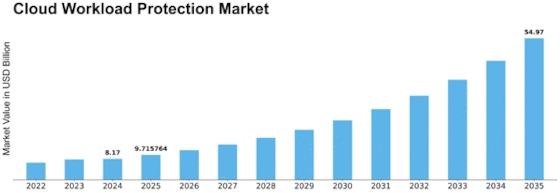

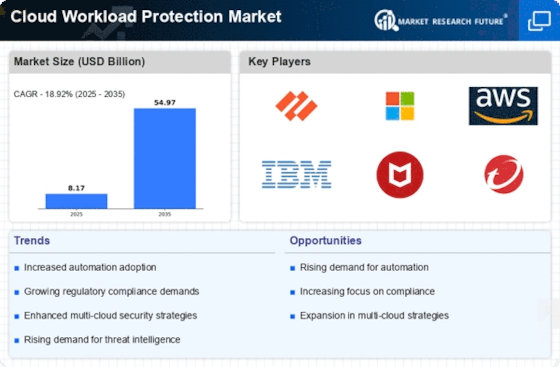

Cloud Workload Protection Size

Cloud Workload Protection Market Growth Projections and Opportunities

The cloud workload protection market is undergoing significant changes driven by various factors reshaping its landscape. With the rapid adoption of cloud computing across industries, organizations are increasingly reliant on cloud-based workloads to power their operations. However, this shift to the cloud brings about new security challenges, prompting businesses to invest in robust protection solutions tailored to the cloud environment.

One of the primary drivers behind the evolving market dynamics is the growing sophistication of cyber threats targeting cloud workloads. As organizations migrate sensitive data and critical applications to the cloud, they become prime targets for cyberattacks, including malware, ransomware, and data breaches. In response, businesses are seeking advanced workload protection solutions that can safeguard their cloud infrastructure, detect and respond to threats in real-time, and ensure compliance with industry regulations.

Moreover, the complexity of multi-cloud and hybrid cloud environments further complicates security management, driving the demand for comprehensive workload protection solutions. With organizations leveraging multiple cloud platforms and on-premises infrastructure, they require unified security solutions that can provide visibility and control across disparate environments. Cloud workload protection platforms offer centralized management, policy enforcement, and threat intelligence capabilities, enabling organizations to secure their workloads consistently across different cloud environments.

Furthermore, the increasing adoption of containerization and serverless computing models introduces new security challenges for cloud workloads. Containers and serverless functions offer agility and scalability benefits, but they also introduce unique attack vectors and vulnerabilities that traditional security tools may not adequately address. Cloud workload protection solutions are evolving to provide native support for containerized workloads and serverless environments, offering runtime protection, vulnerability management, and configuration hardening capabilities.

Additionally, the rise of DevOps and agile development practices is driving the integration of security into the software development lifecycle (SDLC). Organizations are embracing DevSecOps principles to shift security left, embedding security controls and testing into the development process from the outset. Cloud workload protection solutions integrate seamlessly with CI/CD pipelines, enabling automated security testing, code scanning, and policy enforcement throughout the software development lifecycle. By integrating security into the development workflow, organizations can accelerate time-to-market while minimizing security risks.

Another factor shaping the market dynamics of cloud workload protection is the increasing focus on compliance and data privacy regulations. With the implementation of regulations such as GDPR, CCPA, and HIPAA, organizations are under pressure to ensure the confidentiality, integrity, and availability of sensitive data stored in the cloud. Cloud workload protection solutions offer capabilities such as data encryption, access controls, and audit logging to help organizations achieve regulatory compliance and protect their customers' data privacy.

Furthermore, the COVID-19 pandemic has accelerated the adoption of cloud computing and remote work solutions, driving the demand for cloud workload protection. With employees working from home and accessing corporate resources from remote locations, organizations need robust security solutions to protect their cloud workloads from cyber threats and unauthorized access. Cloud workload protection platforms provide organizations with the visibility and control they need to monitor, manage, and secure their cloud infrastructure from anywhere, at any time.

Leave a Comment