Summary Overview

BA/BE Studies Market Overview:

The global BA/BE (Bioavailability/Bioequivalence) studies market is experiencing significant growth, driven by advances in pharmacology, rising demand for generic drugs, and increased investments in research and development. This market encompasses various applications, including generics, specialized therapeutics, and biologics. Our report offers an in-depth analysis of emerging procurement trends, focusing on cost-saving strategies through partnerships, as well as the shift toward digital study tools that streamline processes.

Future procurement challenges include the need for precise demand forecasting, supported by digital procurement solutions to enhance responsiveness in this evolving market. Strategic sourcing and effective procurement management are essential for optimizing BA/BE study processes and ensuring regulatory compliance. As competition grows, companies are utilizing market intelligence and procurement analytics to enhance supply chain efficiency and maintain a competitive edge.

The outlook for the BA/BE studies market is positive, with strong growth projected through 2032 due to several contributing factors:

-

Market Size: The global BA/BE studies market is expected to reach USD 1451.7 million by 2032, growing at a CAGR of approximately 8.2% from 2024 to 2032. Growth Rate: 8.2%

-

Sector Contributions: Growth is largely driven by: -

Generic Drug Development: Increased need for bioequivalence studies to support generic approvals. -

Regulatory Compliance: Rising regulatory demand for detailed bioavailability data in both novel and generic drugs. -

Technological Transformation and Innovations: Advancements in pharmacokinetics and data analytics are driving progress in BA/BE studies, improving study accuracy and efficiency.

-

Investment Initiatives: Organizations are investing in advanced technologies, such as pharmacokinetic modelling and simulation tools, to improve study accuracy and reduce trial costs. -

Regional Insights: North America remains a significant player due to its advanced clinical research infrastructure, while emerging markets are also seeing growth due to expanding generic drug production.

Key Trends and Sustainability Outlook:

-

Enhanced Digital Integration: Adoption of digital and automated tools is improving study accuracy and speeding up trial timelines. -

Advanced Methodologies: Innovations in pharmacokinetic modelling and virtual trials are providing more efficient and reliable study methods. -

Focus on Sustainability: Growing pressure to adopt eco-friendly practices is encouraging organizations to minimize trial waste and reduce emissions. -

Demand for Customized Studies: Sponsors are increasingly looking for tailored bioequivalence and bioavailability studies to align with specific regulatory and therapeutic needs. -

Data-Driven Approaches: Enhanced use of data analytics is optimizing study design and improving the precision of trial outcomes.

Growth Drivers:

-

Generic Drug Demand: The rising popularity of generic drugs globally is a primary driver, as BA/BE studies are crucial for regulatory approvals. -

Regulatory Standards: Stringent global regulations are creating a demand for thorough bioavailability and bioequivalence data. -

Innovation in Methodologies: Emerging techniques, such as in vitro-in vivo correlations, are expanding study options and improving trial efficacy. -

Environmental Awareness: Sustainable practices in trial management are becoming increasingly important, encouraging eco-friendly approaches. -

Tailored Solutions: Demand for customized and precision studies is growing as pharmaceutical companies seek specific trial designs for targeted regulatory requirements

Overview of Market Intelligence Services for the BA/BE Studies Market

Recent analyses show that the BA/BE studies market faces challenges with rising research and operational costs, largely driven by the increasing complexity of studies and stringent regulatory requirements. Market reports offer detailed cost projections and insights into procurement savings opportunities, enabling pharmaceutical companies to manage cost variations while ensuring high-quality studies. By leveraging these insights, stakeholders can adopt cost-saving strategies and enhance procurement processes, helping to maintain efficiency and compliance in an evolving market.

Procurement Intelligence for BA/BE Studies: Category Management and Strategic Sourcing

To remain competitive in the BA/BE studies market, companies are refining procurement strategies by utilizing spend analysis tools for vendor expenditure tracking and boosting supply chain efficiency through market intelligence. Effective category management and strategic sourcing are essential for achieving cost-efficient procurement and ensuring the timely availability of critical resources needed for conducting high-quality BA/BE studies.

