Global market valuation was derived through connected vehicle data monetization mapping and telematics service revenue analysis. The methodology encompassed:

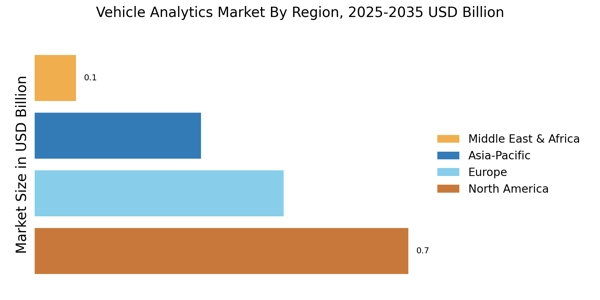

Identification of 50+ key stakeholders across North America, Europe, Asia-Pacific, and emerging markets, including automotive OEMs with proprietary analytics platforms, independent telematics service providers, cloud infrastructure providers serving automotive verticals, insurance telematics specialists, and fleet management solution vendors.

Technology stack mapping across descriptive diagnostics, predictive maintenance algorithms, prescriptive safety analytics, and autonomous vehicle data processing layers.

Analysis of reported and modeled annual recurring revenues (ARR) specific to vehicle analytics software portfolios, including SaaS subscriptions, per-vehicle-per-month (PVPM) fees, and enterprise licensing agreements.

Coverage of manufacturers and service providers representing 65-70% of global connected vehicle data market share in 2024, with particular emphasis on embedded OEM telematics (GM OnStar, BMW ConnectedDrive, Mercedes-Benz MBUX) and aftermarket fleet solutions.

Triangulation methodology combining bottom-up approaches (total vehicle parc × telematics penetration rate × average software revenue per unit by country/region) with top-down validation (total automotive IT spending × analytics software allocation percentage, cross-referenced with reported segment revenues from publicly traded mobility companies).

Segment-specific extrapolation for Usage-Based Insurance (UBI), Fleet Management & Logistics (FML), Safety & Security Analytics, Traffic Management Systems, and Infotainment/User Experience Optimization, adjusting for regional variations in data privacy regulations (GDPR, CCPA, China Personal Information Protection Law) and 5G/V2X infrastructure deployment maturity.

Forecast modeling incorporating autonomous vehicle disengagement data volumes, electric vehicle (EV) battery analytics adoption curves, and OEM data-sharing partnership announcements (e.g., recurring revenue streams from vehicle-generated data marketplaces).

Data Attribution Note: Secondary sources specific to this methodology include NHTSA, Eurostat, OICA, SAE International, IEEE, and national transport authorities. Primary research percentages have been adjusted to reflect the automotive technology sector's distribution, emphasizing mid-tier specialized providers (Tier 2) and operational/technical decision-makers over pure C-suite respondents, while weighting Asia-Pacific higher to account for connected vehicle growth in China and South Korea.