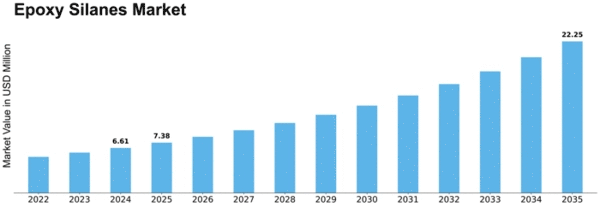

Epoxy Silanes Size

Epoxy Silanes Market Growth Projections and Opportunities

Epoxy Silanes market dynamics are shaped by many factors. Construction, adhesives, sealants, and coatings demand are driving factors. The coupling, adhesion, and surface modification properties of epoxy silanes make them popular in these industries. These industries' growth and performance affect epoxy silane demand, making them essential to production processes.

In the Epoxy Silanes business, regulations and environmental awareness are crucial. Manufacturers must follow these requirements to meet regulations and satisfy environmentally concerned consumers. Sustainable practices have led to the development of sustainable and low VOC epoxy silanes to meet the growing need for environmentally friendly solutions.

Global economic conditions shape the Epoxy Silanes market. Economic factors including construction, automobile, and industrial manufacturing affect silane product demand. Epoxy silane demand rises during economic growth due to increased building, manufacturing, and consumer goods output. Conversely, economic downturns may diminish industrial and construction activity, hurting market dynamics.

Technological advances in silane synthesis and application drive market growth. Coupling agent, surface modification, and epoxy silane formulation innovations can improve these compounds' performance, compatibility, and adaptability. Staying ahead of technical advances through research and development helps companies meet changing industry needs and establish a competitive edge in the Epoxy Silanes market.

The Epoxy Silanes market depends on supply chain characteristics including raw material availability and pricing. Epoxy compounds and organosilanes are common silane raw sources. Raw material price fluctuations affect production costs and market dynamics. A reliable and efficient supply chain is needed to provide epoxy silanes to end-users without disruptions and preserve market stability.

Global trade policy and geopolitics shape the Epoxy Silanes market. Tariffs, trade agreements, and geopolitical conflicts affect chemical supply and demand. Market players must adjust to these external influences to manage global trade dynamics.

Key players, market share, and strategic activities affect Epoxy Silanes market competition. To gain market share, companies innovate, extend their product portfolios, and develop strategic collaborations. To obtain market share and a competitive edge in the epoxy silanes business, mergers and acquisitions are typical."

Leave a Comment