Pricing Outlook for BA/BE Studies: Spend Analysis

The pricing outlook for BA/BE studies is expected to remain steady, though moderate price increases may occur due to several factors. Rising costs related to advanced technology adoption, regulatory compliance, and the need for high-quality clinical trial management are key drivers for potential price hikes. With an increasing demand for bioequivalence and bioavailability studies across the pharmaceutical sector, these higher costs could lead to elevated study fees.

Graph shows general upward trend pricing for ba/be studies and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to enhance operational efficiency, streamline clinical trial designs, and utilize automation tools may help organizations maintain competitive pricing in the long run. Partnering with technology providers, research institutions, or sustainable suppliers can also offer cost-effective solutions.

Despite rising costs, the focus on innovation, quality, and regulatory compliance will be essential to manage pricing effectively. As demand for bioequivalence studies continues to rise, balancing cost efficiency with quality service will be crucial for stakeholders in the sector.

Cost Breakdown for the BA/BE Studies Total Cost of Ownership (TCO) and Cost Saving Opportunities:

- Research Materials (30%)

- Description: Raw materials in BA/BE studies mainly include pharmaceutical compounds, formulations, test drugs, and consumables needed for clinical trials and laboratory processes. These materials must meet strict quality standards to ensure accurate results and regulatory compliance.

- Trends: Increasing demand for high-quality, sustainable raw materials is driving the market. A shift towards eco-friendly and ethically sourced materials is becoming more prominent as regulatory requirements tighten and sustainability concerns grow. Additionally, technological advancements are improving the sourcing and efficiency of raw material usage in clinical settings.

- Labor (XX)

- Description: XX

- Trends: XX

- Regulatory Services (XX%)

- Description: XX

- Trends: XX

- Infrastructure & Overheads (XX%)

- Description: XX

- Trends: XX

Cost Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies

In refining procurement and operational methods, BA/BE studies can achieve notable cost efficiencies and enhance workflow effectiveness. Building partnerships with suppliers of medical equipment, laboratories, and clinical facilities enables organizations to leverage volume discounts and shared resources, reducing per-unit costs and gaining stronger negotiation positions for favourable terms.

Investing in modernized clinical and analytical technologies, such as automated testing and advanced data management tools, can streamline study processes, reduce redundancy, and improve data accuracy, ultimately minimizing operational expenses. Incorporating sustainable practices, like reducing waste in clinical materials and adopting eco-friendly alternatives, not only reduces costs but also enhances reputation among clients focused on sustainability.

Supply and Demand Overview for the BA/BE Studies: Demand Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The BA/BE studies market is experiencing strong growth, by rising demand for generics, increased investment in healthcare, and advancements in pharmacological research. Demand is particularly high due to the need for reliable bioequivalence studies, supported by collaborations between pharmaceutical companies, regulatory agencies, and research organizations.

Demand Factors:

-

Rising Need for Generic Drug Approvals: With the demand for affordable generic drugs, there is an increased need for reliable BA/BE studies to ensure bioequivalence and regulatory compliance. -

Expansion in Emerging Markets: Growing healthcare access in emerging markets drives demand for BA/BE studies to support new generic drug entries. -

Stringent Regulatory Requirements: Heightened scrutiny by regulatory agencies worldwide has raised demand for high-quality studies that meet rigorous standards. -

Growth in Therapeutics and Speciality Drugs: The rise in specialized and biologic drugs increases the need for complex BA/BE studies tailored to these novel formulations.

Supply Factors:

-

Technological Innovation in Testing: Advanced equipment and software improve study quality, efficiency, and capacity, enhancing the supply side by offering more reliable testing. -

Access to Qualified Researchers: Availability of skilled professionals in clinical pharmacology and data analysis impacts supply, with shortages potentially creating capacity challenges. -

Infrastructure and Lab Capacity: Facilities with advanced laboratory and clinical trial capacities can better manage fluctuating demand and deliver timely studies. -

Competitive Market Pressures: Increasing numbers of firms conducting BA/BE studies can drive service improvements, but also add pressure on pricing and resources as firms strive to offer cost-effective solutions.

