Research Methodology on Biomarker Technologies Market

Introduction

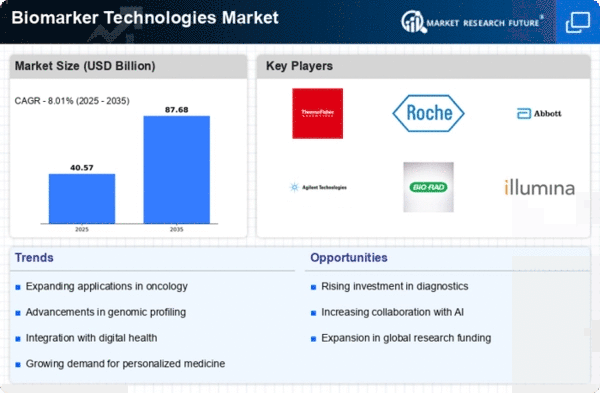

Biomarkers are biological molecules- molecules that can be observed or measured in a biological sample and used as an indicator of health or disease. Biomarkers are widely used in the medical field as a tool to diagnose or monitor the progression of a wide range of diseases. Market Research Future (MRFR) in its report titled “Biomarker Technologies Market- Global Industry Analysis and Forecast 2023-2030” has made an effort to identify the conventional as well as emerging trends in the global market for biomarkers.

Research Objective

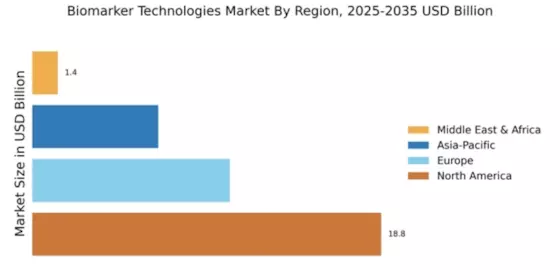

The research objective of this study is to analyze and present a comprehensive overview of the global biomarker technologies market. The report is expected to provide information on the market size, industry trends, share and growth rate over the upcoming years.

Research Methodology

This research study has been conducted using a quantitative and qualitative approach. The primary data collected from which the report is based includes information collected from interviews with private and public sector experts, industry stakeholders, service providers, government institutions, and industry participants. The survey was conducted to study the interest of key players and stakeholders in the potential future growth of the biomarker technologies market.

Secondary data was collected from case studies, books, and published documents including reports, white papers and articles, news releases, industry annual reports, and international databases. Secondary data will be used in order to validate the primary data and to provide an indication of the potential size of the market.

Analysis Techniques

In order to provide an accurate assessment of the global biomarker technologies market, both primary and secondary data have been used in the estimation of the market size and growth rate. The primary collection of data was obtained through interviews and surveys conducted with market participants and key decision-makers. Secondary data has been collected from published reports, industry associations, IDC databases, and online databases.

In order to arrive at the market size, the market has been segmented into key product categories and application areas. Analysis of the market trends, supply and demand, and regulation and policy shifts are also important parts of the market study. The data and information collected have been analyzed using market models such as Porter's Five Forces Model and SWOT analysis.

The following three steps have been used to generate a market forecast:

Market Drivers and Barriers Analysis

Market drivers and barriers were identified and used to determine the current market scenario and to forecast the future growth of the biomarker technologies market. Growth drivers such as technological advances and increasing medical research activities in the biomarker technologies were identified while barriers such as lack of professional expertise and rising cost of developing biomarker technologies were also taken into consideration.

Market Scenario Development

Based on the market drivers and barriers, a market scenario was developed which showed the expected market trends and size of the biomarker technologies market over the next seven years (2023-2030).

Market Forecasting

Based on the developed market scenario, a market forecasting model was developed which estimated the absolute dollar growth of the biomarker technologies market. The market forecast was generated based on the key drivers and barriers identified in the market study.

Conclusion

This research study has provided an estimated market size of the global biomarker technologies market along with a forecast of its growth. The research methodology used in this study has been conducted over a period of several months. Primary and secondary research along with analysis techniques have been used to provide an accurate assessment of the market size and growth rate. MRFR believes that the data and information provided in this report will be of great benefit to stakeholders and market participants in the field of biomarker technologies.