Summary Overview

Digital Payment Services Market Overview:The global digital payment services market is experiencing exponential growth, driven by increasing adoption across industries such as retail, e-commerce, banking, and transportation. This market encompasses various payment methods, including mobile wallets, online payment gateways, and contactless payments. Our report provides a detailed analysis of procurement trends, emphasizing cost optimization strategies and the integration of digital technologies to enhance payment processes.

Key future challenges in procurement include ensuring compliance with evolving regulatory frameworks, managing cybersecurity risks, and addressing interoperability issues across platforms. Strategic sourcing and investment in secure digital infrastructure are essential for optimizing digital payment processes and ensuring seamless transactions. As global adoption continues to rise, companies are leveraging market intelligence to enhance operational efficiency and mitigate risks.

The digital payment services market is expected to maintain rapid growth through 2032, with key highlights including:

-

Market Size: The global digital payment services market is projected to reach USD 726.6 Billion by 2032, growing at a CAGR of approximately 17.10% from 2024 to 2032.

-

Sector Contributions: Growth in the market is driven by:-

E-commerce and Retail Expansion: Increasing preference for online shopping and digital checkout solutions. -

Banking and Financial Services: Enhanced customer experience through seamless and secure payment methods.

-

-

Technological Transformation: Integration of AI and blockchain in payment systems to improve security and efficiency. -

Innovations: Development of omnichannel payment solutions enabling interoperability across devices and platforms. -

Investment Initiatives: Companies are investing in advanced fraud detection systems, machine learning algorithms, and real-time transaction monitoring tools. -

Regional Insights: North America and Asia Pacific remain significant contributors due to high internet penetration and robust financial infrastructure.

Key Trends and Sustainability Outlook:

-

Digital Integration: Enhanced user experience through AI-powered chatbots and voice-assisted payment systems. -

Advanced Security: Adoption of tokenization, biometrics, and encryption technologies to ensure secure transactions. -

Focus on Inclusion: Promoting financial inclusion through the deployment of affordable and accessible payment solutions. -

Customization Trends: Demand for industry-specific payment solutions, such as subscription-based billing for software companies. -

Data-Driven Decision Making: Utilizing analytics to track user behavior and optimize payment workflows.

Growth Drivers:

-

E-commerce Growth: Rapid expansion of online marketplaces driving demand for secure and efficient payment services. -

Government Initiatives: Policies promoting digital transactions and reducing reliance on cash in economies worldwide. -

Cybersecurity Investments: Companies prioritizing robust security frameworks to mitigate the risks of fraud and data breaches. -

Regulatory Compliance: Adherence to global payment standards such as PCI DSS and GDPR to ensure secure operations. -

Cross-Border Transactions: Increasing need for efficient international payment systems to support global trade.

Overview of Market Intelligence Services for Digital Payment Services:

Recent analyses have highlighted key challenges such as compliance with dynamic regulatory requirements and managing cybersecurity threats. Market intelligence reports offer actionable insights into procurement opportunities, helping companies identify cost-saving measures, optimize supplier management, and enhance system resilience. These insights also support compliance with industry standards and maintain high security while effectively managing costs.

Procurement Intelligence for Digital Payment Services: Category Management and Strategic Sourcing:

To stay competitive in the digital payment services market, companies are streamlining procurement processes through spend analysis and performance tracking of technology providers. Effective category management and strategic sourcing are critical to reducing operational costs and ensuring a seamless payment experience. By leveraging actionable market intelligence, businesses can refine their procurement strategies and negotiate favourable terms with payment service providers.

Pricing Outlook for Digital Payment Services: Spend Analysis

The pricing outlook for digital payment services is expected to remain dynamic, with variations driven by factors such as evolving transaction volumes, regulatory compliance costs, advancements in payment technologies, and increasing competition among service providers. Additional influences include currency exchange rates for cross-border payments and integration expenses for businesses adopting digital payment systems.

Graph shows general upward trend pricing for Digital Payment Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Leveraging advanced analytics for transaction monitoring, price forecasting, and efficient financial planning can further enhance cost management. Partnering with reliable payment service providers, adopting customizable pricing models, and optimizing payment system integration workflows are key strategies for managing digital payment service costs.

Despite these challenges, ensuring robust security measures, compliance with evolving regulations, and providing seamless user experiences will remain essential to sustaining cost efficiency.