Regional Demand-Supply Outlook: BA/BE Studies:

The Image shows growing demand for ba/be studies in both North America and Asia, with potential price increases and increased Competition.

North America: Dominance in BA/BE Studies

North America, specifically the U.S. and Canada, holds a prominent position in the BA/BE studies market, driven which are characterized by:

1.Rising Demand for Generic Drug Approvals: As the demand for affordable generics grows, North American companies are increasingly conducting BA/BE studies to meet stringent regulatory requirements and support generic drug approvals.

-

Advanced Technological Infrastructure: The region benefits from a strong healthcare technology ecosystem, which includes state-of-the-art laboratories, advanced bioanalytical tools, and specialized software, all of which enhance the efficiency and accuracy of BA/BE studies. -

Rigorous Regulatory Standards: North America has established clear frameworks for drug testing and bioequivalence studies, ensuring compliance with regulatory standards set by bodies such as the FDA, thereby maintaining study integrity and consistency. -

Innovation in Study Methods: The North American market is evolving with new study approaches, such as adaptive trial designs and advanced modelling, which improve study outcomes and accelerate the approval process for generic and specialty drugs.

North America Remains a key hub ba/be study can price drivers Innovation and Growth.

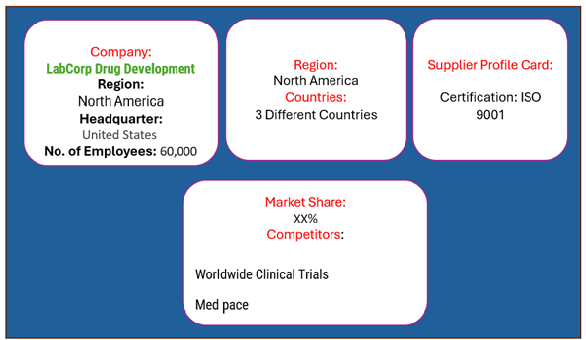

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the BA/BE studies market is extensive, with numerous global and regional players involved in providing bioavailability and bioequivalence testing services. These suppliers significantly impact market dynamics, influencing pricing, technological innovation, and accessibility. The market is highly competitive, encompassing large contract research organizations (CROs) and specialized firms focused on regulatory-compliant BA/BE studies.

Currently, the supplier landscape features notable consolidation among major CROs that command significant market share. However, smaller CROs and emerging firms are also increasing their presence by focusing on specialized therapeutic areas and advanced study methodologies.

Some key suppliers in the BA/BE studies market include:

- LabCorp

- Covance Inc.

- Charles River Laboratories

- ICON plc

- PRA Health Sciences

- PPD, Inc.

- Symes Health

- SGS Life Sciences

- Quintiles IMS Holdings (IQVIA)

- Parexel International

Key Developments Procurement Category Significant Development:

BA/BE Studies Attribute/Metric |

Details |

Market Sizing |

Global BA/BE studies market is expected to reach USD 1451.7 million by 2032, growing at a CAGR of approximately 8.2% from 2024 to 2032. |

BA/ BE Studies Technology Adoption Rate |

Around 50% of pharmaceutical firms are adopting advanced tools to improve study accuracy and efficiency. |

Top BA/ BE Strategies for 2024 |

Focus on optimizing clinical trial designs, ensuring regulatory compliance, enhancing data analytics, and managing costs. |

BA/BE Process Automation |

40% of companies have automated data collection and analysis processes to streamline study workflows. |

BA/BE Process Challenges |

Major challenges include strict regulatory standards, high study costs, and patient recruitment hurdles. |

Key Suppliers |

Leading providers include Covance, Parexel, Charles River, Symes Health, and ICON, offering end-to-end BA/BE study services. |

Key Regions Covered |

North America, Europe, Asia-Pacific, with key markets in the U.S., India, China, and Germany due to robust R&D and regulatory support. |

Market Drivers and Trends |

Growth driven by the rise in generic drug production, regulatory requirements, and advancements in clinical trial technologies. |