Market Share

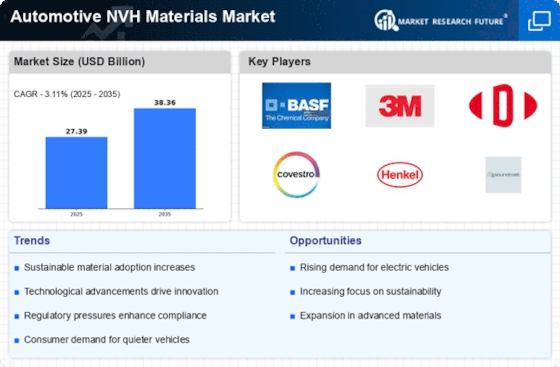

Automotive NVH Materials Market Share Analysis

Multifunctional administrations, autonomous driving, digitalization, and electric powertrains are transforming the car industry. Due to the complexity of NVH materials, automotive professionals utilize mathematical models to analyze and design. Hot stamping may become the commercial norm for underlying body components. Passenger vehicle NVH materials are often used since lower NVH levels impact buyers' purchases. Automotive NVH materials' growing income from battery-controlled light vehicles will drive the industry. Vehicle dynamic noise reduction systems may drive the automotive NVH materials industry. Noise, vibration, and harshness (NVH) materials reduce car noise, vibration, and pain.

A trend toward lightweight NVH materials is also evident. NVH materials that regulate sound and vibration without adding too much weight are sought by automakers since they reduce vehicle weight for eco-friendliness and performance. strong-level lightweight materials with strong NVH weakening qualities meet the business' need for lighter, calmer vehicles and the desire for eco-friendly cars.

In the automobile industry, affordable and eco-friendly NVH materials are becoming more popular. To reduce environmental impact, companies are studying reused and bio-based NVH materials. Recycled textures, regular filaments, and bio-based polymers reduce noise and promote eco-friendly assembly, addressing purchasers' concerns about environmental sustainability.

Additionally, smart and versatile NVH materials must be improved. Beyond noise and vibration management, these materials protect against fire, heat, and effect. Smart materials use stage shifting materials and shape memory compounds to adapt to diverse driving conditions, improving vehicle performance and security while addressing NVH issues.

The NVH materials industry is also affected by electric and crossover car trends. Electric and hybrid cars have unique functioning characteristics that require particular NVH solutions to reduce noise sources including electric engine whine and street/tire noise. Creators are generating NVH materials tailored to electric impetus framework acoustics, making electric vehicle lodges quieter and more refined.

Innovations in noise and vibration management, lightweight materials, supportability drives, multifunctional materials, electric vehicle applications, testing and replication, and cooperation organizations are driving the automotive NVH materials industry. These patterns influence the outcome and acceptance of cutting-edge NVH materials, indicating calmer, more pleasant, and environmentally conscious automobiles. NVH materials help automakers meet consumer demands for better driving experiences and eco-friendly automobiles by reducing lodges and vibrations, improving vehicle refinement and customer loyalty.

Leave a Comment