Summary Overview

Drilling Equipment and Consumables Market Overview

The global drilling equipment and consumables market is experiencing substantial growth, driven by the increasing demand for energy and natural resources, advancements in drilling technologies, and growing investments in the oil and gas, mining, and construction industries. The market is also benefiting from innovations in drilling technology and a focus on improving operational efficiency. This market is characterized by fluctuating commodity prices, which can significantly affect procurement strategies, along with challenges related to environmental regulations and sustainability. Our report offers a comprehensive analysis of procurement trends in the drilling equipment and consumables market, with a focus on cost-saving opportunities through strategic sourcing and optimized supply chain practices. We also emphasize the role of digital procurement tools in forecasting market dynamics and enhancing procurement processes to help businesses stay competitive in a rapidly evolving landscape.

Market Outlook for Drilling Equipment and Consumables

The drilling equipment and consumables market is poised for continued growth, with key trends and projections pointing to steady expansion through 2032:

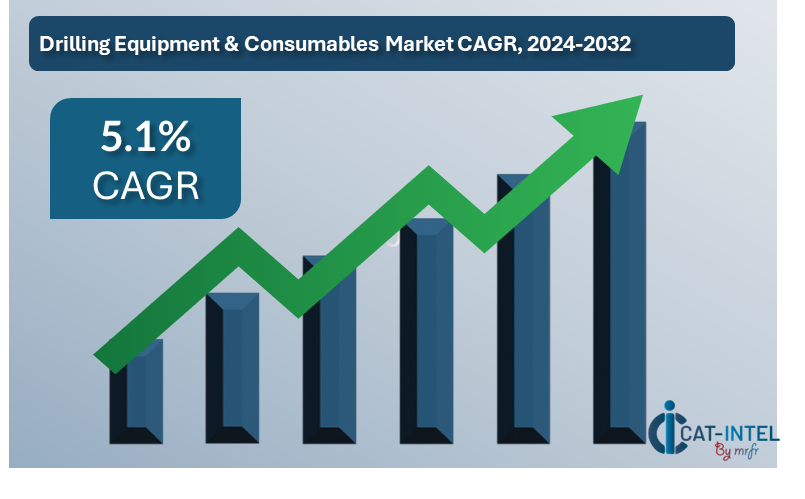

Market Size: The global drilling equipment and consumables market is expected to reach approximately USD 17.8 billion by 2032, reflecting a compound annual growth rate (CAGR) of about 5.1% from 2024 to 2032.

Growth rate: 5.1%

-

Sector Contributions: Growth is primarily driven by:

Oil and Gas Industry: The demand for advanced drilling technologies to access untapped reserves and enhance extraction efficiency is a major contributor.

Mining Industry: Increased exploration activities and demand for minerals are driving the need for drilling equipment and consumables.

Construction and Infrastructure: Rising construction activities, particularly in urban areas, are increasing the demand for drilling equipment for foundation works and other applications.

Technological Advancements: Continued innovation in drilling technologies, such as automation, directional drilling, and hydraulic fracturing, is enhancing operational efficiency and reducing the environmental footprint of drilling activities. Moreover, the advent of smart drilling equipment is improving performance monitoring, contributing to better cost control and risk management.

Sustainability Initiatives: Increasing emphasis on sustainable drilling practices is driving the adoption of environmentally friendly equipment and technologies. Companies are focusing on reducing the energy consumption of drilling equipment and minimizing environmental impact through eco-friendly drilling fluids and waste management solutions.

Regional Insights: North America, especially the United States, remains a dominant player in the drilling equipment market due to ongoing exploration and production activities. However, the Asia-Pacific region is expected to experience rapid growth, driven by infrastructure development and an increasing demand for natural resources.

Key Trends and Sustainability Outlook

Sustainability Focus: The drilling equipment and consumables market is witnessing a shift toward more sustainable practices, including the development of energy-efficient equipment, biodegradable drilling fluids, and reduced carbon footprints in drilling operations.

Technological Innovation: Automation and the integration of artificial intelligence (AI) and machine learning are playing a significant role in optimizing drilling processes, reducing costs, and enhancing safety and performance.

Rising Demand for High-Performance Materials: With the increasing complexity of drilling operations, there is a growing demand for high-performance materials such as wear-resistant alloys, composite materials, and advanced drilling fluids.

