Summary Overview

Drug Development Core Lab Market Overview

The global drug development core lab market is experiencing substantial growth, driven by advancements in pharmaceuticals, biotechnology, and clinical research. This market encompasses a wide range of services, including bioanalytical testing, clinical trial support, and biomarker development. Our report provides an in-depth analysis of procurement trends, emphasizing cost optimization strategies and the integration of advanced technologies to enhance core lab services and supply chain processes.

Key future challenges in procurement include managing escalating operational costs, ensuring compliance with stringent regulatory standards, and maintaining supply chain resilience in a highly dynamic market. Leveraging digital procurement tools and adopting strategic sourcing are essential for optimizing core lab operations and ensuring long-term competitiveness. As the global demand for drug development services continues to rise, companies are utilizing market intelligence to enhance efficiency and mitigate risks.

The drug development core lab market is projected to maintain steady growth through 2032, with key highlights including:

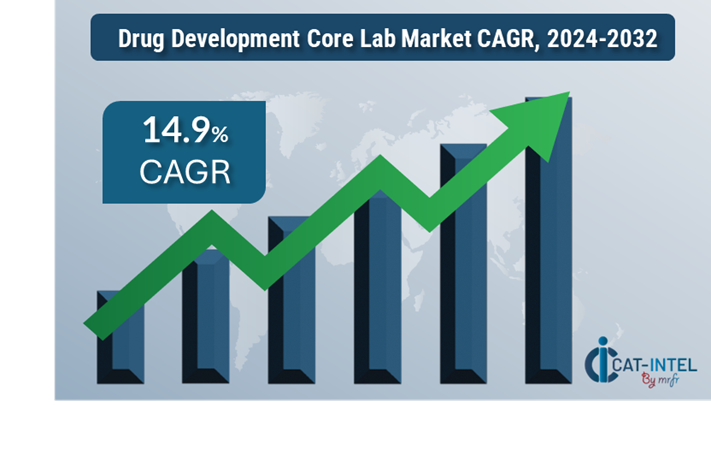

· Market Size: The global drug development core lab market is expected to reach USD 62.10 billion by 2032, growing at a CAGR of approximately 14.9% from 2024 to 2032.

Growth Rate:14.9%

· Sector Contributions: Growth in the market is driven by:

Ø Bioanalytical Services Demand: Rising need for precise testing to support drug discovery and validation.

Ø Clinical Trial Expansion: Increasing number of global clinical trials requiring core lab expertise in biomarker analysis and pharmacokinetics.

· Technological Transformation: Advancements in laboratory technology, such as high-throughput screening and automation, are enhancing testing accuracy and reducing turnaround times.

· Innovations: Innovative methods, including next-generation sequencing (NGS) and AI-driven data analytics, are transforming drug development processes.

· Investment Initiatives: Companies are investing in state-of-the-art core lab infrastructure and expanding their capabilities in bioinformatics, genomics, and proteomics.

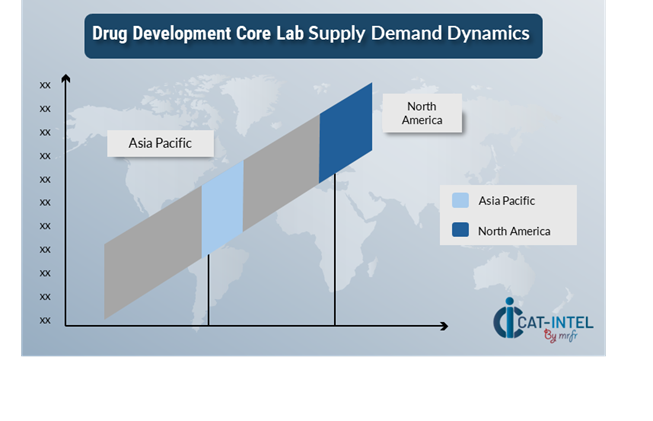

· Regional Insights: North America remain significant contributors due to robust pharmaceutical industries and strong regulatory frameworks, while Asia-Pacific is emerging as a key market due to cost-effective clinical trial operations and growing biotechnology sectors.

