- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

The marketplace elements of the robo-advisory software marketplace are impacted with the aid of some factors that characterize its improvement and development. Robo-advisory software is supposed to provide mechanized, calculation-pushed, monetary-arranging administrations with almost no human management. One of the vital drivers of the robo-advisory software market is the growing demand for affordable and open speculation advisory administrations. As people look for realistic options in comparison to standard economic counsel, robo-advisory software offers a resounding arrangement through giving mechanized task tips, portfolio the board, and monetary arranging administrations for a portion of the rate. This openness has democratized assignment advisory administrations, drawing in an extra vast base of economic backers and incorporating current college grads and people with greater modest speculation portfolios. Moreover, with the broad reception of automatic economic degrees and the developing inclination for online abundance, the board preparations are riding the extension of the robo-advisory software market.

With the multiplication of advanced banking, versatile applications, and online mission levels, people are progressively disposed to address their funds and speculations through automated channels. Additionally, the growing requirement for custom-designed and powerful abundance of executive preparations is also pushing the demand for robo-advisory software. As financial backers search for custom-made project strategies and redid financial advisory, robo-advisory ranges use progressed calculations and information exams to carry custom-designed hypothesis tips, resource allotment methodologies, and goal-based total financial guidance. This accentuation on personalization and productivity resounds with an expansive variety of financial backers, riding the reception of robo-advisory preparations across exclusive socioeconomics and venture profiles.

Nonetheless, the robo-advisory software marketplace additionally faces unique difficulties and imperatives that affect its elements. Concerns related to facts protection and protection, administrative consistency, and the anticipated regulations of calculation-based project picks to deal with huge problems for the marketplace. Moreover, the need to correctly train and gain the trust of financial backers inside the capacities and dependability of robo-advisory software represents a distinguished impediment. In any case, progressing headways in facts safety efforts, administrative systems, and economic backer schooling drives are tending to these difficulties, adding to the marketplace's flexibility and advancement.

Robo Advisory Software Market Highlights:

Robo-Advisory Software Market Overview

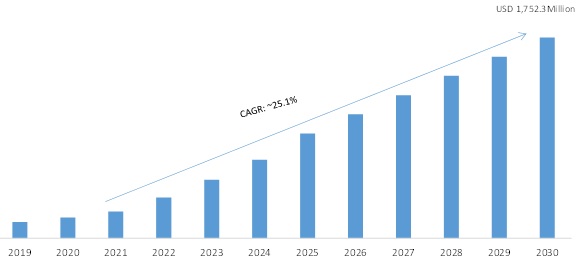

The global Robo-Advisory Software market was valued at projected to reach USD 1,752.3 million by 2030 with a CAGR of 25.1% during 2021-2030.

Robo advisor is not a new term, it is already in the market for two decades, however, the technology has geared up in the last four to five years. The current surge of Robo-advice is already shifting the advisory industry landscape. The low fees are encouraging the adoption of the Robo advisors, in turn, fuelling the adoption of Robo-advisory software tools. The traditional advisor model replacing by the modern Robo-advisory model and is expected to make a significant impact on the future portfolio management system.

Robo-advisory software is used by wealth managers to automate portfolio management and provide investment advice without human assistance. Robo-advisory software platforms automate portfolio creation based on an input of acceptable risk parameters, income, and other factors of a client’s investment mandate. These applications can also automate the reinvestment of dividends and tax optimization activities. The software tool uses algorithms and Artificial Intelligence (AI) to give advisors unique insights about their clients to lower churn and increase engagement. Many traditional advisory businesses are already turned into modern advisory firms by adapting the Robo-advisory tool which performs all business functions with minimum human engagement. Robo advice is a rising trend that is becoming broadly accepted. Robo-advising is not just about automation and the use of digital techniques to build as well as manage portfolios; Robo advisor software provides advisors with the tools to address their market, competitively.

Market Dynamics

Drivers

- The Rapid Automation across the Financial Institutions to Manage the Client’s Portfolio

In recent years, automation across the banks and financial services companies are soaring owing to the emergence of advanced technologies. The companies are leveraging these technologies in order to provide an enhanced customer experience as well as automate the traditional business processes. The major factor behind the rapid automation can be attributed to rising expenditures on traditional business processes, increasing client’s expectations, the rising demand to reduce human errors and risks, to comply with the regulatory policies, etc.

