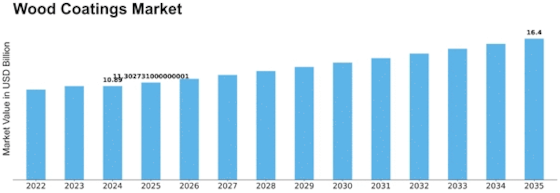

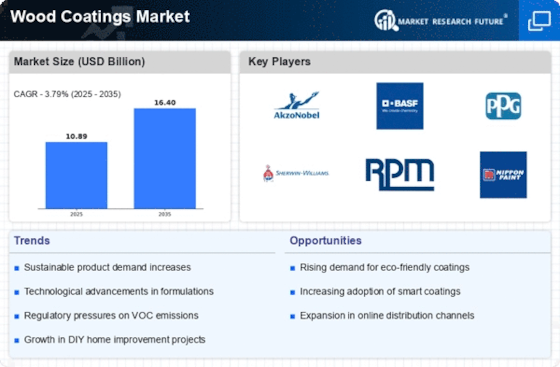

Wood Coatings Size

Wood Coatings Market Growth Projections and Opportunities

The wood coatings market is influenced by a myriad of factors that dictate its supply and demand dynamics, technological advancements, regulatory landscape, and economic conditions. Primarily, the demand for wood coatings is fueled by the construction, furniture, and flooring industries, where these coatings are essential for protecting and enhancing the aesthetics of wood surfaces. As these industries continue to grow, driven by urbanization, construction activities, and interior design trends, the demand for wood coatings rises correspondingly, driving market expansion.

On the supply side, factors such as raw material availability, production capacity, and technological innovations play pivotal roles. Raw materials like resins, solvents, and additives are essential components in wood coatings production. Therefore, fluctuations in the availability or cost of these raw materials can impact production costs and pricing strategies within the wood coatings market. Additionally, advancements in production technologies, such as water-based formulations or UV-curable coatings, contribute to enhancing supply chain efficiency and meeting market demands for environmentally friendly and high-performance coatings.

Regulatory policies and standards also significantly impact the wood coatings market. Environmental regulations regarding volatile organic compound (VOC) emissions, hazardous substances, and product safety drive manufacturers to develop coatings that comply with stringent standards. Compliance with these regulations not only ensures market access but also enhances consumer trust and brand reputation, particularly in industries where environmental concerns and health risks are paramount.

Moreover, macroeconomic factors such as GDP growth, housing starts, and consumer spending patterns influence the overall demand for wood coatings and its downstream products. Economic fluctuations or changes in construction activity can affect market growth, while increasing investments in residential and commercial real estate can stimulate demand for wood coatings, driving market expansion.

Global market dynamics, including trade policies, geopolitical tensions, and currency fluctuations, also play a crucial role in shaping the wood coatings market landscape. Changes in global trade patterns, trade agreements, or geopolitical events can disrupt supply chains, alter market dynamics, and influence pricing strategies within the wood coatings market.

Furthermore, technological advancements and innovations continue to drive developments within the wood coatings market. Research and development efforts aimed at improving coating performance, durability, and sustainability contribute to market innovation. For instance, the development of nanotechnology-based coatings or bio-based resins offers new opportunities for market growth and differentiation.

Leave a Comment