Key Trends and Sustainability Outlook:

· Digital Integration: Automation in data processing and reporting is improving accuracy and operational efficiency.

· Advanced Testing Materials: Use of innovative reagents and consumables tailored for high-sensitivity assays.

· Focus on Sustainability: Reducing energy consumption and adopting green lab practices to minimize environmental impact.

· Customization Trends: Increasing demand for specialized testing services, such as companion diagnostics for personalized medicine.

· Data-Driven Research: Utilizing AI and machine learning to accelerate drug development timelines and improve outcomes.

Growth Drivers:

· Pharmaceutical R&D Investments: Increased funding in drug discovery and clinical trials.

· Biotechnology Expansion: Growing reliance on core labs for testing and validation of biopharmaceuticals.

· Regulatory Compliance Needs: Stricter guidelines driving demand for reliable core lab partners.

· Sustainability Goals: Implementation of eco-friendly lab operations and reduction of waste.

· Customization: Development of niche services, such as cell-based assays and advanced bioanalytical testing.

Overview of Market Intelligence Services for Drug Development Core Labs:

Recent analyses have highlighted key challenges, such as escalating costs of reagents and the increasing need for specialized services. Market intelligence reports provide actionable insights into procurement opportunities, enabling companies to identify cost-saving measures, optimize supplier relationships, and enhance supply chain robustness. These insights also ensure adherence to regulatory standards while maintaining high-quality services and managing operational expenses effectively.

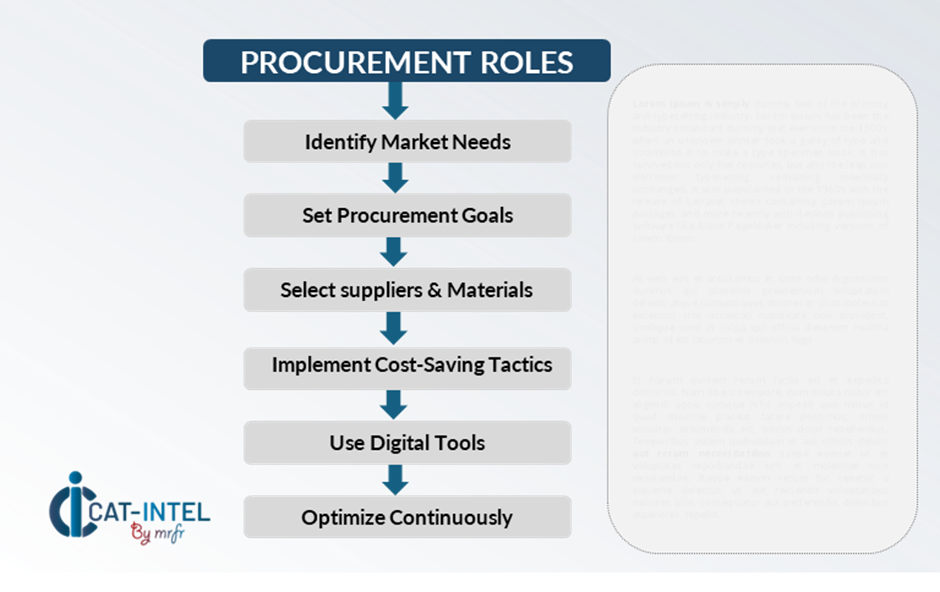

Procurement Intelligence for Drug Development Core Labs: Category Management and Strategic Sourcing

To remain competitive, companies are refining procurement strategies through spend analysis, supplier performance evaluation, and risk assessment. Effective category management and strategic sourcing are pivotal for reducing costs and ensuring reliable access to high-quality testing materials and services. By leveraging actionable market intelligence, businesses can negotiate favorable terms, streamline procurement processes, and enhance overall operational efficiency.

