Top Industry Leaders in the Hydrogen Generation Market

*Disclaimer: List of key companies in no particular order

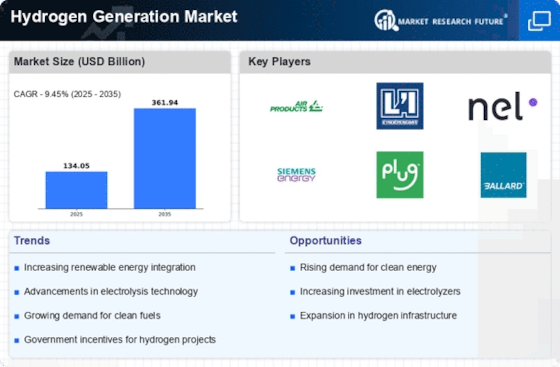

The global hydrogen generation market is currently a hotbed of intense competition, with established players and nimble startups battling it out to gain a foothold in the burgeoning clean energy solutions sector. This vibrant and dynamic landscape necessitates a thorough examination of the strategies employed by key players, the factors influencing market share, and the emerging trends that have the potential to reshape the future of hydrogen generation.

Dominant Players and Their Strategic Playbook:

Leading the charge are industrial giants such as-

Praxair Inc. (US)

Air Liquide S.A. (France)

Air Products and Chemicals Inc. (US)

Hydrogenics (Canada)

Iwatani (Japan)

Messer Group (Germany)

Plug Power (US)

Linde (US)

Showa Denko (Japan)

Ballard Power systems (Canada)

Fuelcell Energy (US), and others.These established players leverage their extensive experience, robust distribution networks, and technological expertise to maintain their top-tier positions. Their strategic approaches include:

-

Technological Diversification: Offering a comprehensive portfolio that spans steam methane reforming (SMR), water electrolysis, and other green hydrogen technologies.

-

Strategic Partnerships: Collaborating with governments, energy companies, and technology providers to secure project bids and gain access to capital.

-

Geographical Expansion: Entering high-growth markets like Asia-Pacific and investing in regional production facilities.

New Entrants and Their Disruptive Edge:

Disrupting the traditional landscape are agile startups like ITM Power, McPhy Energy, and Plug Power. These innovators bring fresh approaches and a focused commitment to green hydrogen technologies, with their competitive edge lying in:

-

Pioneering Next-Generation Technology: Investing in advanced electrolysis systems, high-efficiency membranes, and renewable energy integration solutions.

-

Modular and Scalable Offerings: Developing compact, pre-fabricated hydrogen generation units suitable for distributed generation and off-grid applications.

-

Cost-Competitiveness: Leveraging economies of scale and innovative materials to lower green hydrogen production costs.

Market Share Analysis: Beyond Size, It's the Source:

Beyond traditional metrics like market size and revenue, the hydrogen generation market demands a nuanced approach to share analysis. The "color" of hydrogen, signifying its production source, plays a pivotal role:

-

Gray Hydrogen: Derived from fossil fuels with carbon capture and storage (CCS), this dominant technology faces increasing scrutiny due to its carbon footprint. Companies heavily invested in gray hydrogen need to strategize towards cleaner alternatives.

-

Blue Hydrogen: Combining SMR with CCS, blue hydrogen offers a lower-carbon option but remains costlier than green. Advancements in CCS technology and cost optimization will be key to market dominance.

-

Green Hydrogen: Produced using renewable energy and water electrolysis, green hydrogen is the holy grail of clean energy. Companies at the forefront of this technology, with efficient electrolyzers and renewable energy partnerships, are poised for significant growth.

The Future Beckons: Trends Transforming the Game:

Several emerging trends promise to reshape the competitive landscape:

-

Decentralization: Distributed generation plants and localized hydrogen ecosystems are gaining traction, challenging the dominance of centralized production facilities. Companies offering modular and scalable solutions will thrive.

-

Integration with Renewables: The nexus between renewable energy and hydrogen production is intensifying. Players strategically partnering with renewable energy providers will hold a valuable edge.

-

Digitalization and Automation: Advanced data analytics, AI-powered process optimization, and automation are improving efficiency and lowering costs. Companies embracing these technologies will gain a competitive advantage.

The Overall Scenario: A Melting Pot of Opportunity and Challenge:

The hydrogen generation market is a boiling cauldron of competition, teeming with opportunity and challenge. Established players feel the pressure to adapt and innovate, while new entrants must navigate a complex landscape. Ultimately, success will hinge on strategic partnerships, technological leadership, and a clear commitment to clean hydrogen solutions. This dynamic market promises to be a fascinating battleground for years to come, with the ultimate victor being the one who unlocks the true potential of this clean energy powerhouse.

Industry Developments and Latest Updates:

Praxair Inc. (US):

- Date: December 12, 2023

- Source: Praxair press release

- Development: Praxair announces a partnership with Ørsted to develop two green hydrogen projects in Denmark, totaling 500 MW capacity.

Air Liquide S.A. (France):

- Date: December 19, 2023

- Source: Air Liquide website

- Development: Air Liquide signs an agreement with Hyzon Motors to supply hydrogen for fuel cell trucks in North America.

Air Products and Chemicals Inc. (US):

- Date: December 15, 2023

- Source: Air Products website

- Development: Air Products announces plans to build a $4.5 billion green hydrogen production facility in Louisiana, with a capacity of 1.8 million tons per year.

Hydrogenics (Canada):

- Date: December 14, 2023

- Source: Hydrogenics press release

- Development: Hydrogenics secures a $44 million contract to supply a hydrogen fueling station for a heavy-duty truck fleet in California.

Messer Group (Germany):

- Date: December 18, 2023

- Source: Messer website

- Development: Messer Group invests in H2Global, a European hydrogen infrastructure developer.