Environmental Regulations: Stricter environmental regulations are prompting companies to adopt cleaner, more efficient drilling technologies to minimize environmental risks.

Growth Drivers

Energy Demand: The growing global demand for oil, gas, and other natural resources continues to drive investments in drilling operations.

Technological Advancements: Continuous innovation in drilling technologies and materials is improving efficiency and reducing costs, enabling companies to maintain competitiveness.

Infrastructure Development: Ongoing infrastructure projects in developing regions, particularly in Asia and the Middle East, are driving demand for drilling equipment and consumables.

Digital Transformation: The rise of digital procurement tools, including predictive analytics and data-driven decision-making, is enabling companies to better manage supply chains, forecast demand, and optimize procurement costs.

Overview of Market Intelligence Services for Drilling Equipment and Consumables Market

Recent market analysis indicates that the drilling equipment and consumables market is facing challenges related to volatile commodity prices, supply chain disruptions, and regulatory pressures. To mitigate these challenges, market intelligence services provide valuable insights into cost forecasts, market dynamics, and supplier performance. These services help businesses make informed procurement decisions, reduce risks, and optimize supply chain management. By leveraging these insights, stakeholders can navigate market volatility, ensure the timely availability of equipment and consumables, and enhance procurement efficiency.

Procurement Intelligence for Drilling Equipment and Consumables Market: Category Management and Strategic Sourcing

"To stay competitive in the drilling equipment and consumables market, companies are optimizing procurement strategies through advanced spend analysis, vendor performance evaluations, and supply market intelligence. Category management and strategic sourcing are critical to achieving cost-effective procurement while ensuring a reliable supply of high-quality equipment and consumables. By implementing these strategies, companies can streamline their procurement processes, improve supplier relationships, and enhance their operational efficiency in a dynamic and

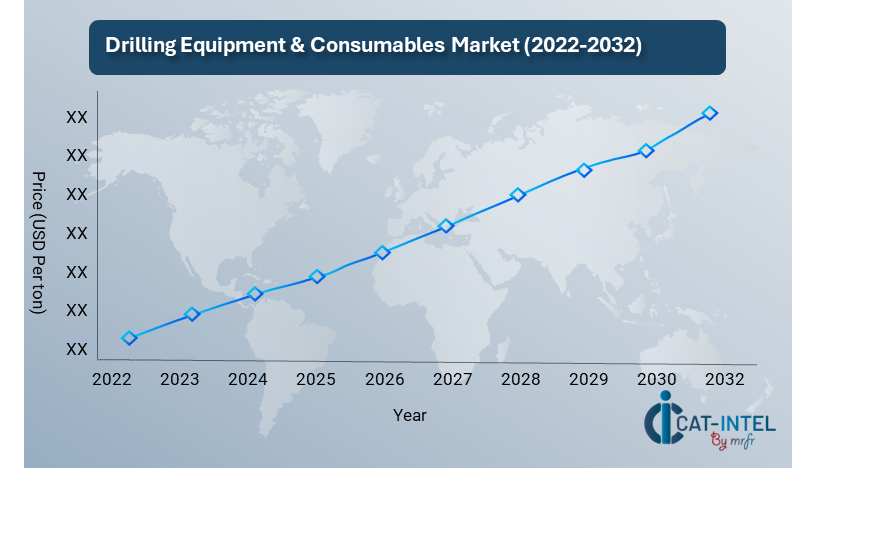

Pricing Outlook for Drilling Equipment and Consumables Market: Spend Analysis

The drilling equipment and consumables market is experiencing a dynamic pricing landscape, influenced by factors such as fluctuating raw material costs, advancements in drilling technologies, geopolitical tensions, and supply chain challenges. The pricing outlook for this market indicates a gradual increase in costs due to evolving industry demands and global economic conditions.

A line chart illustrating the pricing outlook for the drilling equipment and consumables industry from 2022 to 2032 shows projected price trends. The chart indicates a steady upward trajectory in prices, reflecting increasing production costs and growing demand for advanced drilling solutions.

Key Drivers Influencing Pricing Trends:

Raw Material Costs:The prices of key raw materials such as steel, alloys, and composite materials used in manufacturing drilling equipment are rising due to supply chain constraints and geopolitical factors.

Technological Advancements:As drilling operations become more complex, the demand for advanced, high-performance drilling tools is growing, contributing to higher production costs. Innovations like automation and smart drilling systems are also impacting pricing dynamics.

