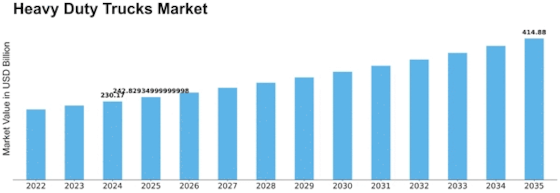

Heavy Duty Trucks Size

Heavy Duty Trucks Market Growth Projections and Opportunities

Government efforts to promote the adoption of electric trucks and ensure cost-effectiveness are pivotal drivers propelling the growth of the global electric truck market. This market has been intricately segmented based on truck type, charge type, application, and geographical regions, delineating key trends and growth trajectories.

The segmentation based on truck type differentiates between medium duty trucks and heavy-duty trucks. Notably, in 2019, the medium duty trucks segment emerged as the dominant force, commanding a substantial market share of 94.12% and a volume of 15,974 units. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 73.39% during the anticipated timeline, underscoring its progressive market penetration and anticipated expansion.

Furthermore, the charge type classification segregates the market into distinct categories, encompassing battery, plug-in hybrid, hybrid, and hydrogen fuel cell electric trucks. The battery segment, in particular, asserted its dominance in 2019, claiming a significant market share of 52.26% and showcasing a market volume of 8,870 units. Forecasts suggest an impressive CAGR of 78.58% for this segment over the forecast period, signifying its projected trajectory towards substantial growth and market influence.

The segmentation based on application delves into various utility sectors, categorizing the market into logistics, municipal, and other applications. Notably, the logistics segment emerged as the primary driver in 2019, securing the largest market share of 53.81% with a volume of 9,133 units. Projections anticipate an impressive CAGR of 77.35% for this segment, highlighting its substantial growth prospects and pivotal role in the electric truck market.

Moreover, geographical segmentation underscores the regional dynamics, with Asia-Pacific spearheading the market in 2019 by claiming a staggering market share of 86.93% and boasting a volume of 14,753 units. Forecasts predict an impressive CAGR of 74.52% for the Asia-Pacific region, showcasing its promising trajectory and dominance in driving the growth of the electric truck market across the projected period.

In essence, the segmentation of the global electric truck market based on truck type, charge type, application, and region delineates the distinct market trends and growth trajectories within this burgeoning industry. The dominance of medium duty trucks, the ascendancy of battery-powered vehicles, the surge in logistics applications, and the regional prominence of Asia-Pacific underscore the diverse facets propelling the evolution and expansion of the electric truck market on a global scale.

Leave a Comment