Market Analysis

In-depth Analysis of Glucose Tolerance Test Market Industry Landscape

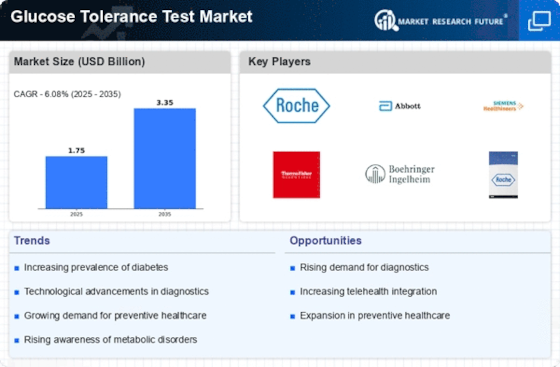

The market dynamics of the glucose tolerance test (GTT) are influenced by various factors that shape its growth and evolution. The GTT is a diagnostic test used to assess the body's ability to metabolize glucose and detect abnormalities in glucose regulation, such as diabetes mellitus and gestational diabetes. The demand for GTT is primarily driven by the increasing prevalence of diabetes and metabolic disorders globally. Factors such as sedentary lifestyles, unhealthy diets, and aging populations contribute to the rising incidence of diabetes, driving the need for accurate diagnostic tests like GTT to facilitate early detection and intervention.

Moreover, advancements in healthcare infrastructure, diagnostic technologies, and diabetes management play a significant role in market growth. The availability of point-of-care testing devices, automated laboratory systems, and continuous glucose monitoring devices has facilitated the widespread adoption of GTT in various healthcare settings, including hospitals, clinics, and diagnostic laboratories. Additionally, the integration of GTT into routine health screenings, preventive care programs, and diabetes management protocols further stimulates market demand by promoting early detection, risk stratification, and personalized treatment approaches.

Furthermore, market dynamics are influenced by regulatory frameworks, reimbursement policies, and healthcare expenditure. Regulatory agencies establish standards and guidelines for the development, manufacturing, and marketing of GTT kits and devices to ensure their safety, efficacy, and quality. Reimbursement policies vary across different regions and healthcare systems, impacting patient access to GTT and reimbursement rates for healthcare providers. Markets with favorable reimbursement policies and healthcare coverage tend to experience higher adoption rates of GTT, while reimbursement constraints may hinder market growth in other regions.

Competitive forces also shape the dynamics of the GTT market, with numerous diagnostic companies, medical device manufacturers, and healthcare providers vying for market share through product differentiation, pricing strategies, and strategic partnerships. Established players leverage their research and development capabilities, regulatory expertise, and global distribution networks to maintain a competitive edge. They invest in the development of innovative GTT kits and devices, such as oral glucose tolerance tests (OGTT), intravenous glucose tolerance tests (IVGTT), and continuous glucose monitoring systems, to address unmet medical needs and improve patient outcomes.

The evolving landscape of personalized medicine and precision diagnostics is driving market dynamics, as healthcare providers increasingly emphasize tailored approaches to patient care and treatment. Advances in genetic testing, biomarker analysis, and digital health technologies enable personalized risk assessment, treatment selection, and disease monitoring in diabetes patients. By integrating clinical, genetic, and patient-specific data, healthcare providers can optimize treatment regimens, improve treatment outcomes, and enhance patient satisfaction in diabetes care.

Despite the promising growth prospects, the GTT market faces certain challenges and uncertainties that may impact its trajectory. Market saturation, pricing pressures, and reimbursement constraints pose challenges for market players, particularly smaller companies and new entrants. Moreover, concerns regarding test accuracy, standardization, and interpretation drive the need for continuous quality improvement and professional education in GTT testing. Additionally, emerging trends such as telemedicine, remote patient monitoring, and digital health technologies present both opportunities and challenges for market players, requiring adaptation to changing healthcare delivery models and patient preferences.

Leave a Comment