Summary Overview

Clinical Logistics Market Overview

The global Clinical Trial Supply and Logistics market is experiencing significant growth, driven by the increasing complexity of global clinical trials and advancements in technology. With the rising demand for clinical trials across various therapeutic areas, efficient logistics solutions are critical to ensure the timely and secure delivery of investigational products. The market is expected to exceed USD XX billion by 2024 and will continue to grow with a strong forecast for expansion through 2034.

Growth rate : 8%

Key Drivers:

Technological Advancements: Innovations in logistics, including temperature-controlled packaging, advanced tracking systems, and digital tools, are streamlining clinical trial supply chains.

Global Health Needs: The expansion of clinical trials, especially in emerging markets, is intensifying demand for efficient and secure supply chain solutions.

Phase-Specific Supply Chain Solutions: Specialized logistics for different phases of clinical trials, from preclinical to post-launch, are improving the efficiency and cost-effectiveness of the supply chain.

Sector Contributions:

Pharmaceutical Industry: The pharmaceutical sector is the largest contributor to the Clinical Logistics market, with ongoing research and clinical trials in drug development demanding more sophisticated logistics support.

Technology and Innovation: Advancements in logistics technology and the adoption of digital procurement tools are transforming the supply chain management processes, ensuring higher efficiency.

Regional Insights:

North America: The U.S. remains a dominant force in the market, thanks to its advanced healthcare infrastructure and large number of clinical trials.

Asia-Pacific: Countries like China and India are witnessing rapid growth due to improvements in healthcare infrastructure and rising clinical trials in the region.

Key Trends and Sustainability Outlook:

Sustainability Initiatives: Companies are increasingly focusing on reducing the environmental impact of clinical logistics through sustainable packaging and optimized transportation.

E-commerce Growth: The growth of digital channels and online procurement solutions is also contributing to the efficiency of logistics in clinical trials.

Growth Drivers:

Rising Global Clinical Trials: As clinical trials become more global, the demand for reliable and efficient supply chain management solutions increases.

Technological Innovation: The adoption of advanced technologies like blockchain, IoT, and artificial intelligence in logistics is improving transparency and security in the supply chain.

Overview of Market Intelligence Services for the Clinical Logistics Market

Recent market analyses show that clinical logistics are increasingly affected by fluctuations in demand and external factors such as regulatory changes. As a result, stakeholders in the industry are leveraging market intelligence solutions and predictive analytics to optimize procurement decisions, manage costs effectively, and ensure high-quality logistics services. By adopting strategic sourcing and vendor management practices, businesses can navigate these challenges and enhance their competitive edge.