Supply Chain Disruptions:Ongoing global supply chain disruptions, particularly in the mining and oil and gas sectors, are causing delays and increasing procurement costs for drilling consumables.

Environmental Regulations:Stricter environmental and safety regulations are driving the need for more sustainable and eco-friendly drilling equipment, which is leading to higher production and compliance costs.

Energy Demand:The rising global demand for energy and natural resources is pushing companies to invest in new drilling projects, contributing to increased demand for equipment and consumables.

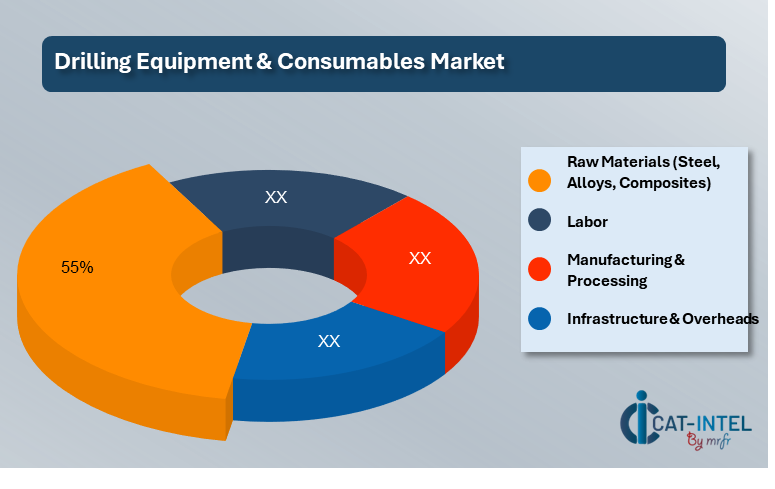

Cost Breakdown for the Drilling Equipment and Consumables Market: Cost-Saving Opportunities

-

Raw Materials (Steel, Alloys, Composites) – 55%

Description:The cost of raw materials, including high-grade steel, alloys, and composites, forms a significant portion of the overall cost for drilling equipment and consumables. These materials are essential for manufacturing drill bits, casings, and other tools used in the oil, gas, and mining sectors.

Trends:Prices for raw materials have been volatile due to supply chain disruptions and geopolitical factors. As of 2024, steel prices remain high, driven by increasing global demand and production limitations. However, strategic sourcing from alternative suppliers and adopting sustainable material practices can present cost-saving opportunities.

Labor – XX%

Manufacturing & Processing – XX%

Infrastructure & Overheads – XX%

Cost-Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies for Drilling Equipment and Consumables Market

In the drilling equipment and consumables market, strategic procurement and effective negotiation can lead to significant cost reductions. Companies can leverage bulk purchasing agreements with key suppliers to secure volume-based discounts on essential items like drill bits, casings, and maintenance parts. Utilizing supplier performance management tools helps identify cost-saving opportunities by negotiating better payment terms and ensuring consistent supply quality.

Supply and Demand Overview of the Drilling Equipment and Consumables Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The drilling equipment and consumables market is witnessing steady growth driven by increasing exploration activities, advancements in drilling technologies, and rising energy demand. The demand is particularly high in oil & gas, mining, and construction sectors, supported by global industrial expansion and infrastructure development.

Demand Factors:

Energy Sector Growth: Increasing exploration activities in oil, gas, and renewable energy sectors drive demand for drilling equipment and consumables.

Infrastructure Development: Expanding infrastructure projects worldwide require drilling solutions for foundation work, tunnels, and water wells.

Technological Advancements: Adoption of advanced drilling technologies, such as automated rigs and directional drilling, increases the need for specialized consumables like drill bits, casings, and mud pumps.

Mining Activities: Growing mineral extraction activities, especially in Asia-Pacific and Africa, are fuelling demand for drilling equipment.

Supply Factors:

Key Manufacturing Hubs: Regions such as North America, Europe, and China dominate the production of drilling equipment, ensuring a stable supply to meet global demand.

Technological Innovations: Continuous advancements in manufacturing processes, including the use of stronger materials and precision engineering, improve the quality and durability of drilling consumables.

Supplier Consolidation: Mergers and acquisitions among key suppliers are creating larger entities capable of meeting diverse buyer needs, impacting pricing and availability.

