Online Payments in India Revolutionizing the Economy in 2023

By Shubhendra Anand , 10 October, 2023

Digital payments are a new way of transforming the economy via online and cashless payments. The world is seeing immense growth in digital payment, and emerging economies like India are developing a new digital ecosystem. The progress in the digital payment field is revolutionizing India digitally.

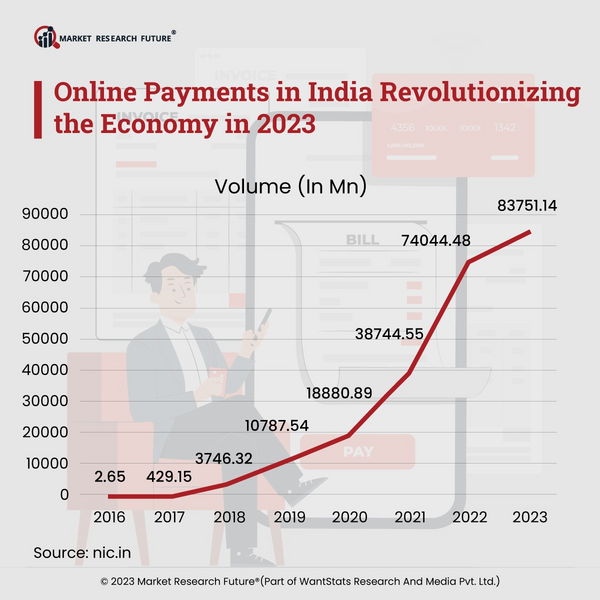

Based on a survey in 2023, online payment numbers have increased more than 100 times in the last nine years, from 127 crore in 2013-14 to 12,735 crore online payments in 2022-2023. Various factors affect the online pay portals to grow in this period. One of the major factors accelerating the growth of digital payments is the convenient-to-pay portals, such as Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), prepaid payment instruments (PPIs), and others. According to another survey report, digital payments through Google Pay and Paytm are the gateways. The report also mentioned that in the last year, almost three-quarters of the online payment users have used these pay portals. These two online payment portals, Amazon Pay and PayPal, are on the list, along with PhonePe, next to them in 2023. BHIM and MobiKwik are also down to the list of India's most used online payment portals; 21 and 19 percent of the online payment users use MobiKwik and RazorPay, respectively, in 2023. In India, Unified Payments Interface (UPI) has been the most preferred payment mode and earned 14.15 lakh crore rupees through 886.3 crore digital payment transactions in April 2023. As pe the data, the Indian digital market is expected to reach USD 200 billion by 2026. Due to significant growth in the usage of smartphones and an increase in e-commerce, among other factors, the Indian digital payment platform has enhanced immensely.

India's target to become a cashless society is progressing day by day with the enhancement in digital payment technology and online payments. The payment gateways are contributing to easy digital transactions. Thus, online payment helps in the sustainable growth of the country economically.

Latest News

Solid-state batteries have not been in use for a long time. However, the rising demand for electric vehicles in the automotive market may revamp the sulfur content of solid-state batteries. There are many advantages of sulfur in solid-state…

Artificial intelligence is enhancing the tech industry nowadays. In the past years, artificial intelligence has played a pivotal role in functioning cloud computing and other tech industry infrastructure. One of the bug techs, Microsoft, is investing…

Renewable energy is considered as an alternative to fossil fuels. Nations are replacing fossil fuels with renewables to achieve sustainability in the environment. Renewable energy sources regulate specific sectors like electricity, transportation…

In the industrial applications and production sector, sustainability will play a significant role in 2024. Industries are growing interested in adopting sustainable approaches in light of the clean energy transition. The aviation industry in 2024…

Energy storage is the main component in the clean energy transition as it facilitates the storage and discharge of energy. Battery storage is expected to support clean energy transition in the upcoming years. A survey shows battery storage can be a…

Head Research

Latest News