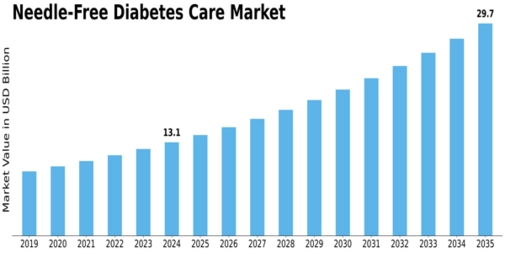

Needle Free Diabetes Care Size

Needle free diabetes care Market Growth Projections and Opportunities

The rising number of diabetes patients worldwide is affecting the needle-free diabetes treatment industry. Novel treatments that are easier to understand and administer are needed as the number of diabetics rises. Technological innovation greatly impacts needle-free diabetes therapy. Modern equipment and technology, such as smooth insulin delivery systems, enable patients feel more comfortable and follow their treatment plan, expanding the market. Patients' demands and adherence to treatment regimens drive the market. Patients may better adhere to their treatment plans and feel less pain when given insulin without needles. Government diabetes management programs and healthcare facility development are driving needle-free diabetes treatment growth. Subsidies, public awareness, and proper payback processes increase the usage of innovative needle-free technology. Businesses face a growing dilemma as people live longer. Diabetics and seniors are expanding at the same pace. As senior diabetics face increasing complications, needle-free options are becoming more important. Consider economic factors including spending money and healthcare costs while choosing needle-free diabetes therapy. People in stable economies may be willing to spend more on modern diabetes management tools. The needle-free diabetes treatment sector is growing due to fierce rivalry among healthcare providers. These companies are striving to innovate and gain market share. Businesses spend in research and development to develop new technologies that expand the market and provide more products. Markets are affected by strict rules and regulations, such as health authority certifications. Market players must follow laws to gain medical and consumer trust. Increased awareness of needle-free therapy by diabetics and healthcare professionals is crucial to the industry. Education programs raise awareness of these new ideas, making them simpler to adopt and apply. Needle-free diabetes control devices are expensive, which worries patients and doctors. These solutions are adopted more if they are affordable and cost-effective, especially in areas with limited healthcare resources. IoT and connection make needle-free devices more user-friendly and enhance data management. These technical advances enable better patient tracking, customized treatment strategies, and industry growth. The accessibility of obtaining needle-free diabetes care products and their effectiveness in delivery affect market penetration. Good marketing methods offer these technology to end customers quickly and easily, expanding the market.

Leave a Comment