Market Share

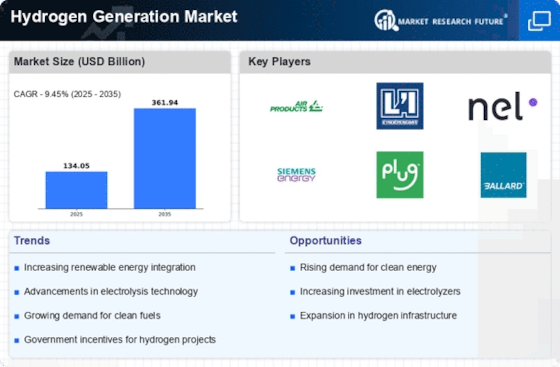

Hydrogen Generation Market Share Analysis

To acquire an upper hand in the hydrogen generation market, organizations execute separation methodologies by giving novel answers for meet the differed necessities of clients. These arrangements might incorporate specific applications or state of the art innovations. An extra basic methodology is cost authority, in which firms attempt to set up a good foundation for themselves as the most monetarily proficient hydrogen generators accessible on the lookout. This habitually involves the investigation of economies of scale, the enhancement of creation processes, and the reception of energy-effective advancements to lessen generally creation costs. Organizations decisively position themselves as cost forerunners to speak to purchasers who focus on value and to get a significant piece of the pie. The arrangement of key unions among government elements, research establishments, and partnerships working in the hydrogen generation industry can possibly encourage the production of weighty advances and grow market entrance. What's more, market division is a strategy that is broadly carried out inside the hydrogen generation area. Associations recognize specific market portions portrayed by novel prerequisites and tendencies, tweaking their contributions to enough serve these specialty markets. By focusing on areas described by significant hydrogen necessities, like synthetic assembling and refining, for example, associations can foster particular contributions that really appeal to their particular customers. Taking a stab at piece of the pie keeps on being predicated on the execution of imaginative methodologies. Associations make significant interests in innovative work to keep a main situation in the domain of hydrogen generation innovation. This not just empowers them to give cutting edge items yet in addition lays out them as leaders in the business, interesting to clients who esteem creativity and ecological obligation. Also, geographic extension can be used to increment piece of the pie. Associations might enter new business sectors decisively in light of rising hydrogen interest, which might be brought about by ecological guidelines, government drives, or expanded consciousness of hydrogen's true capacity as an unadulterated energy source. Associations can grow their buyer base and exploit arising open doors by laying out a traction in essential locales. Also, client driven methodologies are significant for situating piece of the pie. By perceiving and taking care of the prerequisites and tendencies of customers, associations can encourage powerful associations and develop brand faithfulness. To encourage trust and fulfilment, this might involve the arrangement of excellent client assistance, the customization of arrangements, and the upkeep of straightforward correspondence. Various methodologies, including cost administration, joint effort, market division, advancement, and client driven approaches, are used in the hydrogen generation market. Associations that capably execute these methodologies make significant commitments to the overall shift towards reasonable energy.

Leave a Comment