- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Global Metal Grating Market Overview

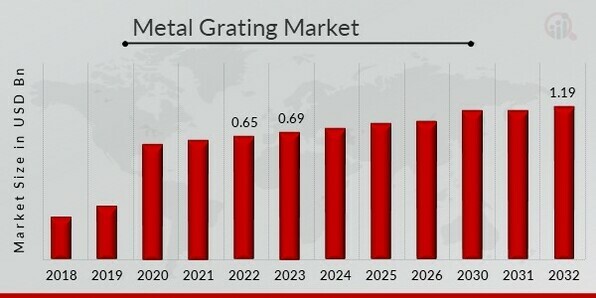

Metal Grating Market Size was valued at USD 0.65 Billion in 2022. The Metal Grating industry is projected to grow from USD 0.69 Billion in 2023 to USD 1.19 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7% during the forecast period (2024 - 2032). Metal gratings are in considerable demand amongst other materials due to their exceptional resistance to corrosion and other physical characteristics, and their increasing need in end-user sectors are the key market drivers driving the market’s growth and expansion.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Metal Grating Market Trends

- Growing need in end-user sectors is driving the market growth

The rising need in end-user sectors drives the market CAGR for metal grating. The surge in demand for metal grating across numerous end-use sectors, including wastewater treatment, natural gas, and oil extraction and processing, is a prominent driver driving market expansion. In recent years, infrastructure construction in many places has boosted its applicability across paths, roads, and bridge fences. Disability ramps, stairs, fencing panels, safety & exhaust displays, rail filler panels, steel sunshades, facades of buildings, decorative louvers, architecture accents, fountains floor grates, and tree grates are also made from them. As a result of its widespread use and the expansion of the worldwide construction sector, the worldwide metal grating industry is predicted to expand significantly over the forecasted timeframe.

Additionally, increasing the number of paths allowing pedestrians, disabled and elderly individuals, and children to stroll comfortably and securely on roadways and in parks is boosting the market's expansion. Furthermore, prominent market players provide end customers with numerous customizations, such as fabricating grate items, which is expected to drive market development. Growing drilling and exploitation operations in the energy sector and significant developments in the pharma industry are projected to create enormous demand for steel gratings, opening up lucrative possibilities for both major companies and emerging players in the market. Growing expenditures in creating new manufacturing facilities will likely drive market expansion in the coming years.

COVID-19 has caused lockdowns, travel restrictions, and company shutdowns worldwide. Due to the epidemic, the manufacturing industry is experiencing major delays in the form of major supply chain breakdowns and workplace closures. These variables have a detrimental influence on the production of medical, defense, and electrical goods. Production interruptions are constraining the expansion of the metal grating industry. After the pandemic, supply chain constraints are being eased, and the extensive usage of metal grating in sectors such as building, transportation, and oil and gas is propelling the Metal grating sector ahead.

For instance, metal grating costs between USD 826.3-831.4 per ton across the globe. Bar grating prices varied between USD 20 -$30 a ton. By 2027, metal grating costs are predicted to climb gradually, from USD 1,012.8 to 1,133.8 per ton. The cost shift is predicted to be driven by raw material pricing and accessibility, while consumer interest in the metal grating is projected to rise throughout the projection period. Thus, it is anticipated that demand for Metal Grating will increase throughout the projection timeframe due to the rising need in end-user sectors. Thus, driving the Metal Grating Market revenue.

Metal Grating Market Segment Insights

Metal Grating Market Product Type Insights

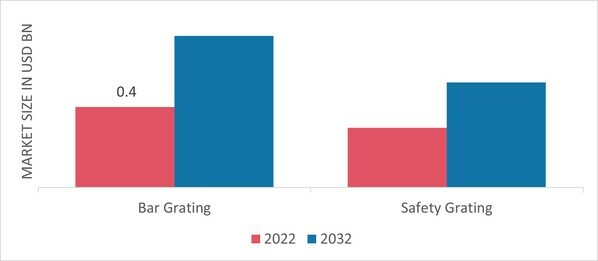

The Metal Grating Market segmentation, based on Product Type, includes Bar Grating and Safety Grating. Bar grating segment dominated the market, accounting for 57% of the market share (USD 0.4 billion) in 2022. This is due mostly to the high ratio of strength to weight and spacing ratio among neighboring bars. Because of these features, bar grating is widely utilized in fire exits, security fences and barriers, grills, bridges, roadway drains, ventilation, and caravan beds.

Figure 1: Metal Grating Market by Material Type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Metal Grating Market Material Type Insights

The Metal Grating Market segmentation, based on Material Type, includes Carbon Steel, Aluminum, Stainless Steel, Galvanized Steel, and Others. The carbon steel category generated the highest revenue of about 35% (USD 0.2 billion) in 2022. The rising use of carbon steel grating is because of its excellent durability against wear and durability when placed in corrosive environments. These materials are often utilized in sectors where chemicals are employed frequently. These are excellent choices for metal grates and commercial steel grating floors. The stainless-steel category is expected to grow steadily during the projected timeframe.

Metal Grating Market End-User Insights

The Metal Grating Market segmentation, based on End-User, includes Water & Wastewater Treatment Industry, Chemical Industry, Oil & Gas, Food Industry, and Others. The water & wastewater treatment industry dominated the market, accounting for 37.9% of the market share (USD 0.25 billion) in 2022. Because of its physical features, such as exceptional stiffness and resistance to corrosion, metal gratings are increasingly being employed for different constructions and designs ranging from pathways to filter grills in water treatment plants. Chemical Industry is expected to grow significantly at the fastest growth rate during the projected timeframe.

