Summary Overview

Comparator Drug Market Overview

The global comparator drug market is experiencing consistent growth, driven by increasing demand in clinical trials, pharmaceutical research, and the healthcare sector. Comparator drugs, used in clinical studies to compare new treatments with established therapies, play a crucial role in the development of new medications. This report provides a comprehensive analysis of procurement trends, focusing on cost reduction strategies and the use of digital solutions to streamline procurement and logistics processes.

Key future challenges in sourcing comparator drugs include managing fluctuating drug prices, ensuring a stable supply chain, and maintaining regulatory compliance across regions. The use of digital procurement tools and strategic sourcing methods is becoming essential to optimize the supply chain for comparator drugs and enhance long-term competitiveness. As demand continues to rise globally, pharmaceutical companies are utilizing market intelligence to improve efficiency and minimize risks.

The comparator drug market is expected to continue its growth trajectory through 2032, with key insights including

-

Market Size The global comparator drug market is projected to reach USD 2.24 billion by 2032, growing at a CAGR of approximately 6.15% from 2024 to 2032.

-

Sector Contributions Growth in the market is driven by -

Pharmaceutical Research Rising investments in clinical trials and the need for reliable comparator drugs to evaluate new treatments. -

Regulatory Requirements Increased stringency in clinical trial regulations requiring precise comparator drugs for valid study results. -

Technological Transformation and Innovations Innovations in drug production, such as improved synthesis methods and more efficient supply chain logistics, are advancing the comparator drug market. Additionally, developments in data management and digital integration help streamline the sourcing process and enhance regulatory compliance. -

Investment Initiatives Companies are investing in advanced systems for tracking comparator drug inventories and ensuring quality through real-time monitoring, reducing waste and improving the overall efficiency of the supply chain. -

Regional Insights North America and Europe remain key contributors to the market due to their strong pharmaceutical sectors and high volume of ongoing clinical trials. Developing regions are also seeing increased activity due to expanding healthcare systems and clinical research initiatives.

Key Trends and Sustainability Outlook

-

Enhanced Digital Integration The automation of sourcing processes is improving the speed and accuracy of procurement operations, ensuring better drug traceability and quality control. -

Sustainability Focus There is a growing demand for eco-friendly packaging and sustainable sourcing practices in the pharmaceutical industry. -

Customization Trends There is an increasing demand for drugs that meet specific clinical trial requirements, including formulation types and dosage variations. -

Data-Driven Procurement Leveraging big data and analytics to enhance the accuracy of drug sourcing, optimize inventories, and ensure compliance with global regulations.

Growth Drivers

-

Clinical Trial Expansion The growing number of clinical trials, particularly in emerging therapeutic areas such as oncology and rare diseases, is fuelling demand for comparator drugs. -

Regulatory Compliance Stringent regulatory standards are pushing for greater precision in the sourcing of comparator drugs. -

Sustainability Initiatives Companies are focusing on sourcing drugs with environmentally friendly processes and packaging to meet sustainability targets. -

Customization Increased demand for comparator drugs tailored to specific trial protocols, including special packaging, labelling, and storage conditions.

Overview of Market Intelligence Services for Comparator Drug Sourcing

Recent analyses have identified key challenges such as fluctuating drug prices and the complexity of sourcing customized comparator drugs. Market intelligence reports offer valuable insights, helping companies identify procurement opportunities, optimize vendor management, and improve supply chain resilience. These reports enable organizations to meet regulatory requirements while managing costs effectively and maintaining high standards of quality and compliance.

