Face Shield Size

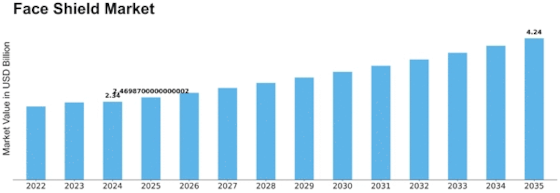

Face Shield Market Growth Projections and Opportunities

This is an industry with a dynamic market, which is influenced by healthcare trends, increasing safety regulations, and changes in how people consume. Originally confined to the health care settings, face shields have been popularized across different industries as well as daily activities, implying that there has been a changing attitude towards personal protection. The trend in healthcare, particularly during the COVID-19 pandemic, has had significant implications on face shield market dynamics. At the start, they were adopted as necessary personal protective equipment (PPE) for medical personnel but later came to be seen as a symbol of infection control measures. Safety regulations and guidelines are some of the factors that have shaped the face shield market. In some specific settings where infectious diseases are common, governmental health authorities, together with occupational safety organizations, have recommended or even made it compulsory to wear them. Consumer behaviors and preferences constitute a great extent of the face shield market dynamics. Face shields are sought by individuals who want extra protection, especially in high-risk environments such as those who use face masks. Technological advancements have also affected face shield market dynamics. Face shields come with advanced materials such as optical-grade plastics and lightweight polymers, which enhance clarity and strength alongside the general effectiveness of face shields, such as lightness and durability, respectively. Some even come with built-in communication systems so one can stay connected while having it on, thus providing an advantage over other products available in the markets, protecting their users more effectively than other brands through this improvement in technology. Brand reputation and product quality are important elements within the competitive environment for face shields being produced every day by different companies globally. Factors affecting competition include brand reputation quality and pricing, among others (Kumaraswamy & Daugherty 2019). Established names within reliable manufacturers of effective PPE tend to be trusted by those who buy them often. However, new players are also entering the industry, offering diverse options ranging from throw-away face masks to reusable/customizable designs. This gives the customer confidence in buying such products as they get to hear what other consumers have said, what doctors have endorsed, and how the product has adhered to safety standards. The presence of E-commerce has transformed distribution channels and made accessibility of face shields easier than before. These platforms avail numerous choices to customers as they can look for more information regarding the item through several online sources and even make purchase decisions on factors like free delivery service or doorstep services offered by most companies, thus eliminating intermediaries who were involved in channeling goods directly from manufacturing facilities back then.

Leave a Comment