Market Share

Heavy-duty Tire Market Share Analysis

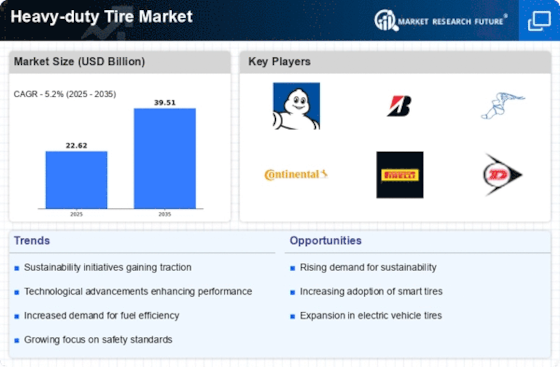

The heavy-duty tire market is witnessing noteworthy trends as it navigates the dynamic landscape of the automotive industry, particularly in the commercial and industrial sectors. One prominent trend is the increasing demand for sustainable and fuel-efficient solutions. With a growing emphasis on environmental consciousness and fuel economy, manufacturers are investing in the development of heavy-duty tires with advanced materials and tread designs that enhance fuel efficiency and reduce carbon emissions. This trend is particularly pronounced in the logistics and transportation sectors, where fleet operators are seeking cost-effective solutions that align with stricter emission standards.

In tandem with the sustainability trend, there is a noticeable shift towards the adoption of smart tire technologies in the heavy-duty segment. These technologies, including tire pressure monitoring systems (TPMS) and sensors, provide real-time data on tire performance, enabling proactive maintenance and optimizing overall vehicle efficiency. Fleet managers are increasingly recognizing the benefits of smart tire solutions in preventing breakdowns, extending tire life, and improving safety on the roads.

The heavy-duty tire market is also experiencing innovations in tire design and construction. Manufacturers are exploring advanced materials, such as high-strength compounds and reinforced sidewalls, to enhance durability and load-carrying capacity. Additionally, advancements in tread patterns and tire geometries are aimed at improving traction, handling, and overall performance in challenging terrains, further catering to the diverse needs of industries like construction, agriculture, and mining.

The advent of electric and autonomous vehicles is another transformative trend in the heavy-duty tire market. As electric trucks and autonomous machinery become more prevalent, there is a growing demand for tires that meet the specific requirements of these vehicles. Electric trucks, for instance, pose unique challenges due to the considerable weight of battery systems, necessitating tires with enhanced load-bearing capabilities. Autonomous vehicles, on the other hand, may benefit from specialized tire technologies that contribute to the precision and safety of self-driving operations.

Globalization and the expansion of logistics networks are influencing the geographical dynamics of the heavy-duty tire market. As emerging economies witness increased industrialization and infrastructure development, the demand for heavy-duty tires is on the rise. Countries with booming construction and mining activities, such as those in Asia-Pacific and Latin America, are becoming key growth markets for heavy-duty tire manufacturers. Consequently, global tire manufacturers are strategically expanding their production and distribution networks to capitalize on these emerging opportunities.

On the regulatory front, stringent safety and environmental standards are shaping the heavy-duty tire market. Regulatory bodies are pushing for the development and adoption of tires that meet specific performance criteria, particularly in terms of safety, fuel efficiency, and noise emissions. Compliance with these standards has become a crucial factor for manufacturers looking to secure contracts with commercial vehicle operators and government agencies.

The aftermarket segment of the heavy-duty tire market is witnessing a surge in demand for retreading solutions. Fleet operators are increasingly recognizing the economic and environmental benefits of tire retreading, which extends the life of tires and reduces the environmental impact associated with tire disposal. This trend is fostering a growing market for retreading services and technologies, providing cost-effective alternatives to purchasing new tires.

In conclusion, the heavy-duty tire market is undergoing significant transformations driven by the demand for sustainable and fuel-efficient solutions, the integration of smart tire technologies, innovations in tire design and construction, the impact of electric and autonomous vehicles, globalization, regulatory pressures, and the rise of the tire retreading aftermarket. As the automotive industry continues to evolve, heavy-duty tire manufacturers are adapting to these trends to meet the changing needs of commercial and industrial sectors worldwide.

Leave a Comment