Market Share

Arthroscopy Instruments Market Share Analysis

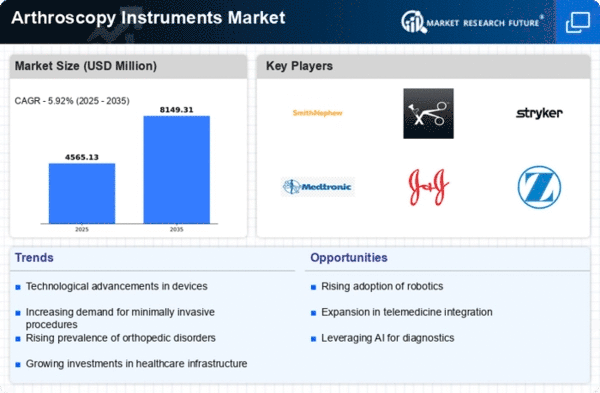

Within the medical device business, the Arthroscopy Instruments Market is a dynamic sector that focuses on minimally invasive surgical methods for joint evaluation and therapy. In this highly competitive marketplace, market share positioning strategies are critical to a company's success. Comprehending Customer demands: A thorough comprehension of customer demands is the first step towards effective market share positioning. Businesses in the arthroscopy instruments industry spend a lot of money on market research to find out how healthcare professionals' needs are changing and to make sure their product offerings meet these needs as well as the most recent developments in technology. Technological Advancements and Innovation: For market leaders, being on the cutting edge of innovation is a crucial tactic. Businesses continuously spend money on R&D to provide innovative technology that improve the accuracy and effectiveness of arthroscopy treatments. Because of their leadership position, they draw in medical professionals looking for cutting-edge equipment. Product diversification: Companies may meet a wider range of healthcare demands by diversifying their product ranges. Market participants may increase their market share and establish themselves as one-stop shops for medical professionals doing arthroscopy procedures by providing a variety of devices for different joints and particular medical uses. worldwide Expansion and Market Penetration: Businesses frequently concentrate on worldwide expansion in order to get a larger market share. This entails forging a solid foothold and breaking into new geographic areas. Manufacturers of arthroscopy instruments are able to acquire a competitive advantage and access unexplored markets by means of distribution networks, strategic alliances, and cooperative efforts. Cost Leadership and Competitive Pricing: Retaining cost leadership is a strategic choice in a market where prices are critical. Businesses who can manufacture excellent arthroscopy devices at competitive costs frequently take a sizable chunk of the market. Healthcare establishments seeking economical solutions without sacrificing quality will find this technique appealing. Marketing and Branding Initiatives: Positioning for market share is greatly influenced by effective marketing and branding techniques. Establishing a robust brand identity via focused advertising efforts, involvement in medical conferences, and educational endeavors establishes a business as a trustworthy and respectable participant in the arthroscopy tools industry.

Leave a Comment