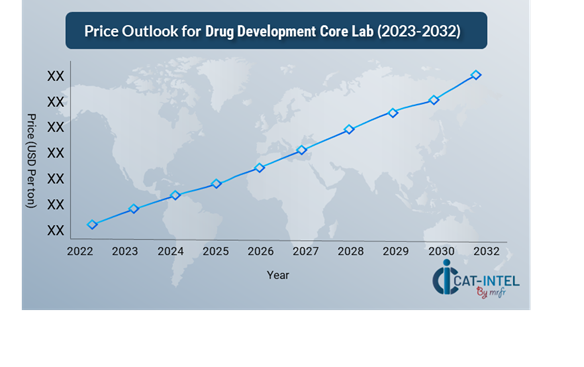

Pricing Outlook for Drug Development Core Lab: Spend Analysis

The pricing outlook for drug development core labs is expected to remain moderately dynamic, with potential variations driven by key factors. Influencing elements include advancements in testing technologies, fluctuations in reagent and consumable costs, regulatory compliance requirements, and the rising demand for specialized lab services such as biomarker development and bioanalytical testing. The increasing adoption of digital tools, AI, and automation for lab operations is also contributing to operational cost shifts.

Efforts to streamline procurement processes, enhance supplier collaboration, and adopt cost-effective innovations are essential to controlling expenses. Leveraging analytics for market monitoring, cost forecasting, and optimized resource allocation can further improve cost management.

Establishing long-term partnerships with dependable suppliers, negotiating favourable contracts, and implementing efficient workflows are key strategies to maintain cost stability. Despite these challenges, prioritizing regulatory compliance, adopting advanced technologies, and focusing on sustainability will be critical to achieving cost efficiency.

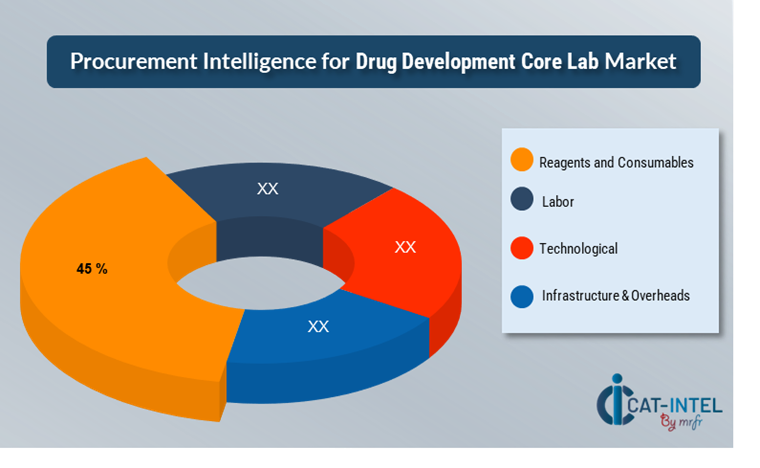

Cost Breakdown for Drug Development Core Labs: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

1. Reagents and Consumables (45%)

Ø Description: The primary costs involve purchasing specialized reagents, assay kits, and consumables required for bioanalytical testing, clinical trial support, and advanced lab services. Pricing is influenced by supplier capabilities, quality standards, and global availability.

Ø Trends: Strategies such as bulk purchasing, supplier consolidation, and evaluating alternatives to high-cost proprietary reagents are gaining traction. Labs are increasingly sourcing eco-friendly and reusable consumables, which may carry an initial premium but offer long-term savings.

2. Labor (XX%)

3. Technological (XX%)

4. Infrastructure and Overheads (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the drug development core lab sector, optimizing procurement processes and employing strategic negotiation tactics can result in significant cost savings and enhanced operational performance. Establishing long-term partnerships with suppliers, particularly in regions with high production capabilities, can secure competitive pricing and favorable terms, including bulk discounts and reduced lead times. Volume-based agreements and forward contracts provide additional leverage to mitigate cost volatility.

