Research Methodology on Gaming Console Market

Research methodology is an organized set of activities and techniques applied to identify and answer a research problem. The methodology for the study titled ‘Global Gaming Console Market’ is rigorously researched, evaluated and validated through primary and secondary data sources.

The extensive secondary research analysis is done to research industry publications such as whitepapers, industry reports, financial reports, annual reports and other industry resources such as regional and trade reports to get an understanding of the industry and its associated market. Secondary research also includes market size estimation laid down in terms of value and volume through published market news, public databases, and information from customers and suppliers. The collected data is validated and analyzed using different statistical tools to identify market trends, opportunities and emerging markets. The scope of the research involves analyzing the gaming console industry by type, end user, and in terms of revenue.

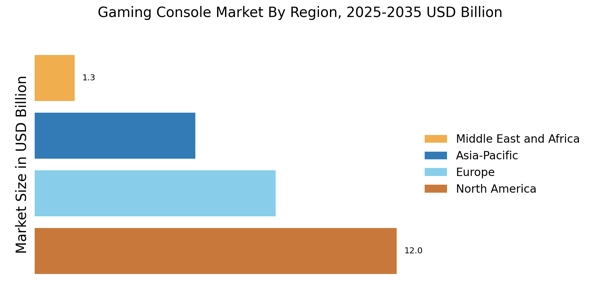

Geographic segmentation for the report encompasses regions such as Latin America, North America, Europe, China, Japan, India, and the Rest of the World (RoW). The report also covers current market trends and developments, drivers, restraints, opportunities, and challenges prevailing in the industry. This detailed information is presented in the report with accuracy to understand the overall market dynamics and the opportunities emerging in the gaming console industry. The research methodology applied to the entire study is based on a three-step approach, which includes primary and secondary research, market size estimation, market forecasting, and market data validation.

Primary Research

Primary research constitutes interviews conducted to gain qualitative and quantitative information from industry executives and personnel. These primary interviews were conducted via telephonic and face-to-face interviews, and a rigorous review process was undertaken to validate the accuracy of the collected data. These primary interviews are analyzed to gain an understanding of industry drivers, restraints, challenges, opportunities, and market trends. Additionally, interviews were conducted with C-level executives including VPs, CEOs, and directors to gain comprehensive further insights. Data from primary conversations are further checked and validated through secondary resources as well.

Secondary Research

The research methodology also includes secondary research, which includes external and internal sources of information, mainly published statistical data on the market and its associated segments. This data is collected and collated from reports available online, data journals, printable reports, magazines, and other related resources.

Market Size Estimation

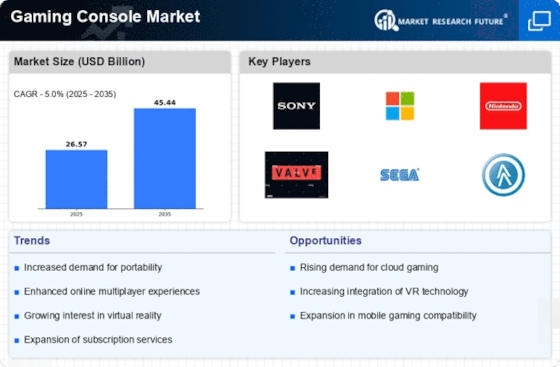

The market size is estimated using the bottom-up approach wherein key companies’ revenues were tracked, particular market segments were derived, and every component was then assembled to derive the overall market size. Different regional and global markets have had specific price bands applicable to gaming consoles, and these secondary-derived contexts and assumptions have been taken into consideration while estimating the market size.

Market Forecasting

Market forecasting refers to the prediction of the upcoming growth opportunities for gaming console players in the market.

Market Data Validation

Market data validation is carried out to authenticate whether the collected data is appropriate and relevant in terms of market assessment and trends, followed by identifying new ones. The data is validated by refining the collected data through various data triangulation experiments. Moreover, a detailed synopsis of the background for the player’s market share, performance, and positioning was prepared.

Disclaimer

Any data, information, or opinions expressed or implied in this document along with any assumptions, conclusions, or recommendations, are based on limited research and presented in good faith without guarantee, warranty, or representation of any kind. The analyst recognizes different points of view on the market and related trends and generates this report by utilizing primary and secondary research to offer a holistic view of the market.