- The Rising Demand for Robo-advisory Software Tools Over the Traditional Advisory Owing to the Lower Management Costs and Convenience

Robo-based advisory services are reaching new heights owing to the increasing adoption among wealth management firms. Moreover, Robo-based advisory services charge comparably less as compared to the traditional model. For instance, traditional (human) financial advisors typically charge 1% or more per year of AUM, many Robo-advisors charges around just 0.25% per year. This factor is accelerating the demand for Robo-based advisory services in order to cut costs and increase transparency. In addition, the 24 by 7 services as well as convenience offered by the Robo-advisory services such as greater efficiency and profitability is also augmenting the demand among the wealth managers.

Restraints

- The Risk Associated with Robo-advisory Software such as cyberattacks or IT glitches or outages

Robo-advisory software platforms are fully dependent on technology systems, which could expose investors to potential risk situations derived from cyberattacks or IT glitches or outages. There could be so many target points for hackers to steal the data as well as money if the tool is with less security. Inadequate security can pose cyber and phishing attacks which is the major constraint for the Robo-advisory software market. Moreover, IT glitches or outages could also occur and are expected to create a downturn for the systems.

Opportunity

- The Upsurging Demand for Robo-advisory Services across the Emerging Economies

Robo-advisory services are majorly popular in developed countries such as the US, Germany, UK, Canada, Japan, etc. However, emerging economies such as China, India, and Brazil, among other countries are shifting towards digitalization at a rapid pace. Emerging countries now have accelerated the adoption of advanced technologies in order to increase efficiency as well as surge profitability, in turn, several lucrative opportunities are expected to emerge during the projected period.

Moreover, the rise in internet penetration, increase in internet users, expansion of global financial giants across those countries are some of the major factors propelling the growth of the market. Therefore, the rapid adoption of Robo-advisory services is expected to open lucrative opportunities for the Robo-advisory software vendors.

Challenge

- Regulatory Challenges

Regulatory challenges could pose a major challenge to the Robo-advisory software market. As the Robo advice is provided in a number of jurisdictions, laws, and regulations of different jurisdictions may apply. Without a unified supervisory body across multiple jurisdictions, it could be challenging for financial institutions to anticipate the applicability of regulations to their new technologies and ensure their compliance with these rules. Moreover, Delivering personalized investment Robo advice requires the collection of substantial financial information and personal data from clients. There are also issues around data storage, retention, and retrieval in the context of cross-border provision of advice and services where privacy laws in more than one jurisdiction may apply.

Impact of COVID19

The Impact on Robo-Advisory Software Adoption

In response to the COVID‐19 pandemic, the World Health Organization (WHO) had recommended preventive measures to lessen close contact between human interaction and public gatherings. Subsequently, the pandemic forced financial advisors to conduct virtual meetings instead of physical meetings with clients while creating challenges in securing new clients due to higher advisory fees and existing biases. This development has accelerated the adoption of digital technology, including Robo‐advisory platforms that preclude human intervention within automated processes. In addition, the COVID‐19 crisis has led to financial volatility, prompting investors to adopt Robo‐advisory services for wealth as well as investment management, in turn, fuelling the demand for Robo-advisory software among wealth managers.

The Impact on Robo-Driven AUM

The pandemic disrupted the financial industry at a larger scale, however, technology gained significant prominence to overcome the traditional approach. Asset under management largely shifted to the Robo-based and surpassed record 1.4 trillion USD in the 2020 year. That implies the exponential surge in ~30% Robo-based AUM YOY growth over 2019.

Global Robo-Advisory Software Market, 2019–2030 (USD Million) Source: MRFR Analysis

Source: MRFR Analysis

Cumulative Growth Analysis

YOY Growth to Expand at a Strong Rate

According to MRFR, the Robo-advisory software market is expected to witness XX% to XX% percent YOY growth every year during the projected period.

Value Chain Analysis / Technology Analysis / Regulatory Implications

The global Robo-Advisory Software market supply chain has evolved from a traditional approach to a set of highly efficient processes, including procurement, system integration, and distribution. The supply chain of the Robo-advisory software market involves the designers & programmers, software/platform developers, system integrators, and end-users.

Segment Overview

The global Robo-advisory software has been segmented into deployment, organization size, end user, and region/country.