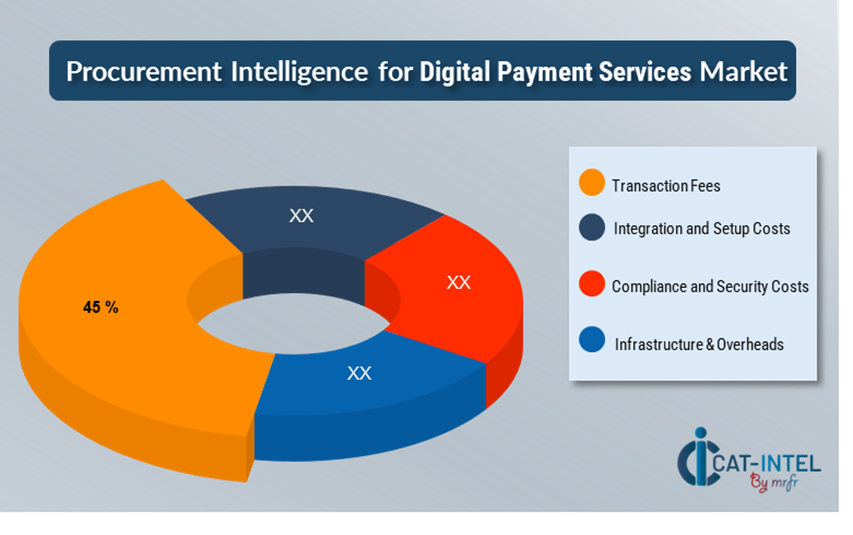

Cost Breakdown for Digital Payment Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Transaction Fees (45%)

-

Description: Transaction fees constitute a major portion of the costs, encompassing charges for each payment processed, including fixed and variable rates depending on the service provider and transaction volume. -

Trends: Businesses are negotiating bulk transaction discounts, exploring flat-rate pricing models, and leveraging platforms offering lower transaction fees to optimize costs. Cross-border payments often involve additional currency conversion fees, further influencing pricing.

- Integration and Setup Costs (XX%)

- Compliance and Security Costs (XX%)

- Infrastructure & Overheads (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation StrategiesIn the digital payments services industry, optimizing procurement processes and leveraging strategic negotiation techniques can drive significant cost savings and operational efficiencies. Establishing long-term agreements with technology and service providers, especially in key markets, enables businesses to negotiate favourable pricing terms, volume discounts, and reduced transaction fees. Prepaid contracts and bulk service subscriptions offer opportunities to lock in lower rates and hedge against price fluctuations.

Partnering with providers that prioritize innovation and regulatory compliance can yield additional advantages, such as access to cutting-edge payment technologies and streamlined integration processes. Implementing advanced tools for financial management, such as real-time transaction tracking and predictive analytics, enhances operational efficiency, reduces errors, and minimizes costs associated with chargebacks and fraud. Diversifying service providers and adopting multi-partner strategies mitigate risks like service outages or compliance challenges while improving negotiation leverage.

Supply and Demand Overview for Digital Payment Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)The digital payments services market is experiencing robust growth, driven by rising demand across sectors such as e-commerce, retail, and financial services. Supply and demand dynamics are influenced by factors including technological advancements, regulatory changes, and evolving consumer preferences.

Demand Factors:

-

E-commerce Expansion: The surge in online shopping has increased the demand for secure and efficient digital payment solutions. -

Mobile Payment Adoption: Growing smartphone penetration and the popularity of mobile wallets are driving the need for advanced payment platforms. -

Consumer Preference for Cashless Transactions: Increasing acceptance of digital payment methods is reshaping traditional payment ecosystems. -

Industry-Specific Needs: Sectors such as hospitality, education, and healthcare require tailored payment solutions to meet operational and compliance requirements.

Supply Factors:

-

Technology Infrastructure: Availability of scalable, cloud-based payment platforms is improving service reliability and accessibility. -

Regulatory Compliance: Adherence to international standards like PCI DSS ensures a steady supply of compliant payment services. -

Innovation in Security Features: Advancements in encryption and fraud detection are bolstering supplier offerings. -

Market Competition: An influx of fintech players and established financial institutions is driving innovation and competitive pricing in digital payment services.