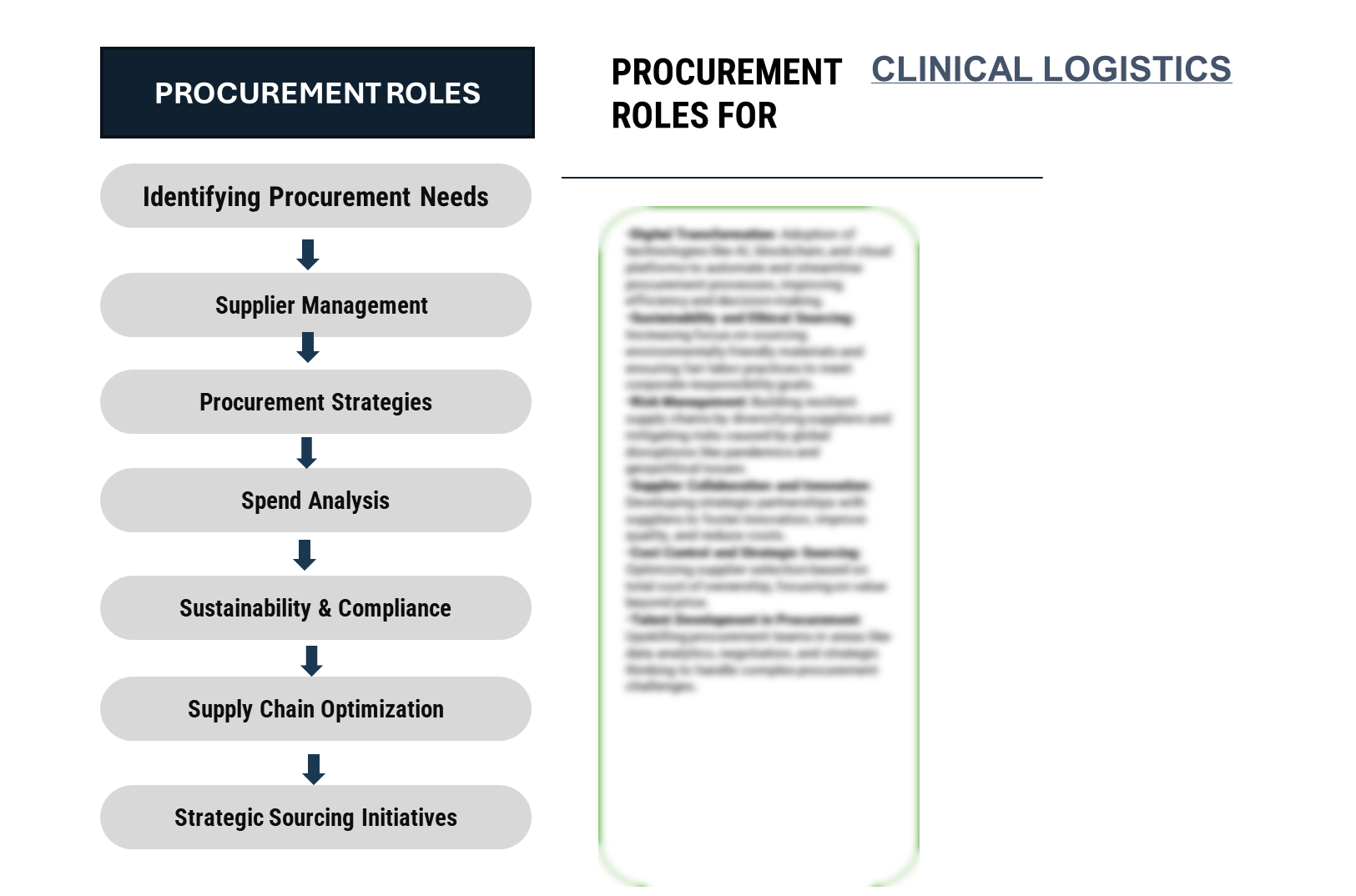

Procurement Intelligence for Clinical Logistics Market: Category Management and Strategic Sourcing

"To stay competitive in the clinical logistics market, companies are optimizing procurement strategies by leveraging spend analysis solutions for vendor spend analysis and enhancing supply chain efficiency through market intelligence. Procurement category management and strategic sourcing are becoming crucial for ensuring cost-effective procurement and timely delivery of clinical trial supplies. By utilizing advanced analytics and vendor management techniques, companies can mitigate risks associated with supply chain disruptions and maintain high-quality standards across clinical trial logistics. This approach allows stakeholders to optimize procurement decisions and improve overall trial execution, ensuring better outcomes and cost management."

Pricing Outlook for Clinical Logistics Market: Spend Analysis

The clinical logistics market is experiencing a complex pricing environment, influenced by several dynamic factors such as global demand for clinical trials, advancements in logistics technology, and regulatory changes. These factors are impacting both the cost structure and pricing trends across the supply chain, creating a fluctuating but steadily growing pricing outlook.

The line chart illustrating the projected pricing outlook for the Clinical Logistics market from 2024 to 2034

Our advanced analysis indicates a steady growth trajectory in pricing for clinical logistics, driven by several key factors, including:

Rising Operational Costs: Increased costs for specialized services like temperature-controlled storage, transport, and security are affecting pricing.

Surge in Global Clinical Trials: The global expansion of clinical trials, especially in emerging markets, is driving up demand for clinical logistics, placing upward pressure on costs.

Technology Integration: The adoption of advanced tracking systems, data analytics, and automation in the logistics chain is improving efficiency but also adding new cost layers.

Regulatory Compliance: Stricter regulatory requirements, including the need for more secure packaging and documentation, are contributing to higher compliance-related costs.

Supply Chain Disruptions: Global supply chain challenges, such as the ongoing impact of geopolitical factors and logistical bottlenecks, are creating cost volatility in the clinical logistics sector.