Based on the deployment, the market has been segmented into on-cloud and on-premises. The on-cloud segment holds the largest share within the market and is expected to exhibit robust growth during the anticipated period. This can be attributed to the low cost and affordable flexible features given by the cloud.

Based on the organization size, the market has been segmented into SMEs and large enterprises. SMEs are expected to exhibit the fastest growth during the projected period. This can be attributed to an increased number of small and medium wealth management firms.

Based on end user, financial services companies dominated the market and is expected to retain their dominance throughout the projected period. However, banks are expected to exhibit the fastest growth rate during the anticipated period.

Regional Analysis

The global Robo-advisory software market is expected to gain significant revenue from the various continents during the projected period. The geographic analysis of the global Robo-Advisory Software market has been conducted for North America, Europe, Asia-Pacific, the Middle East & Africa, and South America. North America is further classified into the US, Canada, and Mexico. Europe is further classified into the UK, Germany, France, and the Rest of Europe. The Asia Pacific is further segmented into China, Japan, India, and the Rest of Asia Pacific.

North America Holds the Largest Share in the Global Market Thanks to the US & Canada

North America holds the leading share within the market. This can be attributed to the rapid adoption of the Robo-based advisory model by wealth managers and investors. The US is the leading nation in adopting a 100% automated investment platform. Globally, the US has the highest Assets Under Management in the Robo Advisor segment with USD one trillion. Therefore, Robo-advisory software has already gained traction among financial institutions for automated wealth management.

Europe Grips Second Highest Share in Global Market

The Europe region holds the second position in the global market in terms of revenue. The United Kingdom, Germany, and France are the major growth engines of the market. The United Kingdom holds the leading share within the European Robo-Advisory Software market. Wealth management firms across the UK already have shifted maximum operations to automated investment platforms. Germany and France are also contributing significant revenue for the European market. Benelux and Nordic countries have shown significant adoption for Robo-Advisory Software applications.

The APAC region is expected to be the Fastest Growing Continents

Asia Pacific region is expected to grow with the fastest CAGR rate during the forecast period. Asia Pacific region has seen a rapid boom the market growth owing to digitalization across the financial sector. The countries such as China, Japan, India, South Korea, Singapore, and Australia are the major growth engines of the APAC region's market growth. The region has large untapped potential for Robo-advisory software companies and is expected to generate significant revenue streams for the market players.

Competitive Analysis

The global Robo-advisory software market is highly competitive with the presence of several leading vendors. However, some of these players have created goodwill within the market by offering advanced features at affordable prices. Empirica (Poland), Mangosteen BCC Pte Ltd. (Bambu) (Singapore), Profile Software (UK), Techrules (Spain), and Comarch (Poland) are the prominent players within the market which have captured the largest client base across the globe. Some of these prominent players have adopted some organic and inorganic strategies such as mergers, acquisitions, partnerships, strategic alliances, and product launches among others in order to gain a competitive advantage. Moreover, some of the leading players are constantly focusing on technological advancements so as to offer advanced and upgraded features as per the dynamic consumer needs. The vendors compete in terms of software types, deployment, after-sales services, among other factors. Technological advancements are mandatory for new entrants to compete against the leading giants within the market.

List of Key Companies Covered in this Report:-

- Empirica (Poland)

- InvestCloud, Inc. (US)

- Mangosteen BCC Pte Ltd. (Bambu) (Singapore)

- Profile Software (UK)

- Techrules (Spain)

- AdvisorEngine (US)

- REDVision Technologies (India)

- Vestmark, Inc. (US)

- Pintec (China)

- WeAdvise (Germany)

- Additive AG (Germany)

- Accord Fintech Pvt. Ltd. (India)

- AQUMON (Hong Kong)

- EbixCash Financial Technologies (India)

- Comarch (Poland)

- FA Solutions Oy (Finland)

Report Overview

This study estimates revenue growth at global, regional, and country levels and offers an overview of the latest developments in each of the sub-sectors from 2019 to 2030. For this analysis, MRFR segmented the global Robo-advisory software market has based on deployment, organization size, end user and region/country.

Based on Deployment

- On-cloud

- On-premises

Based on Organization Size

- SMEs

- Large Enterprises

Based on End User

- Banks

- Financial Services Companies

Based on Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.