Market Share

Circulating Tumor Cell Market Share Analysis

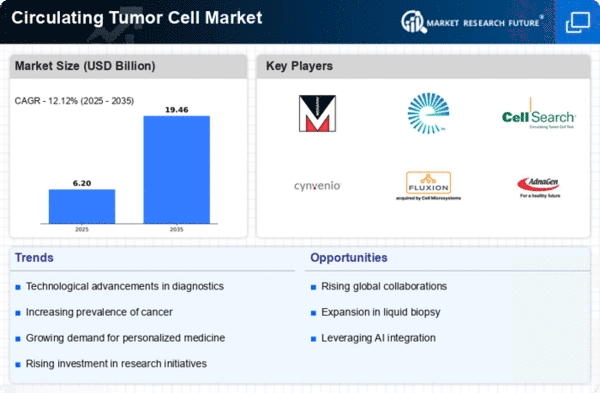

The exponential growth of the circulating tumor cells (CTC) market is intricately linked to the escalating research and development activities in the pharmaceutical and biotechnology sectors. As these industries channel substantial resources into addressing the pressing treatment needs of various chronic diseases, including cancer, the CTC market is witnessing a significant upswing. Notably, the surge in research and development expenditures is a global phenomenon, with key players such as the United States, the United Kingdom, and Australia leading the charge in advancing breakthroughs for conditions like cancer, dementia, and rare genetic diseases.

In the United States, the pharmaceutical and biotech industry demonstrated its commitment to pioneering research and development by investing a staggering USD 102 billion in 2015, as revealed by a recent survey. This colossal sum underscores the industry's dedication to innovation and underscores the pivotal role it plays in advancing healthcare solutions. The relentless pursuit of new therapies and treatments for chronic diseases, particularly cancer, has propelled the pharmaceutical and biotech sector into a central force driving the growth of the CTC market.

Across the Atlantic, the United Kingdom's pharmaceutical industry, represented by the Association of the British Pharmaceutical Industry (ABPI), stands as a formidable contributor to global research and development efforts. The ABPI invested over Euro 4.1 billion in research and development, focusing on breakthroughs that could revolutionize the landscape of conditions such as cancer, dementia, and rare genetic diseases, according to data from the National Institute for Health Research. This investment not only reflects the industry's commitment to scientific advancements but also positions the UK as a crucial player in shaping the future of healthcare.

Australia, too, has made substantial strides in allocating resources to cancer research and development. The National Health and Medical Research Council reported that the Australian government dedicated over USD 174.6 million to advancing research initiatives aimed at combating cancer. This robust investment signifies the country's commitment to leveraging scientific breakthroughs to address the complexities of cancer and improve patient outcomes.

The growing momentum in research and development within the healthcare sector is proving to be a driving force for the CTC market. As advancements in cancer research unfold, the relevance of CTCs as invaluable biomarkers becomes increasingly apparent. These cells, found in the bloodstream, provide critical insights into the status and progression of cancer. The emphasis on understanding the molecular and genetic characteristics of tumors fuels the demand for advanced diagnostic tools like CTC-based technologies.

The integration of CTC technologies into the broader landscape of cancer research and treatment heralds a new era in precision medicine. By capturing and analyzing CTCs, healthcare professionals gain real-time information that can guide personalized treatment strategies, monitor disease progression, and enhance overall patient care. The synergy between heightened research and development efforts and the expanding applications of CTCs underscores the transformative potential of these technologies in the realm of oncology.

Leave a Comment