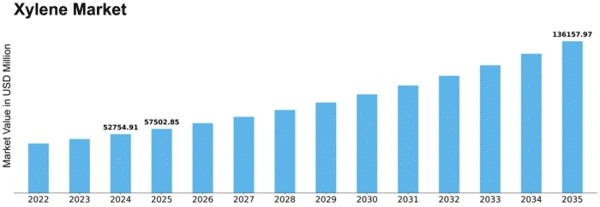

Xylene Size

Xylene Market Growth Projections and Opportunities

The Xylene market is influenced by various market factors that shape its dynamics and performance. One significant factor is the demand-supply balance within the industry. Xylene, primarily used as a solvent in various applications such as paints, coatings, adhesives, and plastics, experiences fluctuations in demand based on the overall economic conditions and specific sectors' performance. For instance, during periods of economic growth, the construction and automotive industries typically witness an increase in activity, consequently driving up the demand for xylene as a key ingredient in paint and coating formulations. Conversely, economic downturns can lead to reduced construction and automotive activity, dampening the demand for xylene.

Wondering what xylene is xylene is an organic compound. This organic compound is obtained by catalytic reforming and coal carbonization processes. Xylene is a hydrocarbon with properties such as greasiness and colorlessness in nature. In addition to these properties, it quickly evaporates and has good dissolving power. Its demand is increasing in all the major industries. This is the reason the xylene market is increasing globally. Hence xylene production automatically increases with this increases the xylene market production.

Moreover, the price of crude oil, from which xylene is derived as a byproduct during the refining process, significantly impacts the xylene market. Since xylene production is closely tied to the refining of crude oil, any fluctuations in crude oil prices can directly influence xylene prices. When crude oil prices rise, production costs for xylene increase, leading to higher prices for end-users. Conversely, a decrease in crude oil prices can result in lower production costs and subsequently lower prices for xylene.

Additionally, geopolitical factors play a crucial role in shaping the xylene market. Political instability or conflicts in regions that are major producers or consumers of xylene can disrupt the supply chain and affect market prices. For example, tensions in oil-producing regions can lead to supply disruptions, impacting the availability of crude oil and, consequently, xylene production. Similarly, trade policies and agreements between countries can affect the flow of xylene and its derivatives across borders, influencing market dynamics.

Furthermore, environmental regulations and sustainability initiatives have become increasingly important market factors for the xylene industry. As concerns over environmental pollution and climate change continue to rise, there is growing pressure on industries to adopt eco-friendly practices and reduce emissions. This has led to the development and adoption of alternative solvents and processes that offer lower environmental impact compared to traditional xylene-based products. Consequently, manufacturers in the xylene market are compelled to innovate and invest in sustainable solutions to meet regulatory requirements and consumer preferences.

Moreover, technological advancements and innovations play a significant role in shaping the xylene market. Continuous research and development efforts aimed at improving production processes, enhancing product performance, and reducing costs drive innovation within the industry. Advancements in catalyst technologies, process efficiencies, and recycling methods contribute to increased productivity and competitiveness in the xylene market.

Lastly, market competition and industry consolidation impact the xylene market landscape. Intense competition among key players and the presence of numerous small and medium-sized enterprises create a dynamic market environment characterized by price competition and product differentiation. Mergers, acquisitions, and strategic alliances among companies are common strategies employed to gain market share, expand product portfolios, and enhance competitiveness in the xylene market.

Leave a Comment