Market Share

Federal Edge Computing Market Share Analysis

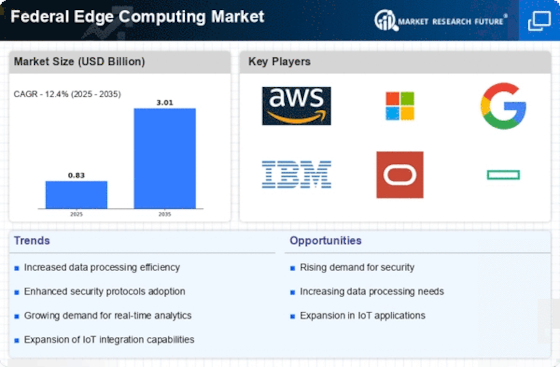

The Federal Edge Computing market has been characterized by notable trends that reflect the evolving nature of technology adoption within government agencies. The shift towards using Edge Computing solutions by federal entities in recent years is motivated by the need for real-time processing of data with low latency and improved security. In this market space, one key trend is the deployment of Edge Computing at the edge of federal networks, where it's closer to data sources and end users. Additionally, there has been a growing focus on integrating Artificial Intelligence (AI) and Machine Learning (ML) capabilities into the Federal Edge Computing market. On some occasions, ML or AI algorithms can provide insights based on captured edge collected data, thereby allowing timely decisions to be made with more information available. Federal agencies have adopted edge computing as a solution to the increasing amount of data generated by Internet of Things (IoT) devices, which is leading to a more efficient management and processing of this information. The use of edge computing in federal IoT initiatives allows local extraction of valuable insights among agencies rather than relying on centralized data processing. Additionally, the US federal government plans to deploy 5G technology alongside Edge Computing for improved connectivity, bandwidth, and communication capabilities. By moving 5G networks closer to the edge, device-to-device communication becomes faster and more reliable, enabling support for low-latency, high-throughput applications. This includes real-time communication, which is necessary in case of autonomous systems or remote operations or during emergencies. Interoperability has become a major trend in the Federal Edge Computing market. The US government often relies on different kinds of system operations and applications that require integration with current IT infrastructure. To avoid problems associated with such migration into federal networks, these interoperable technologies must work seamlessly with legacy systems as well as other components of edge computing. Furthermore, federal agencies have started focusing on sustainability and energy efficiency when deploying Edge Computing solutions. These green computing endeavors seek to reduce environmental footprints resulting from IT activities while at the same time offering ways through which various organizations can optimize power usage within edge computing under federal jurisdiction since this trend is consistent with wider goals towards sustainable development within the country.

Leave a Comment