Growing Industrial Applications

The Global White Biotechnology Market Industry is witnessing a diversification of applications across various sectors, including agriculture, food, and pharmaceuticals. The utilization of enzymes and microorganisms in industrial processes enhances product quality and reduces waste. For instance, the food industry increasingly adopts biotechnological methods for fermentation and preservation, leading to improved flavors and shelf life. This broadening of applications not only boosts market growth but also underscores the versatility of white biotechnology in addressing diverse industrial challenges. As a result, the industry is poised for substantial expansion in the coming years.

Rising Demand for Sustainable Products

The Global White Biotechnology Market Industry experiences a notable surge in demand for sustainable products, driven by increasing consumer awareness regarding environmental issues. As industries seek to reduce their carbon footprints, white biotechnology offers innovative solutions through bioprocesses that utilize renewable resources. For instance, the production of biofuels and biodegradable plastics is gaining traction, with projections indicating that the market could reach 5.64 USD Billion in 2024. This shift towards sustainability not only aligns with global environmental goals but also presents significant opportunities for growth within the industry.

Government Support and Policy Initiatives

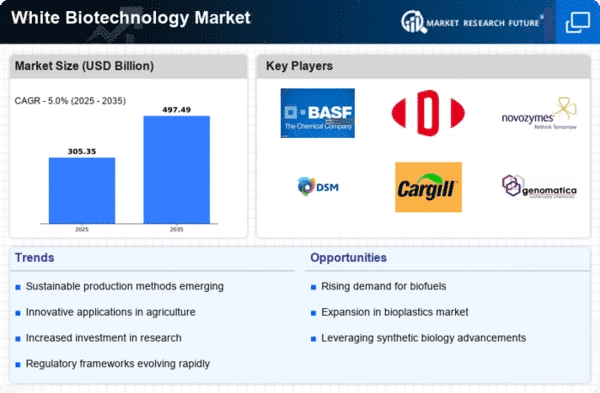

Government support plays a crucial role in the advancement of the Global White Biotechnology Market Industry. Various nations are implementing policies and providing funding to promote biotechnological innovations. For example, initiatives aimed at reducing greenhouse gas emissions and promoting bio-based products are becoming increasingly common. These policies not only encourage research and development but also facilitate collaborations between public and private sectors. As a result, the market is projected to experience a compound annual growth rate of 7.1% from 2025 to 2035, reflecting the positive impact of governmental support on the industry's growth trajectory.

Technological Advancements in Biotechnology

Technological advancements significantly influence the Global White Biotechnology Market Industry by enhancing the efficiency and effectiveness of bioprocesses. Innovations such as synthetic biology, metabolic engineering, and advanced Microbial fermentation technologies are revolutionizing the production of bio-based products. These advancements enable the conversion of biomass into valuable chemicals, fuels, and materials, thereby expanding the scope of applications. As the industry evolves, it is anticipated that the market will grow to 12 USD Billion by 2035, highlighting the potential of technology-driven solutions in meeting the increasing demand for sustainable alternatives.

Increasing Investment in Research and Development

Investment in research and development is a key driver of the Global White Biotechnology Market Industry, fostering innovation and the discovery of new biotechnological applications. Companies and research institutions are allocating significant resources to explore novel bioprocesses and improve existing technologies. This focus on R&D not only enhances the competitiveness of the industry but also leads to the development of more efficient and sustainable production methods. As the market evolves, the emphasis on innovation is expected to contribute to its growth, with projections indicating a robust trajectory in the coming decade.