Market Trends

Key Emerging Trends in the Fracking Chemicals Market

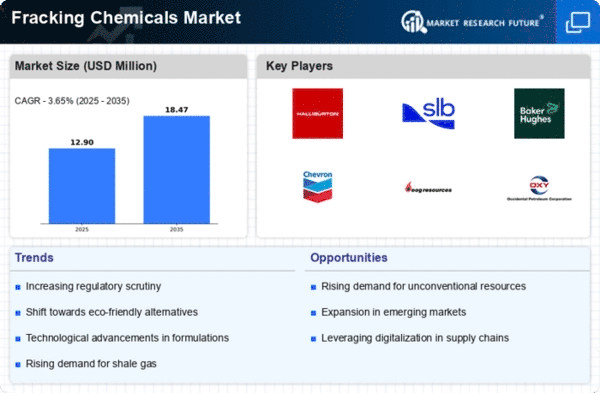

The Fracking Chemicals Market has witnessed significant trends and transformations in recent years, reflecting the dynamic nature of the oil and gas industry. As a key player in the extraction of unconventional oil and gas resources, hydraulic fracturing, commonly known as fracking, has become a pivotal technology. One prominent trend in the market is the increasing demand for environmentally friendly and sustainable fracking chemicals. With growing concerns about the environmental impact of fracking operations, there is a rising emphasis on developing and using chemicals that are less harmful to ecosystems. This shift is driven by both regulatory pressures and a heightened awareness of the industry's responsibility to mitigate its environmental footprint.

Moreover, the market has seen a surge in research and development activities focused on improving the efficiency and effectiveness of fracking chemicals. The quest for advanced formulations that enhance the extraction process while minimizing environmental risks has become a central theme. Companies are investing in innovative solutions that not only boost oil and gas recovery rates but also address concerns related to water usage and chemical disposal. This trend aligns with the industry's commitment to responsible and sustainable practices.

Another noteworthy trend is the regional diversification of fracking activities, leading to varied requirements for fracking chemicals. As fracking operations expand to different geographies, the composition and characteristics of the geological formations vary. Consequently, there is a growing need for customized fracking chemical solutions tailored to specific regional demands. This trend is driving market players to develop a diverse portfolio of products to cater to the unique challenges posed by different geological conditions.

Furthermore, market participants are increasingly focusing on strategic collaborations and partnerships to strengthen their positions and expand their product offerings. Joint ventures between chemical manufacturers, oil and gas companies, and service providers have become common, fostering a collaborative approach to addressing the complexities of the fracking chemicals market. These partnerships enable the sharing of expertise, resources, and technology, ultimately enhancing the industry's ability to innovate and adapt to evolving market dynamics.

The digital transformation of the oil and gas sector has also left its mark on the fracking chemicals market. The integration of digital technologies, such as data analytics, artificial intelligence, and IoT (Internet of Things), is gaining momentum. These technologies play a crucial role in optimizing fracking processes, monitoring equipment performance, and predicting potential issues. The adoption of digital solutions not only improves operational efficiency but also contributes to the overall sustainability of fracking operations by minimizing resource wastage and reducing environmental impact.

Leave a Comment