Ingaas Camera Size

InGaAs Camera Market Growth Projections and Opportunities

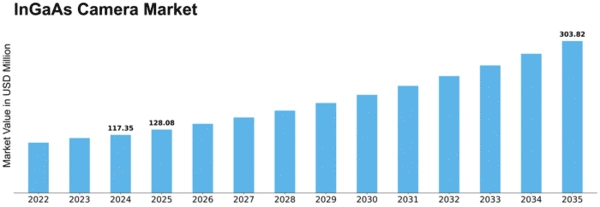

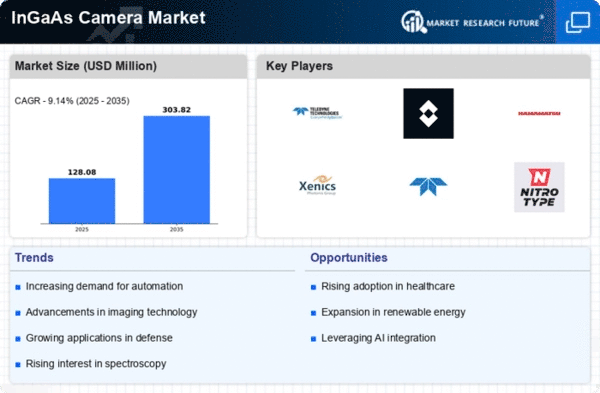

InGaAs cameras have played a crucial role in detecting and capturing images within the near-infrared (NIR) and short-wave infrared (SWIR) wavelengths. Their versatile applications span various fields, including industrial processing monitoring and security & surveillance. Projections indicate that the global InGaAs cameras market is poised to reach USD 167.4 million by the close of 2026, with an anticipated Compound Annual Growth Rate (CAGR) of 8.26% throughout the forecast period from 2021 to 2027. Notably, in 2020, North America led the market with a dominant 32.97% share, trailed by Europe at 29.07% and Asia-Pacific at 25.11%.

The segmentation of the InGaAs camera market revolves around scanning type, camera cooling technology, application, and region. In terms of the scanning type, the market distinguishes between line scan cameras and area scan cameras. The latter, specifically the area scan camera segment, is expected to command a significant portion of the InGaAs camera market. Camera cooling technology further divides the market into cooled cameras and uncooled cameras, with the latter projected to hold a larger share. The diverse applications of InGaAs cameras encompass military & defense, industrial automation, surveillance, safety & security, scientific research, spectroscopy, and other sectors.

The prevalence of InGaAs cameras in the near-infrared and short-wave infrared imaging has led to their widespread adoption in diverse industries. The anticipated growth in the InGaAs camera market reflects the increasing demand for advanced imaging solutions, driven by applications in security, defense, industrial automation, and scientific research. As technology continues to evolve, InGaAs cameras are likely to play an even more pivotal role in addressing the complex imaging needs across various domains. With North America currently leading the market, the geographical distribution highlights the global significance and acceptance of InGaAs cameras in facilitating advanced imaging capabilities for a wide array of applications. The widespread adoption of InGaAs cameras in near-infrared (NIR) and short-wave infrared (SWIR) imaging underscores their pivotal role in addressing diverse imaging needs. These cameras have become integral in industries such as security, defense, industrial automation, and scientific research, driven by the quest for advanced imaging solutions. As technology continues to evolve, the versatile applications of InGaAs cameras are likely to expand further, contributing to their sustained growth in the market.

Leave a Comment