Cost Breakdown for the Clinical Logistics Market: Cost Saving Opportunities

-

Transportation and Shipping (40%)

Description: Represents the bulk of the cost, including the shipping of clinical trial supplies, temperature-controlled transportation, and logistics services for international shipments.

Trends: Costs have been impacted by global supply chain disruptions, rising fuel prices, and the need for specialized transportation solutions like cold chain logistics. As of 2024, prices are projected to remain volatile due to the ongoing impacts of fuel costs, but the demand for global clinical trials is driving overall growth in this segment.

Labor (XX%)

Packaging & Temperature Control (XX%)

Regulatory Compliance & Documentation (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the Clinical Logistics market, optimizing procurement through strategic negotiation can lead to significant cost savings. Collaborative purchasing enables bulk discounts on services like transportation and packaging. Technology integration, such as route optimization and predictive analytics, reduces transportation costs, while cold chain optimization cuts energy expenses. Vendor consolidation and outsourcing logistics functions streamline operations, lowering costs. Automation in compliance processes and shared facilities further enhances efficiency. Additionally, adopting sustainable practices in packaging and transportation helps reduce operational costs while meeting sustainability goals. These strategies collectively improve profitability and supply chain efficiency.

Supply and Demand Overview of the Clinical Logistics Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The clinical logistics market is experiencing rapid growth, driven by the increasing demand for efficient, timely delivery of clinical trial supplies and medicines, along with advancements in cold chain logistics and technology. The demand is particularly high in global clinical trials, healthcare supply chains, and pharmaceutical distribution, fuelled by the rise of personalized medicine and growing global healthcare needs.

Demand Factors:

Global Healthcare Growth: The expanding global healthcare market and increasing healthcare spending drive the demand for clinical logistics services, particularly in clinical trials and pharmaceutical supply chains.

Cold Chain Requirements: The need for temperature-sensitive products, such as vaccines, biologics, and biosimilars, is elevating demand for specialized cold chain logistics services.

Regulatory Complexity: Increasing regulatory requirements for shipping and tracking pharmaceuticals and clinical trial supplies are driving demand for specialized logistics solutions that ensure compliance.

Personalized Medicine: As personalized and gene therapies become more widespread, demand for logistics services that can manage small batch, high-value, and time-sensitive deliveries is growing.

Supply Factors:

Established Global Supply Networks: Major logistics providers, including those offering cold chain solutions, have built robust international networks to meet the growing demand.

Technological Advancements: The adoption of advanced technologies, including IoT for tracking, AI for route optimization, and temperature monitoring systems, improves supply chain reliability and transparency.

Infrastructure Investment: Ongoing investments in warehousing and transportation infrastructure, especially in emerging markets, are ensuring the scalability and reliability of clinical logistics services.

Competition and Vendor Networks: The competitive landscape among logistics providers is increasing, pushing for higher quality, faster delivery times, and cost optimization, which directly influences supply dynamics.

Regional Demand-Supply Outlook: Clinical Logistics Market

The image shows growing demand for clinical logistics services in North America and Asia, with potential for increased competition and demand due to the expansion of clinical trials and pharmaceutical distribution networks.

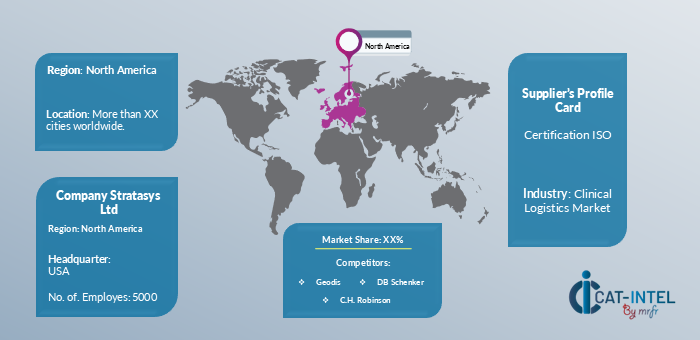

North America: A Key Player in the Clinical Logistics Market

North America, particularly the U.S., plays a pivotal role in the clinical logistics market, characterized by:

Leading Providers: North American clinical logistics providers, including specialized cold chain logistics companies, lead in the ability to handle temperature-sensitive and time-sensitive products, ensuring the U.S. remains a central hub for global distribution.

