Wireless Connectivity Size

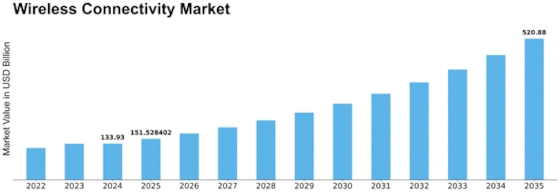

Wireless Connectivity Market Growth Projections and Opportunities

The competitive landscape, growth, and direction of the wireless connectivity market are all affected by a number of factors. Modern technology is changing quickly, which is really driving the market. Switching from 4G to 5G is one example of how constantly changing and improving wireless link standards has a big effect on how the market works. The sector is driven by the need for more reliable networks, lower delay, and faster data speeds, which has led to huge R&D costs. Consumer interest is another important factor that affects the market for cell data connections. Societies need smooth, high-performance digital contact more and more as they become more linked. Nowadays, customers expect to be able to connect reliably in public places, on public transportation, in faraway places, and in everyday places like homes and businesses. Businesses engage in expanding their networks and improving the quality of their services because of this demand. This creates a competitive environment where meeting customer standards is fundamental. In the market for digital connection, acts and rules taken by the government have a big impact. Regulatory choices about frequency sharing, license requirements, and security standards have a big effect on people who work in the business. When laws change, they can bring about new chances or problems that affect investments and strategy decisions. The growing demand for wireless connection is partly due to the worldwide trend toward more technology and connectivity in all fields. Adding wireless technologies is helping many areas work better and more efficiently, from smart cities and homes to healthcare and industry systems. This trend opens up a lot of possibilities for wireless access solutions in many different areas because the market is growing beyond just regular consumer gadgets. Environmental responsibility is becoming a bigger factor in the wireless connection market. Making things, using energy, and throwing away electronics all have effects on the world that are becoming better known as the demand for connected devices grows. By making devices that use less energy and adopting eco-friendly practices, businesses are looking into ways to make wireless equipment less harmful to the environment.

Leave a Comment