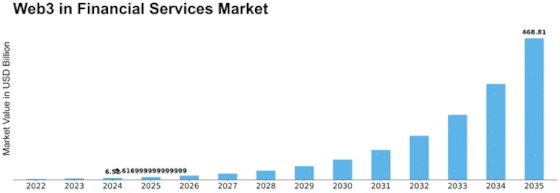

Web3 In Financial Services Size

Web3 in Financial Services Market Growth Projections and Opportunities

Web3 technology has transformed the financial services market, influencing several business sectors. Web3, a decentralized and linked structure, has given financial institutions new opportunities and challenges. Web3 democratizes monetary administrations, affecting the market. Decentralized finance (DeFi) platforms allow users to lend, buy, and trade without intermediaries. As decentralized apps (dApps) disrupt the norm, financial services competition has increased.

The combination of blockchain technology with Web3 has disrupted financial exchanges' simplicity and security. Blockchain's unchangeable and simple record has increased financial administrations' trust and reliability, attracting new and established market players. To be competitive in the growing business sector, established financial institutions are exploring blockchain integration. This has led to collaboration between traditional financial institutions and blockchain-based startups, changing market dynamics.

Web3's tokenization has opened new financial services business opportunities. Blockchain networks may now treat land, craftsmanship, and, unexpectedly, protected invention as computerized coins, enabling fragmented ownership and liquidity. This has led to new resource classes and venture instruments, challenging resource ownership and speculation methods. Venture portfolios have grown and new market participants seeking tokenized resources have flooded the market.

As decentralized autonomous associations (DAOs) rise in Web3, financial services market administration and dynamic cycles have changed. DAOs enable aggregate management and asset executives through brilliant agreements, making financial administrations more extensive and local. This move toward decentralized administration models has prompted traditional financial institutions to rethink their administration structures and consider the benefits of decentralization.

Despite these opportunities, Web3 has created new financial services industry challenges. Market participants are confused by administrative vulnerability involving decentralized finance and computerized resources, leading arguments on the best administrative structure for Web3 advances. Blockchain interoperability and flexibility are significant specialized movements that must be addressed to fully grasp Web3's financial services industry potential."

Leave a Comment