Strong Export Market: The U.S. is a major exporter of pharmaceutical products and clinical trial materials, driving a robust demand for clinical logistics services across North America, Europe, and Asia.

Innovation in Technology: The adoption of cutting-edge technologies, including AI-driven route optimization, IoT-based tracking, and blockchain for transparency, is improving the efficiency and reliability of clinical logistics operations.

Focus on Regulatory Compliance: With stringent regulations governing pharmaceutical and clinical trial logistics, U.S. companies emphasize ensuring compliance, which solidifies the region’s leadership in global clinical logistics.

Health and Pharmaceutical Trends: The increasing number of clinical trials, along with the rise of personalized medicine and biologics, boosts the need for specialized clinical logistics services in North America.

North America remains a key hub for clinical Logistics market and its growth

Supplier Landscape: Supplier Negotiations and Strategies – Clinical Logistics Market

The clinical logistics market has a diverse and dynamic supplier landscape, comprising both global and regional players that supply critical services essential for the transportation and distribution of clinical trial materials, pharmaceuticals, and medical supplies. Key suppliers provide services such as transportation, warehousing, cold chain logistics, packaging, and technology solutions that ensure the safe, compliant, and timely delivery of clinical trial products.

Currently, the supplier landscape is characterized by strong partnerships between clinical logistics providers and pharmaceutical companies. These collaborations are vital for maintaining the integrity of products, meeting regulatory requirements, and ensuring the efficiency of clinical trials. Additionally, packaging suppliers and cold chain logistics companies are crucial in meeting the growing demand for temperature-sensitive pharmaceuticals and biologics.

Some of the key suppliers in the clinical logistics market include:

DHL Supply Chain

Kuehne + Nagel

World Courier

UPS Healthcare

FedEx Logistics

CEVA Logistics

Panalpina (now part of DSV)

Geodis

C.H. Robinson

DB Schenker

Key Development: Procurement Category significant development

Procurement Category |

Key Development |

Impact |

Cold Chain Logistics |

Implementation of advanced temperature-controlled storage and transportation solutions. |

Enhanced product integrity and compliance for temperature-sensitive drugs, such as biologics and vaccines. |

Packaging Solutions |

Development of innovative, secure, and sustainable packaging solutions for clinical trials and pharmaceuticals. |

Reduced risk of contamination and improved product safety during transit and storage. |

Transportation & Freight Services |

Growth of specialized freight services catering to the medical and pharmaceutical sectors. |

Improved efficiency in the delivery of critical materials, reducing delays and ensuring timely shipments. |

Regulatory Compliance Services |

Integration of compliance tools and services to meet increasing regulatory demands for clinical trials and drug distribution. |

Better adherence to global regulatory standards, mitigating risks of non-compliance and penalties. |

Technology Integration |

Advancements in tracking technologies (e.g., RFID, IoT) to monitor the movement and condition of products in real-time. |

Enhanced visibility, transparency, and control over the supply chain, reducing errors and improving supply chain efficiency. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The clinical logistics market is projected to grow from USD 8.75 billion in 2023 to USD XX billion by 2032, with a CAGR of 8% during the forecast period. |

Adoption of Clinical Logistics Solutions |

Increasing demand for cold chain logistics and regulatory-compliant transportation solutions for pharmaceuticals, biologics, and clinical trial materials, especially during COVID-19. |

Top Strategies for 2024 |

Focus on enhancing cold chain capabilities, expanding technology integration for real-time tracking, improving supply chain visibility, and ensuring regulatory compliance. |

Automation in Clinical Logistics |

Over 35% of clinical logistics operations are integrating AI-driven tracking, automation in warehousing, and predictive analytics for enhanced efficiency and reduced error rates. |

Procurement Challenges |

Key challenges include rising transportation costs, stringent regulatory compliance, lack of standardization in clinical trials, and delays in delivery due to logistics disruptions. |

Key Suppliers |

Major players include DHL, FedEx, UPS Healthcare, Kuehne + Nagel, and World Courier, specializing in temperature-sensitive product transport and clinical trial supply management. |

Key Regions Covered |

Key markets include North America, Europe, and Asia-Pacific, with major demand from the U.S., Germany, India, and China. |

Market Drivers and Trends |

Growth is driven by increasing demand for biologics, vaccines, and clinical trial materials, along with the need for secure, compliant, and efficient transportation in clinical trials. |