Market Trends

Key Emerging Trends in the Federal Edge Computing Market

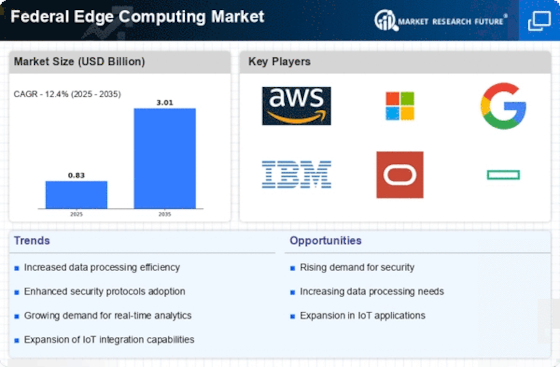

As many companies struggle to establish or increase their share in the ever-changing landscape of the Federal Edge Computing Market, they adopt various strategies. One common approach involves technological innovation whereby organizations try to create and provide advanced-edge computing products that are tailor-made for various requirements by different federal institutions with enhanced properties on security needs, thereby enabling them to compete favorably within this market niche. Some firms take up a cost leadership strategy where they aim to provide low-cost edge computing solutions compared to competition levels. However, collaboration and strategic partnership are seen as important aspects to consider when positioning a company or a product within any given marketplace. In terms of geographical expansion, there are different ways for companies to operate in the Federal Edge Computing Market. Going beyond into new regions or countries helps penetrate untapped markets, gain a wider range of federal clients, and reduce reliance on agencies. Besides government priorities, market share positioning is also concerned with adherence to strict cybersecurity standards as well as environmental responsibility. In the case of companies that follow strict guidelines for handling data securely, comply with federal regulations, and use energy-efficient edge computing solutions, they become more attractive to security-focused and eco-friendly federal customers. This not only makes companies trusted partners but also changes customer perception towards them regarding the Federal Edge Computing Market.

Leave a Comment