasing demand by consumers for more enhanced car window accessories. Additionally, the overall trend towards personalization has increased dynamism in this segment even further. Consequently, buyers prefer uniquely designed and attractive interiors, hence request for customizable OHCs. Another factor that affects the OHC market is continuous innovation in materials and manufacturing processes. Utilization of lightweight but strong materials has resulted not only in an improvement in their quality but also in fuel economy. Furthermore, regulatory standards and safety concerns influence these aspects due to market dynamics. Safety requirements set up by regulatory authorities have led automobile makers to include security features inside their automobiles, such as an overhead console. Moreover, global economic conditions combined with geopolitical factors play a central role in shaping the overhead console market. Consumer spending power might be affected as a result of economic downturns leading to fluctuations in demand for automotive accessories like an overhead console. The competitive landscape adds to its dynamism, where key players are engaged in strategies such as mergers, acquisitions, or partnerships so as to win over other companies. Pursuit of technological change through constant research development still counts for organizations wishing to remain ahead in a dynamic marketplace. Moreover, variations among markets within regions with regard to consumer preferences and economic conditions contribute towards divergent dynamics within them. These producers, therefore, must redesign their products depending on regional preferences such as social attitudes governing different places' tastes, climatic conditions prevailing there, and diverse regulations. Lastly, there remains no doubt that what characterizes the OHCM is the complicated interaction between customer choices along with technological developments versus regulatory compliance against global economic conditions." For them, manufacturers navigating this landscape need to be aware of all these parameters and tailor their strategies to respond to changing market conditions for sustainable development of this important segment within the automotive industry.

Leave a Comment