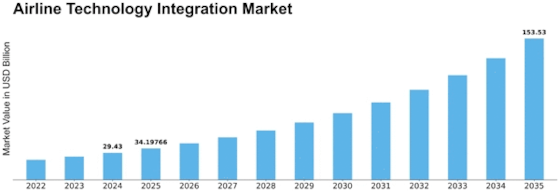

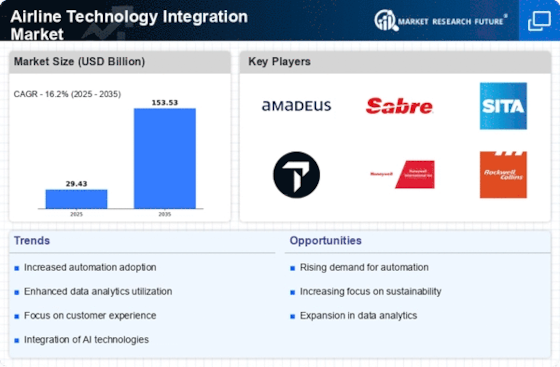

Airline Technology Integration Size

Airline Technology Integration Market Growth Projections and Opportunities

The airline technology integration market is shaped by various factors that drive its growth and development. Firstly, the increasing demand for seamless and connected passenger experiences contributes to the growth of the airline technology integration market. With passengers expecting personalized and convenient travel experiences, airlines are investing in integrated technology solutions to streamline operations, enhance customer service, and improve overall efficiency. Integration of technologies such as mobile apps, self-service kiosks, in-flight entertainment systems, and passenger data analytics enables airlines to deliver personalized services, optimize flight operations, and differentiate their offerings in a competitive market.

Secondly, advancements in aviation technology and digitalization drive innovation and adoption of integrated solutions in the airline industry. Aerospace companies, technology vendors, and aviation startups develop cutting-edge technologies such as artificial intelligence, Internet of Things (IoT), blockchain, and cloud computing to address the evolving needs of airlines and passengers. These technologies enable seamless integration of various systems and processes across airline operations, including flight planning, crew management, maintenance, and passenger services, leading to improved efficiency, cost savings, and enhanced passenger satisfaction.

Furthermore, regulatory requirements and industry standards influence the adoption of integrated technology solutions in the airline industry. Aviation authorities such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) impose regulations and guidelines governing the use of technology in aviation operations to ensure safety, security, and compliance with airworthiness standards. Airlines must adhere to regulatory requirements and obtain certifications for integrated technology solutions to ensure the reliability and integrity of their operations, driving adoption of standardized and certified technologies in the market.

Moreover, market trends such as the rise of low-cost carriers (LCCs), globalization of air travel, and increasing competition drive the demand for integrated technology solutions in the airline industry. LCCs and regional airlines seek cost-effective technology solutions that enable efficient operations, minimize overhead costs, and maximize profitability. Integrated technology platforms offer scalability, flexibility, and cost-effectiveness, making them attractive options for airlines seeking to optimize resources, expand routes, and improve market competitiveness.

Additionally, customer expectations for digital and contactless experiences influence the adoption of integrated technology solutions in the airline industry. With the rise of digitalization and mobile technologies, passengers expect seamless and frictionless travel experiences, from booking flights to baggage claim. Integrated technology solutions enable airlines to offer self-service options, mobile check-in, digital boarding passes, and contactless payments, enhancing convenience, reducing wait times, and improving overall customer satisfaction.

Furthermore, partnerships and collaborations between airlines, technology vendors, and industry stakeholders drive innovation and adoption of integrated technology solutions in the airline industry. Airlines collaborate with technology providers, startups, and research institutions to develop and pilot new technologies, test innovative solutions, and implement best practices for technology integration. Collaborative initiatives such as industry consortia, innovation hubs, and open innovation platforms foster a culture of collaboration and knowledge sharing, accelerating the pace of innovation and adoption of integrated technology solutions in the airline industry.

Leave a Comment