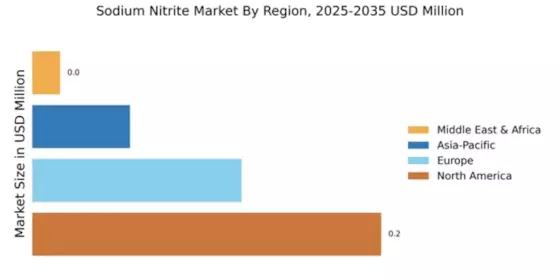

North America : Market Leader in Sodium Nitrite

North America is poised to maintain its leadership in the sodium nitrite market, holding a significant market share of 25% in 2024. The region's growth is driven by increasing demand in food preservation, pharmaceuticals, and chemical manufacturing. Regulatory support for food safety and environmental standards further catalyzes market expansion. The presence of established players and advanced manufacturing technologies also contribute to this robust growth.

The United States stands out as the leading country in this region, with major companies like American Vanguard Corporation and Hindalco Industries Limited driving innovation and market penetration. The competitive landscape is characterized by strategic partnerships and investments in R&D, ensuring a steady supply of high-quality sodium nitrite. This dynamic environment positions North America as a key player in The Sodium Nitrite.

Europe : Emerging Market with Growth Potential

Europe's sodium nitrite market is experiencing notable growth, with a market share of 15% in 2024. The increasing use of sodium nitrite in food preservation and pharmaceuticals, coupled with stringent regulations on food safety, is driving demand. The European Union's commitment to sustainable practices and chemical safety regulations further supports market growth, creating a favorable environment for industry players.

Germany and France are leading countries in this region, with significant contributions from companies like SABIC and Hawkins Watts Limited. The competitive landscape is marked by innovation and a focus on sustainable production methods. As the market evolves, European companies are investing in advanced technologies to enhance product quality and meet regulatory standards, ensuring their competitiveness in the global arena.

Asia-Pacific : Emerging Powerhouse in Chemicals

The Asia-Pacific region is emerging as a significant player in the sodium nitrite market, holding a market share of 7% in 2024. The growth is fueled by rising industrialization, increasing food processing activities, and a growing pharmaceutical sector. Regulatory frameworks are gradually evolving to support safe usage, which is expected to further boost market demand in the coming years.

China and Japan are the leading countries in this region, with companies like Hubei Yihua Chemical Industry Co., Ltd. and Sodium Nitrite Co., Ltd. at the forefront. The competitive landscape is characterized by a mix of local and international players, with a focus on expanding production capacities and enhancing product offerings. As the market matures, innovation and strategic collaborations will play a crucial role in shaping its future.

Middle East and Africa : Resource-Rich Frontier for Chemicals

The Middle East and Africa region is in the nascent stages of developing its sodium nitrite market, currently holding a market share of 2% in 2024. The growth potential is significant, driven by increasing industrial activities and a rising demand for food preservation. Regulatory frameworks are beginning to take shape, which will likely enhance market dynamics and attract investments in the sector.

Countries like South Africa and Saudi Arabia are emerging as key players in this market, with local companies exploring opportunities in sodium nitrite production. The competitive landscape is still developing, with a focus on establishing supply chains and enhancing product quality. As the region continues to grow, strategic investments and partnerships will be essential for capturing market share and driving innovation.