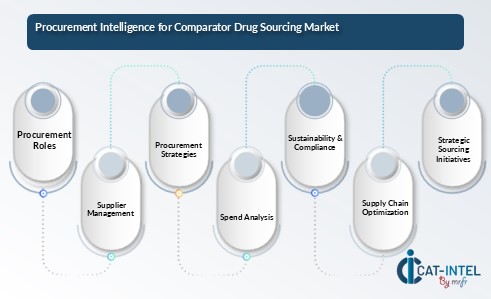

Procurement Intelligence for Comparator Drug Sourcing Category Management and Strategic Sourcing

To remain competitive in the comparator drug market, pharmaceutical companies are refining their procurement processes by using spend analysis tools for vendor tracking and improving supply chain efficiency with market intelligence. Effective category management and strategic sourcing are essential for reducing procurement costs and securing a steady supply of high-quality comparator drugs. By leveraging actionable market intelligence, businesses can optimize their sourcing strategies and ensure the best terms for their clinical trial needs.

Pricing Outlook for Comparator Drug Sourcing Spend Analysis

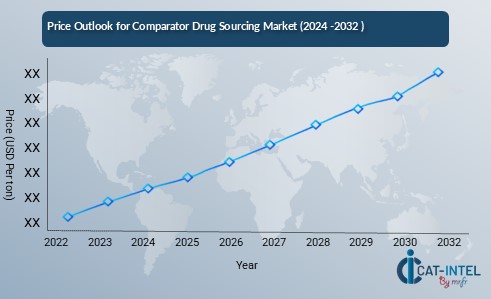

The pricing outlook for comparator drugs is expected to remain steady, though fluctuations are likely due to several influencing factors. Variations in production costs, including manufacturing expenses, regulatory compliance, and distribution logistics, can significantly impact price trends. Furthermore, the rising demand for comparator drugs in clinical trials, particularly in therapeutic areas such as oncology, rare diseases, and gene therapies, is exerting upward pressure on prices.

Graph shows general upward trend pricing for comparator drug sourcing and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to enhance supply chain efficiency, streamline sourcing processes, and ensure regulatory compliance are essential for managing costs. Investment in advanced sourcing technologies, data analytics for procurement optimization, and improving vendor relationships are crucial for addressing pricing challenges.

Collaborating with reliable suppliers, diversifying sourcing strategies, and utilizing digital platforms for market insights are key to controlling costs. Despite these challenges, focusing on sustainability, regulatory compliance, and technological advancements will be vital for managing pricing dynamics effectively.

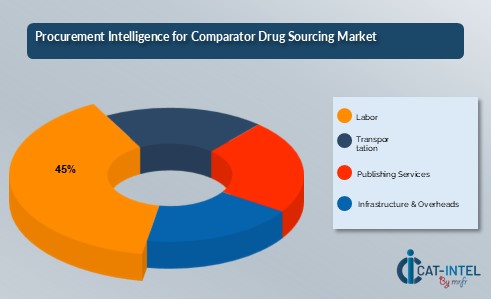

Cost Breakdown for Comparator Drug Sourcing Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Materials (40%)

- Description This includes the costs associated with the production, synthesis, and procurement of comparator drugs. It also covers the expenses for packaging, labelling, and ensuring the drugs meet quality standards. Environmental and regulatory compliance efforts related to the drug manufacturing process are also factored into raw material costs.

- Trends Increasing reliance on advanced production methods, adoption of more efficient and sustainable manufacturing processes, and a growing emphasis on sourcing from eco-friendly and regulated suppliers.

- Labor (XX%)

- Publishing Services (XX%)

- Infrastructure & Overheads (XX%)

Cost-Saving Opportunities Negotiation Levers and Purchasing Strategies

In comparator drug sourcing, strategic procurement and efficient supply chain management can yield significant cost savings and enhance resource allocation. Establishing long-term relationships with suppliers, manufacturers, and distribution partners can help secure competitive pricing, reduce operational costs, and improve overall efficiency. Collaborative partnerships with clinical trial providers and contract research organizations (CROs) can offer benefits such as flexible payment terms, scalable sourcing options, and cost-effective delivery services.

