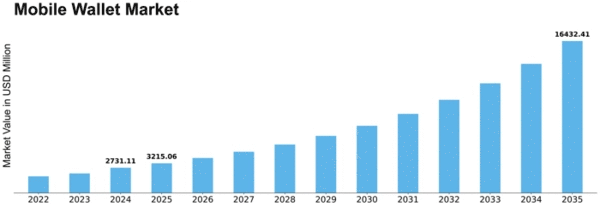

Mobile Wallet Size

Mobile Wallet Market Growth Projections and Opportunities

The Mobile Wallet market is a dynamic and quickly developing industry, impacted by a heap of market factors that shape its development and direction. One of the essential drivers of the Mobile Wallet market is the rising entrance of cell phones and the developing inclination for credit only exchanges. As cell phones become more universal, customers are embracing the accommodation of mobile wallets to make installments, move cash, and deal with their funds in a hurry.

Security concerns assume a significant part in forming the Mobile Wallet market. As customers share delicate monetary data with mobile wallets, guaranteeing vigorous safety efforts is basic. Market players put altogether in creating progressed encryption advances and confirmation conventions to fabricate trust among clients. The capacity to give secure and consistent exchanges turns into a basic element impacting the reception of mobile wallets.

Besides, the administrative scene altogether influences the Mobile Wallet market. States and administrative bodies assume a significant part in forming the business by acquainting and upholding guidelines related with computerized installments and monetary exchanges. Consistence with these guidelines becomes fundamental for mobile wallet suppliers, impacting their systems and activities.

The cutthroat scene is another urgent market factor. The Mobile Wallet market is described by serious contest among central members, including tech monsters, monetary foundations, and new businesses. Consistent development and the presentation of new highlights become fundamental for market players to separate themselves and catch a bigger market share. Associations and joint efforts with shippers, banks, and different partners likewise add to the cutthroat elements of the business.

Purchaser conduct and inclinations assume an imperative part in molding the Mobile Wallet market. The business should adjust to changing purchaser assumptions and requests. Easy to understand interfaces, customized encounters, and worth added administrations are key factors that draw in and hold clients. Understanding and answering advancing shopper patterns become vital for the supported development of mobile wallet suppliers.

The worldwide monetary scene is likewise a critical component impacting the Mobile Wallet market. Monetary circumstances, expansion rates, and the generally speaking monetary prosperity of purchasers influence their readiness to take on advanced installment arrangements. In developing markets, the Mobile Wallet market frequently encounters sped up development because of the absence of customary financial framework, making mobile wallets a helpful and open monetary instrument.

Mechanical headways, especially in the space of man-made reasoning and biometrics, add to the advancement of the Mobile Wallet market. Combination of state of the art innovations improves the security, productivity, and in general client experience of mobile wallet stages. Consistent interest in innovative work is fundamental for market players to remain ahead in this mechanically determined scene.

Besides, the Coronavirus pandemic significantly affects the Mobile Wallet market. The expanded accentuation on contactless installments to limit actual associations has sped up the reception of mobile wallets. The pandemic went about as an impetus, pushing the two shoppers and organizations to embrace computerized installment arrangements, further energizing the development of the Mobile Wallet market.

Leave a Comment