Collaborating with innovative suppliers specializing in cutting-edge technologies can lead to access to advanced solutions while reducing overall costs through streamlined processes. Adopting digital tools for procurement and supply chain management, such as real-time inventory systems and predictive demand analytics, enhances efficiency, minimizes resource wastage, and reduces operational expenses. Diversifying supplier networks and implementing multi-supplier strategies mitigate risks associated with supply chain disruptions and provide enhanced negotiation leverage during procurement discussions.

Supply and Demand Overview for Drug Development Core Labs: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The drug development core lab market is experiencing steady growth, driven by increasing demand for specialized services across preclinical and clinical research phases. The supply-demand balance is influenced by factors like access to advanced technology, availability of skilled personnel, and compliance with global regulatory standards.

Demand Factors:

1. Precision Medicine and Biomarker Research: Rising demand for specialized lab services to support personalized therapies and biomarker identification.

2. Clinical Trial Expansion: Increasing global clinical trial activity drives the need for core lab services, including bioanalytical testing and data management.

3. Regulatory Compliance Needs: Heightened demand for labs that adhere to stringent global regulatory frameworks, such as FDA and EMA standards.

4. Customization Trends: Growing need for tailored lab solutions for niche therapeutic areas, such as oncology and rare diseases.

Supply Factors:

1. Technological Advancements: Innovations in laboratory automation, AI-driven analytics, and high-throughput systems enhance lab capabilities and supply reliability.

2. Skilled Workforce Availability: Access to experienced professionals specializing in advanced testing methods and data analysis is critical for maintaining operational efficiency.

3. Regulatory Adaptability: Labs investing in compliance readiness for emerging regulatory changes ensure uninterrupted supply of critical services.

4. Global Trade and Policies: Trade agreements and compliance with international quality standards influence service availability and pricing.

Regional Demand-Supply Outlook: Drug Development Core Labs

North America: Dominance in the Drug Development Core Lab Market

The North American region, particularly the United States and Canada, is a leading force in the global drug development core lab market due to several factors:

1. Strong R&D Infrastructure: North America boasts a robust network of pharmaceutical companies, biotech firms, and academic research institutions driving demand for core lab services.

2. Technological Leadership: The region excels in adopting cutting-edge technologies, including AI-driven analytics, automation, and advanced imaging systems.

3. Regulatory Expertise: Core labs in North America have extensive experience navigating complex regulatory frameworks, ensuring high compliance standards.

4. Growing Clinical Trial Volume: The increasing number of clinical trials conducted in North America drives sustained demand for specialized lab services.

5. Focus on Innovation: Significant investments in emerging fields like gene therapy, immunotherapy, and rare disease research enable the region to address evolving market needs effectively.

