Market Analysis

In-depth Analysis of Automatic Molding Machine Market Industry Landscape

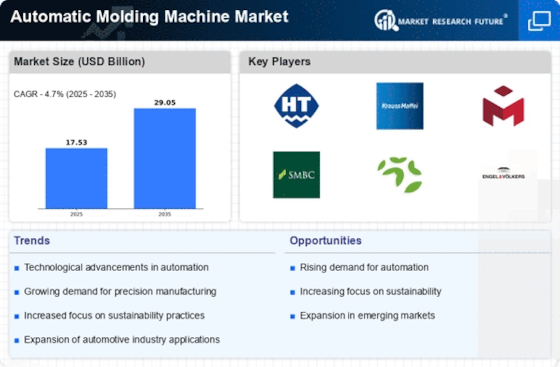

The global automatic molding machine market is set to reach US$ 25.07 BN by 2032, at a 4.70% CAGR between years 2023-2032. Real dynamics of automatic molding machine market indicate twisted laws where numerous factors determine manufacturing models not only in industries, which use high-speed and mass manufactures. Automatic molding machines are an essential part of the system, and they serve as a metal injection molding machine, metalworking machinery and equipment that automatically molds materials like plastic, rubber, or metals. The growing need for accuracy and effectiveness in manufacturing particularly, in automotive, packaging and consumer goods alike has been among the major factors driving this market. Panicked with pressing attention to achieve the greatest productivity of manufacturing processes along with eliminating manual laboring, they choose automatic molding machines that have a great impact on creating market growth. The development of technology has an important role in determining automation system parameter in the automatic molding machine market. The innovativeness in control systems, robotics, and material processing machines produces for advancement automatic molding techniques that are highly complex.

In addition, these machines not only increase the accuracy and consistency manufacturing process but also have capabilities such as machine monitoring in an instant, predictive maintenance to prevent necessity of maintenance action before occurrence of failure within its equipment or a collection having common definitions that allows for changes depending on the variety of material and mold. Holding the view of manufacturers in this market is to provide solutions to industry needs with easy, cost-saving production at high speed. The market’s dynamics for automatic molding machines include many global economic factors that also contribute considerably to the same. Investment in advanced manufacturing equipment is based on the prevailing economic conditions of a country, demand for products and raw material availability that dictates the decision-making process. Large demand for increased production, by economic development or technological advancement, usually accompanies rapid growth of economy and this demands the need for efficient molds that can accomplish high volumes.

On the other hand, it is a more conservative reaction under re-cessions when they try to find cost-effective alternatives that would help them stay competitive. That in the automatic molding machine market, there are several competitive players offering multiple solution. Competing factors among the manufacturers and suppliers of molding machines include productivity, repeatability in precision work replacing people with machines that are imbedded systems while being energy-saving, maintaining material integrity. The maintenance equipment must be able to run on materials ranging from non-metals to carbon graphite metal. First, innovations in technology are one outlet of differentiation that is achieved via providing and development customization capabilities as well beside the provision of support services. Competition plays a tremendous role by inducing advanced automatic molding machine technology that grows continuously. Government rules and standards as well as those promulgated in the industry are all important mechanisms shaping the market of automatic molding machines. To guarantee the reliability and safety of molding, manufacturers have to make sure that they abide by the rules meant for the health and sustainability of their surroundings as well as ensure compliance with quality certifications.

Leave a Comment