Market Analysis

In-depth Analysis of Cerebral Vascular Stent Market Industry Landscape

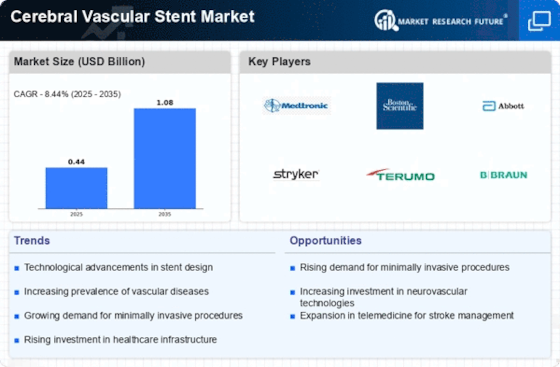

Due to global cerebrovascular disease prevalence, cerebral vascular stents are in demand. Because individuals are living longer and given the changes in lifestyles, strokes and aneurysms are rising. There is a higher need for improved preventative and treatment options. Advanced medical technology has substantially impacted the cerebral vascular stent market. New stent designs, materials, and production procedures have improved safety and efficacy. Because of this, brain vascular stents are the best vascular disease treatment. Neurovascular therapies have shifted toward less-damaging approaches. Brain vascular tubes are crucial to endovascular therapies because they fit precisely and reduce risk. Cerebral vascular stent sales rise as doctors prefer less intrusive procedures. Global longevity is driving the cerebral artery stent market. Atherosclerosis and aneurysms increase with age. Growing numbers of older persons demand effective treatments, driving the market. Producers can service this rising patient base. Rising global healthcare expenses impact the cerebral vascular device industry. Governments and private firms invest more in healthcare, improving access to advanced medical procedures like brain vascular stents. Cash aid boosts the market. Research and development in the medical device industry improves cerebral vascular stents. Stent customization by size and form enhances therapy. Stent manufacturers are investing in flexible, deliverable, and living tissue-compatible stents. This alters the market. The cerebral artery stent market is regulated and requires health authority licenses. Companies who follow these guidelines have an edge over rivals since their products are safe and effective. Following the regulations builds confidence between healthcare personnel and clients, which boosts market growth. Cerebral vascular stent market leaders are competing for share. Mergers and acquisitions help companies expand globally and provide new products. Competition impacts price setting and technical advancement, which transforms the market. Knowledge about cerebrovascular illnesses and treatment options affects market dynamics. Healthcare companies provide early detection and treatment education programs. Cerebral vascular stent demand rises because well-informed patients pick their own therapies.

GDP growth, healthcare facility development, and economic stability impact the cerebral vascular stent market. People spend more on health care when the economy is booming, which boosts market growth. However, in a weak economy, healthcare budgets may be slashed, making care more expensive. This might hinder market development.

Leave a Comment