Web3 In Telecommunications Size

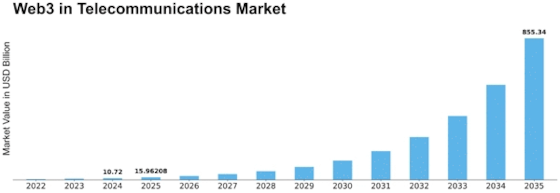

Web3 in Telecommunications Market Growth Projections and Opportunities

The retail market and e-commerce are facing a period of change due to the advancement in Web3. This has changed the state of such spaces that were governed traditionally across all time. Web3, on the other hand, is completely revolutionizing business operations and customer relations by embracing decentralized technologies like blockchain, smart contracts, and decentralized finance (Defi). With the advent of Web 3.0, numerous changes have been taking place in online trading, with the emergence of decentralized marketplaces being one remarkable aspect. Instead of using traditional platforms, this newer version utilizes blockchain technology to allow direct peer-to-peer transactions without intermediaries, hence fostering trust between buyers and sellers at large. By making it possible to authenticate and verify ownership or originality rights for digital or physical belongings, these distinctive digital coins, which are common from aspects like internet artifacts and collectibles, do not leave marks for themselves in the commerce system. E-commerce outlets are considering including NFTs within their products to help create exclusivity through limited availability, thereby building stronger relationships between customers and their brands based on loyalty. This also affects supply chain dynamics within e-commerce and retail. The transparent path helps establish a reliable track record while minimizing cases involving counterfeit goods, among others. In addition to reducing the risks involved in counterfeiting, this transparency plays a big role when consumers want to know how far their purchases came from home. Web3, therefore, enables more responsible supply chains. Additionally, market dynamics regarding e-commerce and retail are coming into play owing to smart contracts, which is another signature feature of Web 3.0. Whenever there are monetary transactions made on a blockchain platform, these kinds of preprogrammed agreements are used to ensure that all tasks can be undertaken automatically according to the set regulations they have stipulated. By enabling secure transactions as well as payment automation plus self-execution of contract terms without intermediaries, smart contracts cut down on operational costs and chances of conflicts. Nevertheless, hurdles to scalability remain in the expansion of Web3. Other challenges include possible regulation problems and the need to have a larger pool of users. It is, therefore, necessary that these obstacles are overcome if e-commerce or retail sectors will enjoy full benefits from Web 3 technologies as a whole. Nevertheless, the current exploration and development within this field indicate that there is a tectonic shift taking place in online businesses for trade purposes. Thus, companies that can adapt and understand web3 are most likely to continue leading in the ever-changing world of e-commerce as well as retail.

Leave a Comment