Market Analysis

In-depth Analysis of Aviation Cyber Security Market Industry Landscape

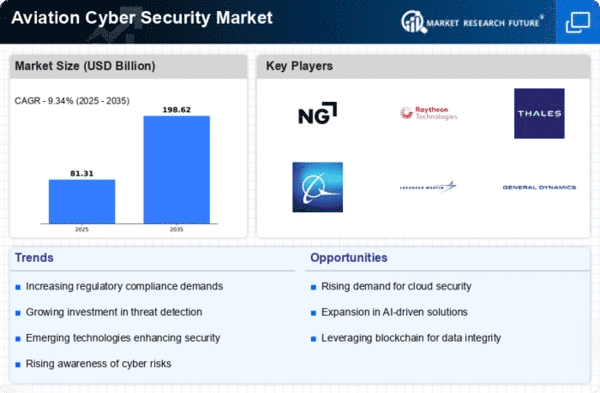

The dynamics of the aviation cybersecurity market represent a complex interplay of technological advancements, evolving threats, regulatory frameworks, and industry-specific challenges within the aviation sector. With the increasing digitization and connectivity of aircraft systems and ground infrastructure, cybersecurity has become a critical concern. One of the significant dynamics driving this market is the persistent threat landscape. The aviation industry faces a multitude of cyber threats, including malware, phishing attacks, ransomware, and potential vulnerabilities within the complex network of aviation systems. These threats continually evolve, necessitating proactive measures to safeguard critical aviation assets against cyber-attacks. Moreover, the rapid technological advancements within the aviation industry contribute to the dynamics of aviation cybersecurity. The adoption of advanced technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and cloud computing in aviation systems enhances operational efficiency but also expands the attack surface for potential cyber threats. This necessitates robust cybersecurity solutions and strategies to mitigate vulnerabilities arising from the integration of new technologies into aviation networks. Regulatory frameworks and compliance standards significantly shape the dynamics of the aviation cybersecurity market. Aviation regulatory bodies impose stringent cybersecurity standards and regulations to ensure the safety and security of aviation systems and data. Compliance with regulations such as the FAA (Federal Aviation Administration) guidelines, ICAO (International Civil Aviation Organization) standards, and industry-specific cybersecurity protocols becomes imperative for airlines, aircraft manufacturers, and aviation service providers, driving the adoption of cybersecurity solutions and practices. Furthermore, the increasing interconnectivity between various stakeholders in the aviation ecosystem contributes to market dynamics. Airlines, airports, aircraft manufacturers, maintenance providers, and third-party service providers form an interconnected network that exchanges critical data and information. This interconnectedness amplifies the need for robust cybersecurity measures to protect sensitive data, flight systems, passenger information, and operational infrastructure from cyber threats. The evolving nature of cyber threats and the emergence of sophisticated attack vectors impact the market dynamics of aviation cybersecurity. Cybercriminals continuously devise new methods to infiltrate aviation systems, exploiting vulnerabilities in network infrastructure, software, and human factors. As the threat landscape evolves, cybersecurity solutions providers need to adapt and innovate rapidly to address emerging threats and protect aviation assets effectively. Additionally, the perception of cybersecurity as a business enabler rather than just a protective measure influences market dynamics. Companies within the aviation cybersecurity sector are increasingly emphasizing the integration of cybersecurity as an integral part of their business strategy. This approach entails embedding cybersecurity into the design of aviation systems, fostering a culture of cybersecurity awareness, and leveraging it as a competitive advantage to instill trust among stakeholders and customers. The collaborative approach among industry stakeholders also shapes the dynamics of the aviation cybersecurity market. Collaboration between airlines, aviation authorities, cybersecurity firms, and government agencies is crucial to developing comprehensive cybersecurity strategies, sharing threat intelligence, and implementing effective defense mechanisms against cyber threats. Partnerships and information-sharing networks within the aviation ecosystem foster a collective effort to combat cyber risks effectively.

Leave a Comment