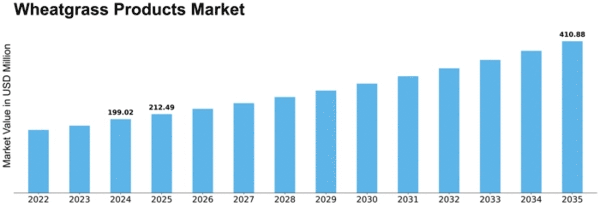

Wheatgrass Products Size

Wheatgrass Products Market Growth Projections and Opportunities

Many factors impact the Wheatgrass Products Market's development and trends. Stress about health and fitness plays a major role. Health-conscious individuals desire natural, nutrient-dense products. Wheatgrass' health properties make it popular. Sales of wheatgrass items are also affected by lifestyle and diet changes. More people are eating vegetarian, vegan, or plant-based diets, and wheatgrass contains chlorophyll, amino acids, and vitamins. Wheatgrass is adaptable, taken as drinks, pills, or supplements. Farm management and raw material availability affect the wheatgrass market. Wheatgrass-growing temperatures are vital to the market. How crops are farmed, such as organic or conventional, might affect product choices. Sustainable and ecologically friendly agricultural practices are becoming more popular, changing the market for wheatgrass products created ethically. The market is rising because more people are learning about wheatgrass' health advantages. Thanks to social media, health blogs, and nutritional education, wheatgrass' health advantages are more known. Because of this, more individuals use wheatgrass products daily, boosting market demand. Income and price setting effect wheatgrass items sales. Organic or cold-pressed products may appeal to wealthy consumers, while poor consumers desire cheaper options. Companies adjust their prices to appeal to a broad variety of clients and strike a balance between price and quality. The wheatgrass product industry is competitive, thus big firms seek to differentiate and maintain quality. Companies create new items by blending and formulating existing ones to suit consumer preferences. Wheatgrass is often marketed for its health and unique nutritional profile. Government food safety and labeling laws impact the market. Quality and health standards must be followed by market actors to protect consumers and develop confidence. Regulatory standards increase wheatgrass products' reliability and market image. Cultural and societal factors can impact green products sales. Health and fitness-focused societies that value natural therapies are more likely to buy wheatgrass products. Due to an aging population and a better awareness of preventive health care, wheatgrass is becoming increasingly popular. The Wheatgrass Products Market is constantly evolving. Health and wellness trends, lifestyle changes, agricultural practices, consumer education, economic reasons, market competition, government laws, and cultural developments impact it. Wheatgrass product sales will expand if these market variables remain. Wheatgrass is healthful and can be used in various diets, therefore more people are discovering it.

Leave a Comment