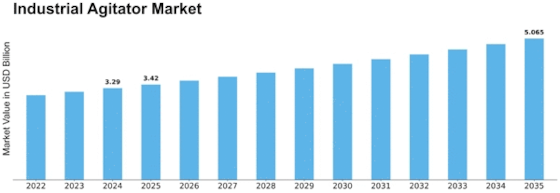

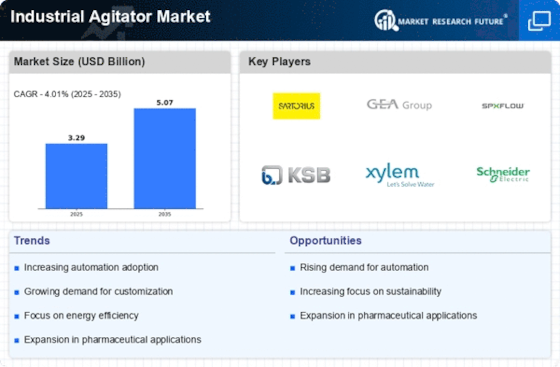

Industrial Agitator Size

Industrial Agitator Market Growth Projections and Opportunities

The Industrial Agitator market is influenced by a myriad of market factors that play a crucial role in shaping its dynamics. These factors, ranging from technological advancements to economic conditions, collectively contribute to the growth and evolution of the market.

Technological innovations stand out as a primary driver of the Industrial Agitator market. As industries embrace automation and smart technologies, the demand for advanced agitators equipped with cutting-edge features has witnessed a significant upswing. Manufacturers are continually striving to develop agitators that not only enhance mixing efficiency but also integrate seamlessly with Industry 4.0 concepts. The integration of sensors, connectivity, and automation capabilities into agitators has become a key trend, allowing industries to optimize their processes and achieve higher levels of productivity.

Economic conditions also exert a substantial influence on the Industrial Agitator market. The overall economic health of a region or country impacts industrial activities, which in turn affects the demand for agitators. Economic downturns may lead to a slowdown in industrial production, resulting in reduced investments in equipment like agitators. Conversely, during periods of economic growth, industries are more likely to invest in upgrading their machinery, including agitators, to enhance operational efficiency and meet the increasing demand for their products.

Regulatory factors play a pivotal role in shaping the Industrial Agitator market landscape. Governments around the world implement regulations to ensure environmental sustainability and workplace safety. Compliance with these regulations often necessitates the use of specific types of agitators or the adoption of certain technologies to minimize environmental impact and ensure the well-being of workers. Manufacturers in the agitator market need to stay abreast of these regulations and adapt their products accordingly to remain compliant and competitive.

The competitive landscape also significantly influences the Industrial Agitator market. The presence of numerous players vying for market share fosters innovation and competitive pricing. Manufacturers strive to differentiate their products by introducing unique features or focusing on specific industries. Collaborations and partnerships between agitator manufacturers and end-user industries further drive innovation, as companies work together to address specific challenges and requirements.

Market demand and supply dynamics are crucial determinants of the Industrial Agitator market's health. Fluctuations in demand from key end-use industries such as chemicals, pharmaceuticals, and food and beverages directly impact the production and sales of agitators. Additionally, the supply chain, including raw material availability and logistics, plays a crucial role in shaping the market's overall dynamics. Disruptions in the supply chain can lead to shortages, affecting both manufacturers and end-users.

Global events and macroeconomic trends can also impact the Industrial Agitator market. Factors such as geopolitical tensions, natural disasters, and pandemics can create uncertainties and challenges for the market. The COVID-19 pandemic, for example, disrupted supply chains, leading to delays in manufacturing and affecting market dynamics. Adapting to such unforeseen circumstances and ensuring business continuity become critical for agitator manufacturers.

Leave a Comment