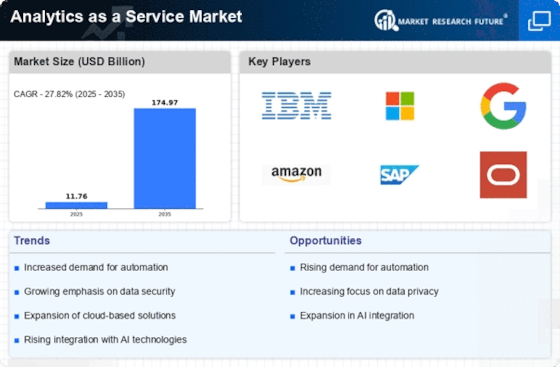

Market Share

Analytics as a service Market Share Analysis

The Analytics as a Service (AaaS) business is very competitive, so companies need to have good market share positioning plans to do well and stand out from their competitors. One common approach is to set yourself apart by offering a wide range of data options. Some of the analytics services that companies try to offer are descriptive, predictive, and prescriptive analytics. This way, they can meet the needs of all kinds of businesses. There are a lot of companies that offer different kinds of data services so that businesses can get all the help they need over one place.

One important way to place yourself is to become an expert in statistics that are specific to your business. As a result of the fact that different businesses have different data needs, some AaaS companies focus on making their solutions fit specific fields like healthcare, banking, or manufacturing. Focusing on a certain area helps businesses get better at what they do, learn more about the ins and outs of each field, and come up with custom analytics solutions that work for the problems and chances in those areas. Cost leadership is a key way to gain market share in the AaaS market.

Some companies stand out by offering cheap analytics services that don't skimp on quality. This plan will work well for companies that want to get the most out of their money, especially in a market where price often plays a role in choices. If a business carefully thinks about the price it charges for its services, it can reach more customers and get an edge in the market. In the world market, new ideas and improvements in technology are very important for companies to move up. As a service (PaaS) providers can show they are committed to new ideas by using cutting edge technologies like machine learning, AI, and advanced data display. Being seen as stars in technological advances not only brings in forward-thinking businesses, but it also boosts the reputation and market place of these businesses. Partnerships and collaborations are slowly but surely becoming more and more popular as ways to get a bigger share of the AaaS market.

Businesses often work with data sources, technology companies, and other people in the same field to offer more products and better services to their customers. Getting a big part of the market depends on tactics that focus on the customer, like giving great service and making solutions that fit their needs. AaaS companies who put a lot of effort into understanding their customers' wants and giving them custom data solutions are likely to build strong, long-lasting relationships. Positive customer experiences help a business stand out in the market by keeping customers and using them as good references and recommendations. A

nother interesting way that AaaS providers try to get a bigger part of the market is by expanding into new areas. Businesses around the world are expanding their presence to serve global markets because they know how important analytics is. "The Analytics as a Service (AaaS) market is constantly changing because more industries are interested in data-based insights.

Leave a Comment