Investing in advanced technologies for sourcing, procurement automation, and data-driven tools can help reduce operational costs, minimize waste, and streamline supply chain processes. Additionally, adopting sustainability practices, such as sourcing from eco-conscious suppliers and optimizing resource efficiency, can reduce long-term procurement expenses. Multi-sourcing strategies, including diversifying supplier networks and using competitive bidding processes, can mitigate risks associated with price volatility and strengthen the buyer's negotiating power with suppliers.

Supply and Demand Overview for Comparator Drug Sourcing Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The comparator drug market is experiencing steady demand, largely driven by the growing number of clinical trials and the need for reliable, high-quality comparator drugs in therapeutic areas such as oncology, rare diseases, and immunology. The supply and demand equilibrium is influenced by several factors, including regulatory changes, advancements in drug development, and the availability of comparator drugs from manufacturers.

Demand Factors

-

Clinical Trials Expansion The rising number of clinical trials, particularly in emerging therapeutic areas, is a major driver of comparator drug demand. -

Regulatory Requirements Increasing regulatory complexity and the need for specific comparator drugs to meet trial standards are driving demand. -

Therapeutic Innovations The growth of new drug classes and treatments, such as gene therapies, requires reliable comparator drugs to support development and approval processes. -

Sustainability Goals Increased demand for eco-friendly sourcing and sustainable packaging is influencing the choice of comparator drugs and their suppliers.

Supply Factors

-

Availability of Comparator Drugs The availability of specific comparator drugs is a crucial factor in supply stability. Sourcing drugs from reliable manufacturers and ensuring timely deliveries is essential. -

Supply Chain Transparency Advances in tracking technologies and supply chain management platforms are enhancing the ability to ensure the availability and quality of comparator drugs. -

Regulatory Compliance Geopolitical and regulatory risks, such as differing compliance standards across regions, can impact the stability of the comparator drug supply. -

Manufacturing Capacity Drug manufacturers' ability to scale production and meet increasing demand for comparator drugs is a key factor in maintaining a stable supply.

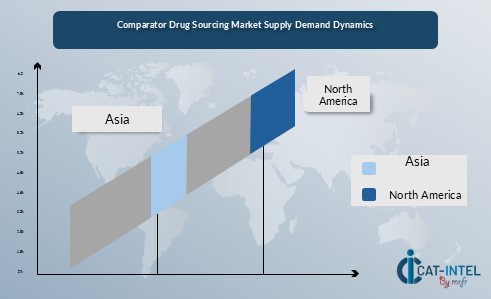

Regional Demand-Supply Outlook Comparator Drug Sourcing

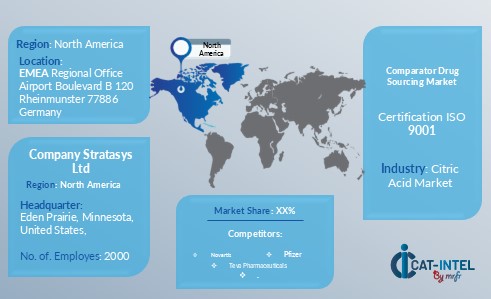

The Image shows growing demand for comparator drug sourcing in both North America and Europe with potential price increases and increased Competition.

North America Dominance in Comparator Drug Sourcing

North American market, particularly the United States, Canada, Mexico is a significant player in the comparator drug sector, with its major role in clinical trials and pharmaceutical research. The region is expected to continue leading global demand, driven by

-

Clinical Trials Expansion The U.S. remains a dominant force in clinical trials, particularly in oncology and rare diseases, which increases the demand for reliable comparator drugs. -

Technological Advancements North America is at the forefront of developing new therapies and clinical trials, necessitating the use of high-quality comparator drugs. -

Regulatory Leadership The region has stringent regulatory standards, making it crucial for comparator drugs to meet compliance requirements for trials. -

Sourcing and Manufacturing Capabilities North American companies are investing in increasing the supply of comparator drugs by improving manufacturing capabilities and leveraging technology to optimize procurement.