Metal Grating Market Regional Insights

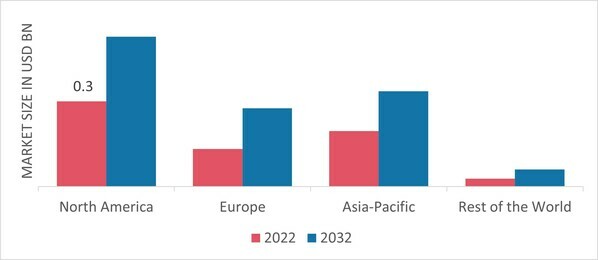

By region, the research provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Metal Grating Market area will dominate this market, owing to increased commercial and residential building construction utilization during the projected timeframe. In addition, the growing utilization of metal grading in railroads, staircases, and other construction building projects will boost market growth in the North American region.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Metal Grating Market Share by Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe region’s Metal Grating Market is expected to grow significantly at the fastest growth rate due to the growth of wastewater treatment plants and the expansion of the chemical sector. Further, the German Metal Grating Market holds the largest market share, and the UK Metal Grating Market is expected to grow and expand rapidly in the European region during the projected timeframe.

The Asia-Pacific Metal Grating Market accounts for the second-highest market share and revenue. This is mostly owing to the substantial need for metal grating in oil & gas, electric power generation, and chemical processing sectors to boost the overall market growth. Moreover, China’s Metal Grating Market dominates the market share, and the Indian Metal Grating Market is expected to grow steadily in the Asia-Pacific region during the projected timeframe.

Metal Grating Market Key Market Players & Competitive Insights

Leading market players invested heavily in research and development (R&D) to scale up their manufacturing units and product lines, which will help the Metal Grating Market grow worldwide. Market participants are also undertaking various organic or inorganic strategic approaches to strengthen and expand their footprint, with important market developments including new product portfolios, contractual deals, mergers and acquisitions, capital expenditure, higher investments, and strategic alliances with other organizations. Businesses are also coming up with marketing strategies such as digital marketing, social media influencing, and content marketing to increase their scope of profit earnings. The Metal Grating Market industry must offer cost-effective and sustainable options to survive in a fragmented and dynamic market climate.

Manufacturing locally to minimize operational expenses and offer aftermarket services to customers is one of the key business strategies organizations use in the Metal Grating Market industry to benefit customers and capture untapped market share and revenue. The Metal Grating Market industry has recently offered significant advantages to the technology industry. Moreover, more industry participants are utilizing and adopting cutting-edge technology has grown substantially. Major players in the Metal Grating Market, including Amico, Harsco Corporation, Saint-Gobain, Interstate Gratings, Lionweld Kennedy Flooring Ltd, Ningbo Jiulong Machinery, Manufacturing Co Ltd, Nucor Corporation, Ohio Gratings Inc, P&R Metals, Inc, Valmont Industries Inc, are attempting to expand market share and demand by investing in research and development (R&D) operations to produce sustainable and affordable solutions.

Carl Martin and Allan Norman Kennedy established Lichtgitter 1929 as a grating manufacturing firm. Lichtgitter is an established producer of forge-welded gratings and perforated steel planks, with affiliates and collaborations worldwide. The offering includes GRP gratings, chequer plate blanks, stair treads, ladder rungs, galvanizing, and metal service. Lichtgitter revealed intentions to broaden the manufacturing area of its Houston operations by creating new offices, with the eventual objective of increasing its manufacturing capacity in 2020.

Standards Australia was founded in 1922 and is regarded as the major non-government standards development agency in Australia by MoU by the Australian government. It is a limited liability business. STANDARDS AUSTRALIA recommends that the following requirements be designed for the stairs, pathways, stairways, scaffolding, and guard fences: AS 1538, AS 3990(Int) or AS 4100 for metal, AS 1664 for aluminum, and AS 3700 for brickwork in April 2018.

Key Companies in the Metal Grating Market include

- Amico

- Harsco Corporation

- Saint-Gobain

- Interstate Gratings

- Lionweld Kennedy Flooring Ltd

- Ningbo Jiulong Machinery

- Manufacturing Co Ltd

- Nucor Corporation

- Ohio Gratings Inc

- P&R Metals Inc

- Valmont Industries Inc

Metal Grating Market Industry Developments

The metal bar grating branch of the NAAMM has membership from the US, Mexico, Canada, and the rest of South America. The American National Standards Institute recognizes and approves the NAAMM requirements for robust and ordinary bar grating.

2020: Lichtgitter revealed intentions to broaden the manufacturing area of its Houston operations by creating new offices, with the eventual objective of increasing its manufacturing capacity.

April 2018: STANDARDS AUSTRALIA recommends that the following requirements design the stairs, pathways, stairways, scaffolding, and guard fences: AS 1538, AS 3990(Int) or AS 4100 for metal, AS 1664 for aluminum, and AS 3700 for brickwork.

Metal Grating Market Segmentation

Metal Grating Product Type Outlook

- Bar Grating

- Safety Grating

Metal Grating Material Type Outlook

- Carbon Steel

- Aluminum

- Stainless Steel

- Galvanized Steel

- Others

Metal Grating Material End-User Outlook

- Water & Wastewater Treatment Industry

- Chemical Industry

- Oil & Gas

- Food Industry

- Others

Metal Grating Market Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.