Sustainability Initiatives: Suppliers are adopting environmentally friendly manufacturing practices, which influence the supply chain and appeal to buyers focusing on sustainable procurement.

Regional Demand-Supply Outlook: Drilling Equipment and Consumables Market

North America: A Key Player in the Drilling Equipment and Consumables Market

North America, particularly the U.S., holds a significant position in the global drilling equipment and consumables market, driven by the following factors:

Leading Manufacturers: The region is home to major drilling equipment manufacturers that dominate the global market, providing advanced drilling solutions across various industries, including oil & gas, construction, and mining.

Robust Energy Sector: The U.S. energy sector, especially in shale gas and oil drilling, significantly contributes to the growing demand for drilling consumables, such as drill bits, casings, and mud pumps.

Infrastructure Development: Large-scale infrastructure projects, including roadways, tunnels, and pipelines, are boosting demand for drilling equipment in North America.

Technological Advancements: Companies in North America are focusing on innovations like automated rigs, real-time data monitoring, and advanced drilling techniques, enhancing efficiency and reducing operational costs.

Sustainability Focus: Increasing adoption of environmentally sustainable drilling practices and eco-friendly consumables is positioning North American manufacturers as leaders in sustainable solutions for the industry.

North America remains a key hub for Drilling Equipment and Consumables market and its growth

Supplier Landscape: Supplier Negotiations and Strategies in the Drilling Equipment and Consumables Market

The drilling equipment and consumables market features a diverse array of global and regional suppliers offering essential tools and services for industries such as oil & gas, mining, and construction. Key suppliers provide a range of products, including drill bits, drilling machines, downhole tools, and related consumables, which are crucial for efficient and effective drilling operations.

The current supplier landscape is characterized by strong partnerships between equipment manufacturers and end-users. These collaborations are vital for ensuring the availability of high-quality, technologically advanced equipment that meets specific operational requirements. Additionally, suppliers are increasingly focusing on sustainability and innovation to enhance product performance and reduce environmental impact.

Some of the key suppliers in the drilling equipment and consumables market include:

Schlumberger Limited

Halliburton Company

Baker Hughes Company

National Oilwell Varco L.P.

Weatherford International plc

Drilling Tools International Inc.

Rubicon Oilfield International Holdings L.P.

Cougar Drilling Solutions Inc.

BICO Drilling Tools Inc.

Perkins Drilling Tools Inc.

Key Development: Procurement Category significant development

Category |

Development |

Impact on Procurement |

Timeframe |

Drilling Equipment |

Introduction of automated drilling rigs |

Reduced labor costs and increased drilling accuracy |

2024-2026 |

Consumables |

Eco-friendly drilling fluids gaining popularity |

Lower environmental impact and compliance benefits |

2025-2030 |

Safety Gear & Tools |

Enhanced safety standards across major drilling regions |

Increased demand for advanced PPE and tools |

Ongoing |

Technology & Software |

Adoption of AI-driven predictive maintenance tools |

Reduced downtime and optimized asset management |

2024-2032 |

Raw Materials |

Shift toward sustainable sourcing of metals |

Increased focus on ethical procurement practices |

2026-2030 |

Procurement Attribute/Metric |

Details |

Market Sizing |

Valued at USD 6.3 billion in 2023, with a CAGR of 5.1% expected between 2024 and 2032. |

Adoption of Advanced Drilling Technologies |

Increasing demand across industries like construction, mining, and oil & gas. |

Top Strategies for 2024 |

Focus on automation and digital technologies to enhance operational efficiency and reduce downtime. |

Automation in Drilling Operations |

Rising need for offshore and deepwater drilling, with automation and digital technologies driving market growth. |

Procurement Challenges |

Fluctuating raw material prices, stringent environmental regulations, and the need for technological upgrades. |

Key Suppliers |

Graford Industrial, SLB, CZM USA, Bay Shore Systems Inc., NOV, Wuxi Anman Construction Machinery Co., Ltd., Prime Drilling GmbH, Herrenknecht AG, Cactus, Inc., Parker Wellbore. |

Key Regions Covered |

North America, Europe, and Asia-Pacific, with significant demand from the U.S., China, and Russia. |

Market Drivers and Trends |

Growth driven by demand from construction, mining, and oil & gas industries, along with technological advancements improving drilling equipment efficiency. |