Regional Demand-Supply Outlook: Digital Payment Services

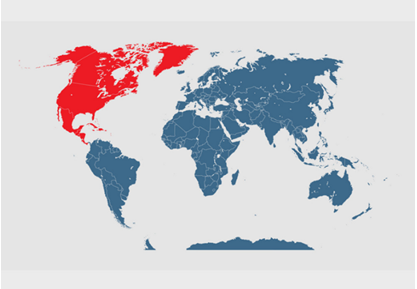

The Image shows growing demand for Digital Payment Services in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in Digital Payment Services

-

High Market Maturity: North America remains a key player, driven by widespread use of credit cards, mobile wallets, and contactless payment technologies. -

Regulatory Framework: A robust legal and regulatory environment ensures consumer protection and fosters innovation. -

Advanced Security Protocols: Strong emphasis on cybersecurity enhances trust and adoption of digital payment platforms. -

Technological Advancements: Integration of artificial intelligence and machine learning in payment systems improves fraud detection and user experience. -

Corporate Adoption: Increasing acceptance of digital payment systems in B2B transactions is expanding market opportunities.

North America Remains a key hub Digital Payment Services price drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the digital payment services market is dynamic and competitive, with a mix of global technology giants, fintech startups, and regional service providers shaping the industry's trajectory. These suppliers play a crucial role in influencing key factors such as transaction fees, security features, platform integration, and customer service. The market is led by established players offering comprehensive payment solutions, while smaller, specialized suppliers focus on niche segments, such as mobile payments, cross-border transactions, or specific regional needs.

As demand for digital payment services continues to grow across industries like retail, e-commerce, banking, and financial services, suppliers are enhancing their offerings by integrating advanced technologies such as blockchain, AI-driven fraud detection, and seamless payment processing. They are also adopting innovative solutions to improve transaction speed, reduce fees, and enhance security features to meet the growing demands of both businesses and consumers.

Key Suppliers in the Digital Payment Services Market Include:

- PayPal Holdings, Inc.

- Square, Inc. (now Block, Inc.)

- Visa Inc.

- Mastercard Inc.

- Stripe, Inc.

- Adyen N.V.

- Ant Group (Alipay)

- Samsung Pay

- Apple Pay

- Google Pay

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The digital payment services market is experiencing rapid growth, driven by the increasing adoption of online transactions, mobile payments, and e-commerce, particularly in emerging markets and across mobile-first economies. |

Sustainability Focus |

There is growing emphasis on secure and energy-efficient payment solutions, with a shift towards reducing environmental impacts by using sustainable infrastructure for digital payments and promoting paperless transactions. |

Product Innovation |

Service providers are diversifying their offerings with innovations such as biometric authentication, contactless payments, and integration of AI-powered fraud detection to enhance the user experience and security of transactions. |

Technological Advancements |

Advancements in blockchain, tokenization, and AI are revolutionizing digital payment solutions, improving transaction security, reducing fraud, and increasing operational efficiency. |

Global Trade Dynamics |

Changes in international trade policies, regulatory frameworks, and the rise of cross-border e-commerce are reshaping digital payment services, influencing pricing, market entry strategies, and the need for localized payment solutions. |

Customization Trends |

There is a growing demand for customized digital payment solutions, such as tailored payment platforms for specific industries (e.g., retail, healthcare, and travel) and the integration of digital wallets with loyalty programs and promotions. |

Digital Payment Services Attribute/Metric |

Details |

Market Sizing |

The global digital payment services market is projected to reach USD 726.6 Billion by 2032, growing at a CAGR of approximately 17.10% from 2024 to 2032. |

Technology Digital Payment Services Adoption Rate |

Around 60% of businesses are adopting advanced payment technologies such as contactless payments, biometric authentication, and blockchain for enhanced security and efficiency. |

Top Industry Strategies for 2024 |

Key strategies include investing in AI for fraud detection, expanding mobile payment platforms, enhancing user experience with seamless transactions, and adopting cryptocurrency solutions for cross-border payments. |

Process Digital Payment Services Automation |

Approximately 50% of payment service providers have implemented automation in fraud prevention, customer support, and transaction processing to increase operational efficiency and reduce human error. |

Process Digital Payment Services Challenges |

Major challenges include ensuring data security, managing regulatory compliance across multiple regions, addressing cybersecurity threats, and tackling the increasing complexity of digital payment systems. |

Key Suppliers |

Leading suppliers in the digital payment services market include PayPal, Square, Stripe, Visa, Mastercard, and Alipay, offering a wide range of payment solutions. |

Key Regions Covered |

Prominent regions for digital payment services include North America, Europe, and Asia-Pacific, with increasing adoption in emerging markets, particularly in Southeast Asia and Africa. |

Market Drivers and Trends |

Growth is driven by the increasing adoption of mobile payments, the rise of e-commerce, advancements in digital wallets, the need for secure payment solutions, and expanding financial inclusion in developing regions. |