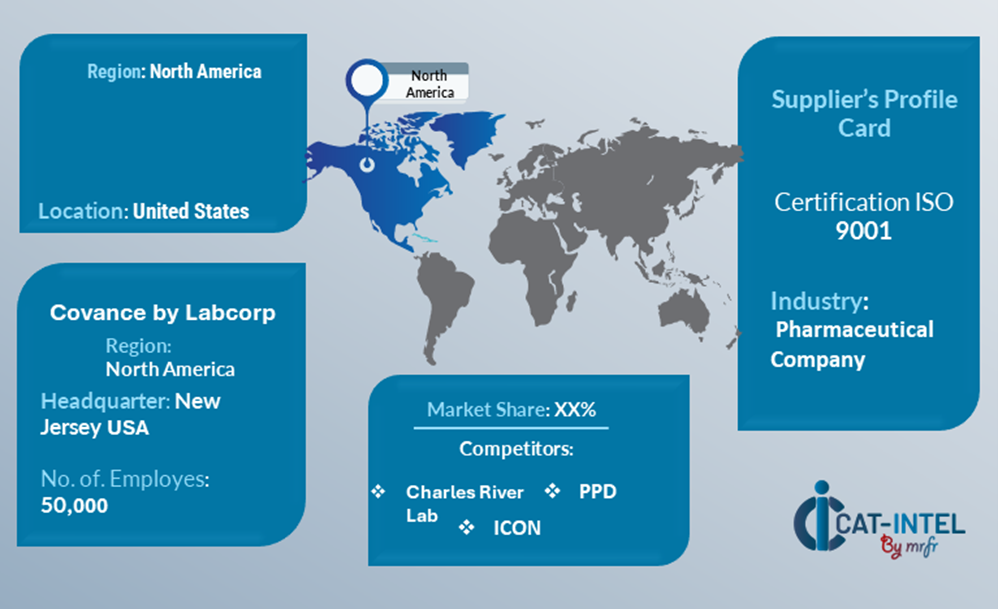

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the drug development core lab sector is highly competitive and characterized by a mix of global and regional providers offering diverse services. These suppliers play a critical role in driving advancements in research capabilities, pricing, technology adoption, and regulatory compliance. The market includes established players with comprehensive service portfolios and niche providers specializing in specific therapeutic areas or advanced analytical techniques.

The supplier ecosystem spans major research hubs worldwide, comprising leading organizations and emerging players meeting both global and regional demands. As the need for specialized core lab services continues to rise, suppliers are expanding their capabilities, integrating cutting-edge technologies, and ensuring compliance with stringent regulatory requirements to deliver innovative, high-quality, and cost-effective solutions.

Key Suppliers in the Drug Development Core Lab Sector Include:

1. Covance by LabCorp

2. Charles River Laboratories

3. ICON plc

4. PPD (Part of Thermo Fisher Scientific)

5. Eurofins Scientific

6. Q² Solutions (IQVIA and Quest Diagnostics Joint Venture)

7. Wuxi AppTec

8. Med pace Core Labs

9. PRA Health Sciences

10. SGS Life Sciences

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The drug development core lab market is experiencing steady expansion due to increased demand for clinical research and pharmaceutical development, particularly in emerging markets. |

Sustainability Focus |

Greater emphasis on sustainable practices is driving the adoption of eco-friendly lab technologies, energy-efficient equipment, and reduced waste generation to minimize environmental impact. |

Product Innovation |

Labs are introducing advanced analytical tools, high-throughput screening technologies, and AI-driven solutions tailored for drug discovery, formulation, and clinical testing. |

Technological Advancements |

Innovations like next-generation sequencing (NGS), automated workflows, and real-time data analytics are enhancing research precision, reducing time-to-market, and lowering costs. |

Global Trade Dynamics |

Shifts in global regulatory standards, trade policies, and intellectual property frameworks are influencing lab operations and partnerships across international markets. |

Customization Trends |

Growing demand for specialized core lab services, such as biomarker development, custom assay design, and patient-specific drug profiling, is shaping the market landscape. |

|

Drug Development Core Lab Attribute/Metric |

Details |

Market Drug Development Core Lab Sizing |

The global drug development core lab market is expected to reach USD 62.10 billion by 2032, growing at a CAGR of approximately 14.9% from 2024 to 2032.

|

Technology Drug Development Core Lab Adoption Rate |

Around 60% of core labs are integrating advanced technologies like AI-driven drug discovery, automated sample handling, and next-generation sequencing (NGS). |

Top Industry Drug Development Core Lab Strategies for 2024 |

Key strategies include adopting AI and machine learning tools, optimizing lab processes, ensuring regulatory compliance, and enhancing patient-centric research methodologies. |

Process Drug Development Core Lab Automation |

Approximately 45% of labs have implemented automation in data analysis, sample preparation, and quality assurance to streamline operations and reduce human error. |

Process Drug Development Core Lab Challenges |

Key challenges include managing regulatory compliance, ensuring data security, integrating advanced technologies, and addressing talent shortages in specialized areas. |

Key Suppliers |

Leading suppliers in the drug development core lab market include Covance by LabCorp (USA), Charles River Laboratories (USA), and ICON Plc (Ireland). |

Key Regions Covered |

Prominent regions include North America, Europe, and Asia-Pacific, with significant demand driven by pharmaceutical innovation and clinical research activities. |

Market Drivers and Trends |

Growth is fuelled by increasing R&D investments, demand for personalized medicine, advancements in analytical tools, and the expansion of biologics and biosimilars research. |