North America Remains a key hub, comparator drug sourcing price drivers Innovation and Growth.

Supplier Landscape Supplier Negotiations and Strategies

The supplier landscape in comparator drug sourcing is highly competitive, with a mix of large multinational pharmaceutical companies and smaller, specialized suppliers focusing on particular aspects of the drug supply chain, such as production, packaging, and distribution. These suppliers are critical in influencing key market factors, including pricing, availability, and the quality of comparator drugs. The market consists of both global players with extensive operations across multiple regions and niche suppliers who specialize in certain areas, such as rare drug manufacturing or regulatory-compliant distribution.

Established multinational pharmaceutical suppliers dominate the market, but smaller and emerging players are increasingly focusing on specific segments, such as rare or hard-to-source comparator drugs, as well as those that meet sustainability and ethical sourcing standards. Additionally, a growing emphasis on regulatory compliance, transparency, and ethical sourcing is driving suppliers to adapt their practices to meet the evolving demands of the clinical trial industry.

Key Suppliers in Comparator Drug Sourcing

- Novartis

- Pfizer

- Sanofi

- Roche

- AbbVie

- Eli Lilly

- Bayer

- Mylan

- Teva Pharmaceuticals

- Cipla

Significant Development |

Description |

Market Growth |

The comparator drug market is expanding rapidly due to increased demand from clinical trials, particularly in areas such as oncology, rare diseases, and gene therapies. |

Sustainable Practices |

A growing focus on ethical sourcing, regulatory compliance, and minimizing environmental impact within the comparator drug supply chain to align with sustainability objectives. |

Service Diversification |

Expansion of services within the comparator drug supply chain, including production, distribution, and regulatory support, to meet the rising demand in clinical research and trials. |

Technological Innovations |

Adoption of advanced technologies such as AI-driven drug sourcing platforms, automation in logistics, and enhanced data analytics to improve procurement and supply chain efficiency. |

E-commerce Expansion |

Increased use of digital platforms for sourcing, trading, and managing comparator drugs, enhancing access to global suppliers and streamlining the procurement process. |

Focus on Efficiency |

Heightened demand for more efficient sourcing, regulatory management, and delivery systems, with real-time tracking to ensure timely availability of comparator drugs for clinical trials. |

Comparator Drug Sourcing Attribute/Metric |

Details |

Comparator Drug Market Sizing |

The global comparator drug market is projected to reach USD 2.24 billion by 2032, growing at a CAGR of approximately 6.15% from 2024 to 2032. |

Technology Adoption Rate in Comparator Drugs |

Around 35% of companies in the comparator drug sourcing industry are adopting advanced technologies such as AI-driven procurement systems, automated logistics, and data analytics to optimize sourcing and supply chain management. |

Top Comparator Drug Strategies for 2024 |

Focus on improving sourcing efficiency, investing in data analytics for better decision-making, enhancing supplier relationships, and ensuring compliance with regulatory standards. |

Comparator Drug Process Automation |

25% of comparator drug suppliers have implemented automation in key areas such as inventory management, distribution, and real-time tracking to improve efficiency and reduce delays. |

Comparator Drug Market Challenges |

Key challenges include regulatory compliance complexity, sourcing rare or specific comparator drugs, rising demand for specialized treatments, and supply chain disruptions in clinical trials. |

Key Suppliers |

Major suppliers in the comparator drug market include Novartis, Pfizer, Sanofi, and Roche, providing reliable sourcing and distribution solutions for clinical trials. |

Key Regions Covered |

The comparator drug market is dominated by regions such as North America, Europe, and Asia-Pacific, with significant demand driven by the growing number of clinical trials and pharmaceutical research. |

Market Drivers and Trends |

Growth is driven by increasing clinical trial activity, demand for specialized drugs, technological advancements in sourcing and tracking, and stricter regulatory and sustainability standards. |