Elevators Size

Elevators Market Growth Projections and Opportunities

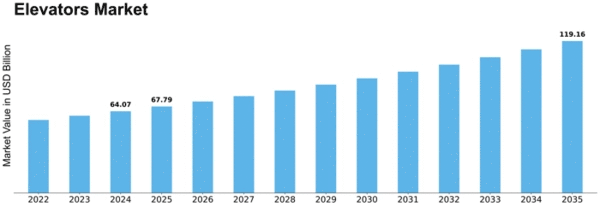

Many variables affect the elevator market. Global construction, where elevators enable vertical movement, is a key driver. As urbanization increases demand for towering buildings and denser populations, efficient and creative elevator systems are needed. Skyscrapers, residential complexes, and commercial structures boost the elevators industry. Elevators Market Size was $50.8 Billion in 2022. The elevator industry is expected to increase from USD 54.1 Billion in 2023 to USD 89.5 Billion in 2032, a CAGR of 5.35%. With improvements improving safety, energy efficiency, and user experience, technology shapes the elevator business. Smart lifts with IoT, destination control, and predictive maintenance are becoming common. These advances boost elevator efficiency and meet the growing need for smart and sustainable building solutions. Safety and accessibility laws and building rules affect the elevator industry. Elevator manufacturers must follow standards and regulations to guarantee user safety and seamless integration into building designs. Regulations aimed at improving energy efficiency and accommodating disabled persons affect elevator design and functionality. Urbanization and population demographics affect elevator market dynamics. Vertical transportation efficiency is crucial in highly populated metropolitan areas. Elevator demand is driven by high-rise residential, commercial, and mixed-use complexes. Retrofitting older buildings with elevators becomes prevalent as the global population ages, further driving market expansion. Construction operations are generally tied to economic growth, hence economic factors shape the elevator industry. In times of economic boom, real estate and infrastructure expenditures boost elevator demand. Conversely, economic downturns or building slowdowns may impair new installations and elevator modernization projects. Sustainability and environmental concerns are growing in the elevator sector. As green building practices proliferate, elevator manufacturers are designing energy-efficient technologies that lessen environmental effect. Energy-efficient elevators, regenerative drive systems, and low-carbon materials fit the green building trend. Elevator market dynamics depend on consumer safety, comfort, and aesthetics. Elevators are useful and part of the building experience. Modern customers choose elevators with safety features, pleasant rides, and attractive designs. Elevator manufacturers include improved safety systems and customized design to meet these needs. Competition in the elevator sector drives R&D to discover new solutions. Manufacturers must differentiate via features, technology, and services to compete. Strong collaborations with architects, developers, and construction companies also affect elevator brand and model acceptance.

Leave a Comment