Market Trends

Key Emerging Trends in the Cerebral Vascular Stent Market

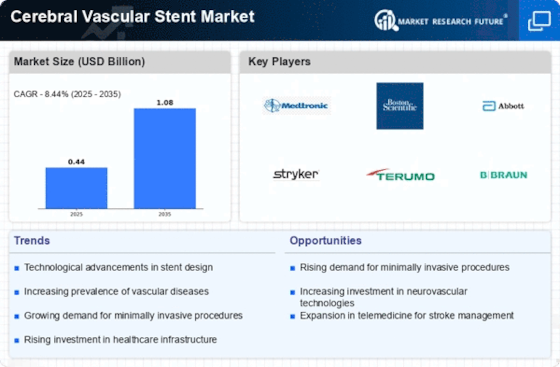

Cerebral Vascular Stent market patterns have changed significantly in recent years. Better medical technology and older populations caused these shifts. This fast-growing market is driven by brain vascular disease stent manufacture and distribution. A major market trend is the rise of cerebral vascular illnesses worldwide. Because people are less active, eating poorly, and living longer, strokes and aneurysms are rising. This increases brain vascular stent need. Medical technology's constant improvement drives the market. New brain vascular stent materials, designs, and delivery systems are major trends. These advances aim to enhance stent placement while reducing risks and complications. Many people prefer somewhat invasive approaches, and endovascular treatments for cerebral vascular diseases are becoming increasingly common. Cerebral vascular stent-based endovascular procedures heal faster, reduce risk, and improve outcomes. This drives the new therapy market. Brain vascular diseases are rising as the global population ages. This population shift influences market trends because older persons buy more brain vascular stents. Healthcare and instructional projects are educating more individuals about cerebral vascular diseases and their treatments. Patients and doctors are learning more about cerebral vascular stent advantages. This promotes these gadgets' adoption. The market is encouraging medical equipment manufacturers and healthcare providers to cooperate. These agreements aim to speed up brain vascular stent development, production, and distribution to make them more accessible and effective. Drug regulations, like brain vascular stents, change often. Market players must follow stringent regulatory regulations to ensure product safety and efficacy. Maintaining compliance with rules and new requirements is a major challenge for market stakeholders. Cerebral vascular stent market leaders are competing for share. To compete for new technologies, market share, and goods, companies are investing heavily in R&D. Modern competition helps the market develop and adapt. Economic conditions and healthcare facilities in various places affect the market. Economic growth, healthcare spending, and high-tech medical facilities impact cerebral vascular stent utilization. This affects regional market patterns.

Leave a Comment