Aircraft Ejection Seat Size

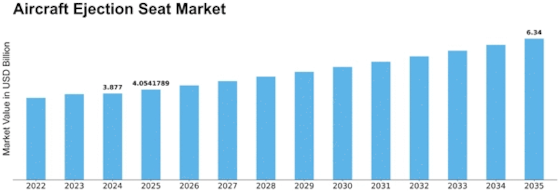

Aircraft Ejection Seat Market Growth Projections and Opportunities

The Aircraft Ejection Seat market is influenced by dynamic factors that underscore the critical role these safety systems play in aviation. One primary market dynamic is the continual advancements in aviation technology and the aerospace industry. As aircraft designs evolve, the demand for state-of-the-art ejection seats that align with the latest aerodynamic and structural considerations grows. Manufacturers in the sector continuously invest in research and development to enhance the performance, reliability, and safety features of ejection seats, ensuring their compatibility with modern aircraft.

Global geopolitical situations and military modernization programs significantly impact the dynamics of the Aircraft Ejection Seat market. Military aircraft, being a critical component of defense capabilities, drive the demand for advanced ejection seats. Nations investing in the upgrading or replacement of their air fleets often seek cutting-edge ejection seat technologies to ensure the safety of their pilots. This dynamic creates opportunities for market growth as defense budgets and military aviation programs shape procurement decisions.

Safety regulations and compliance standards are essential market dynamics in the Aircraft Ejection Seat sector. The aviation industry operates under stringent safety regulations, and ejection seats must meet specific standards to ensure their effectiveness in emergency situations. Adherence to these regulations not only ensures the safety of pilots but also influences the certification and acceptance of ejection seat systems by aviation authorities. Market players must navigate and comply with these regulations to establish trust and credibility in the industry.

The global defense and security landscape, including the threat environment, impacts the demand for Aircraft Ejection Seats. In regions characterized by geopolitical tensions or conflicts, there is an increased focus on military preparedness and the need for robust aviation safety systems. Ejection seats become integral components in ensuring pilot survival in emergency scenarios, leading to heightened demand in areas where security concerns drive military aircraft procurement and upgrades.

Aircraft retrofit and upgrade programs contribute to the market dynamics of ejection seats. As older aircraft undergo modernization to extend their operational life or enhance their capabilities, the need for compatible ejection seat replacements or upgrades arises. Manufacturers offering retrofit solutions that integrate seamlessly with existing aircraft structures and avionics systems find opportunities in this market dynamic, providing cost-effective solutions for air forces and operators seeking to enhance the safety of aging aircraft.

The increasing focus on pilot training and simulation exercises influences the dynamics of the Aircraft Ejection Seat market. Training programs often involve simulated ejection scenarios to prepare pilots for emergency situations. The demand for ejection seat systems that accurately replicate real-world conditions in training environments drives innovation in simulation technologies. Manufacturers catering to the training and simulation segment contribute to the overall market dynamics by providing realistic and effective training solutions.

The commercial aviation sector also plays a role in the dynamics of the Aircraft Ejection Seat market. While ejection seats are primarily associated with military aircraft, there is a growing emphasis on improving safety measures in certain high-performance civilian aircraft, such as supersonic or experimental platforms. This trend creates a niche market dynamic where manufacturers may explore opportunities to provide advanced ejection seat solutions for specific segments of the commercial aviation industry.

Technological collaboration and partnerships are significant market dynamics in the Aircraft Ejection Seat sector. Given the complexity of aerospace systems, manufacturers often collaborate with other industry players, research institutions, or technology providers to integrate cutting-edge technologies into their ejection seat designs. Collaborations contribute to the development of innovative features, materials, and systems that enhance the overall performance and safety of ejection seats.

Leave a Comment